A Meta shareholder is proposing the company invest some of its $72 billion cash pile into bitcoin. The idea is gaining traction among Bitcoin enthusiasts and financial analysts, who see it as a way to hedge against inflation and increase shareholder value.

The proposal was submitted by Ethan Peck, a shareholder and NCPPR member from Washington. Peck says Meta’s cash is being eaten away by inflation and low bond yields and the company’s value is going down.

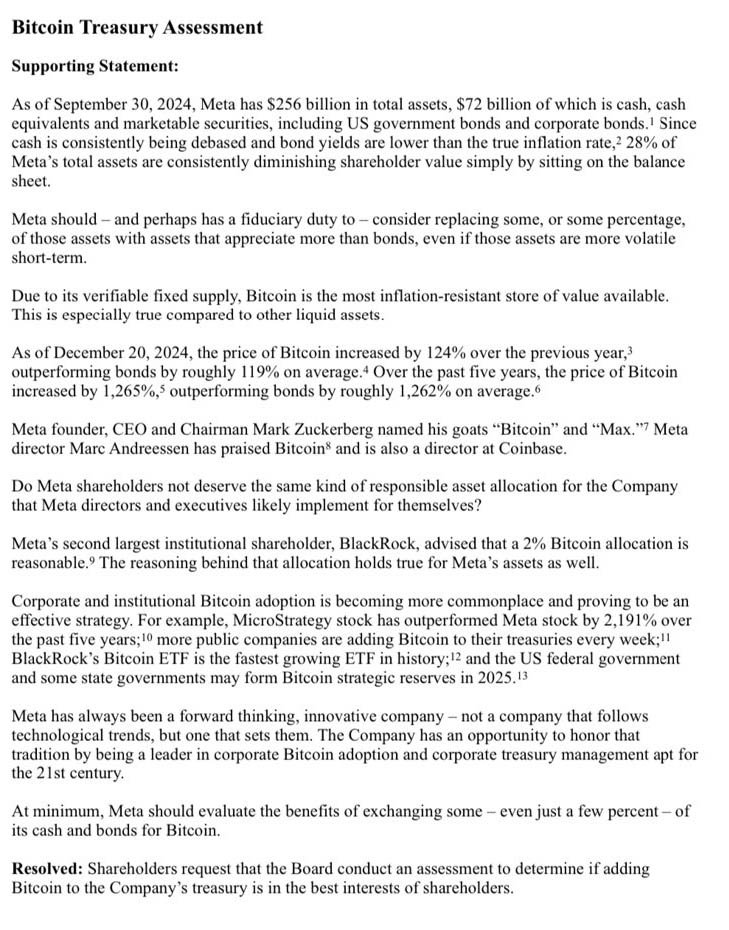

“Since cash is consistently being debased and bond yields are lower than the true inflation rate, 28% of Meta’s total assets are consistently diminishing shareholder value by sitting on the balance sheet,” Peck said in the proposal.

Peck’s solution? Bitcoin. He calls it the “most inflation resistant store of value available” and notes its long term performance. Over the last 5 years, bitcoin has gone up 1,265% while bonds have gone up much less.

Peck lists several reasons why bitcoin would be a good fit for Meta’s strategy:

- Hedge Against Inflation: Bitcoin’s 21 million coin supply is inflation proof, a big problem for cash and other assets.

- Better Returns: Bitcoin has returned 124% in the past year and 1,200% in the last 5 years, much better than bonds.

- Align with Innovation: As a forward thinking tech company, Meta could be the first to adopt Bitcoin, just like they have been with other tech trends.

Peck also pointed to companies like MicroStrategy and Tesla who have added bitcoin to their treasuries. MicroStrategy in particular has seen its stock go up 2,000% in the past 5 years, more than Meta’s mere 380%.

Peck’s proposal also notes that Meta CEO Mark Zuckerberg has mentioned Bitcoin before. He has apparently named his goats “Bitcoin” and “Max”!

“Do Meta shareholders not deserve the same kind of responsible asset allocation for the company that Meta directors and executives likely implement for themselves?” Peck asked in the proposal.

Peck’s idea isn’t alone. The NCPPR has submitted similar proposals to other tech giants like Microsoft and Amazon. While those proposals haven’t passed yet, they are part of a growing trend of companies looking at bitcoin as a reserve asset.

Related: Microsoft Shareholders Reject Bitcoin Investment Proposal

Institutional interest in Bitcoin is growing. BlackRock, Meta’s second largest institutional investor, has said a 2% bitcoin allocation could be a good strategy. With bitcoin at near all-time highs—most recently $108,268—proponents say adding it to the treasury could be very beneficial.

If Meta were to add bitcoin to the treasury, it would set a precedent for other companies to follow. Peck says it would be in line with Meta’s culture of innovation and make it a leader in tech and finance.

“Meta has always been a forward-thinking, innovative company – not a company that follows tradition but one that sets it,” Peck’s proposal stated.

Meta has not responded to Peck’s proposal so the outcome is unknown. But if they do it would be a big deal.