Massachusetts is taking a big step towards integrating bitcoin into its financial plans by introducing a bill to create a bitcoin reserve.

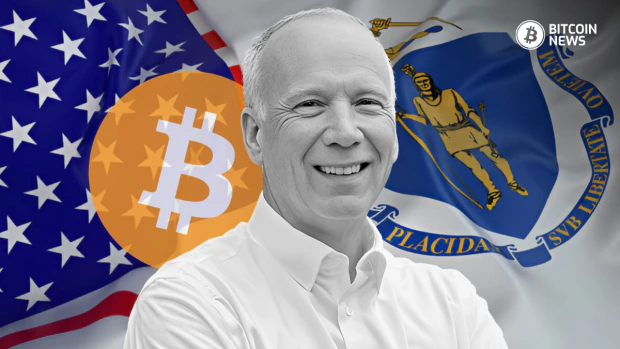

Senator Peter Durant is the lead on the bitcoin reserve bill which, if passed, would make Massachusetts the first “deep blue state” to officially adopt Bitcoin.

This means Bitcoin has gained recognition as a real financial asset and part of a diversified state portfolio. So now, Massachusetts has joined Pennsylvania, North Dakota and other states in looking at bitcoin reserves.

The bill is called the “Commonwealth Bitcoin Strategic Reserve” and proposes to allocate up to 10% of the state’s $9 billion stabilization fund to bitcoin and other digital assets.

Senator Durant said this isn’t about abandoning traditional financial strategies, but about diversification. “It’s not like we’re saying divest everything and put it into Bitcoin,” Durant said. “But we do believe it does make sense as a portion of the commonwealth’s portfolio.”

The bill also allows the state treasurer to buy bitcoin directly and manage it through custodians that are secure, or buy bitcoin-related exchange-traded products (ETPs). The bill also allows lending out the assets to generate returns.

Bitcoin reserve bills are a growing trend among US states.

Texas, Wyoming, Oklahoma, New Hampshire and Ohio have introduced similar bills. Although, Texas is a bit different. It has already established itself as a Bitcoin hub with 27 mining operations and significant legislative efforts to embed bitcoin into its economy.

On the federal level, the conversation is heating up too. Senator Cynthia Lummis, a Bitcoin advocate, has called on the US Treasury to include bitcoin in the federal reserve.

All this is coming as bitcoin gains more appeal as an inflation hedge and a tool for financial innovation.

Supporters of the Massachusetts bitcoin reserve bill point to the benefits, but some are concerned about the risks. Bitcoin’s volatility and lack of regulation in the digital asset space are the usual suspects.

Although some argue that in the world of digital assets, Bitcoin enjoys the most clarity in regulations, at least in the US.

Durant addressed those concerns by pointing out the 10% cap on the stabilization fund, which limits exposure but still allows for big gains when bitcoin’s price goes up.

Durant said the focus isn’t just on gaining profit from increases in bitcoin’s price, but making sure Massachusetts gains a competitive edge in the future of finance.

The bill is still pending a review by Massachusetts State Treasurer Deb Goldberg. Goldberg has not taken a public position on the bill yet. A spokesperson for Goldberg’s office said the treasurer will review it if it comes to her desk.

If passed, this would make Massachusetts the first deep blue state to officially put bitcoin in its reserves. It would show the state is serious about Bitcoin and businesses and investors will see Massachusetts as a hub for financial innovation.