Metaplanet, the Tokyo based company gears up for big expansion as bitcoin is expected to skyrocket.

The company is targeting to increase its bitcoin holdings by 5x in 2025. They currently hold around 1,762 BTC worth $175 million and plan to hold 10,000 BTC by end of 2025. This is in line with the bullish bitcoin market prediction of prices going above $200,000.

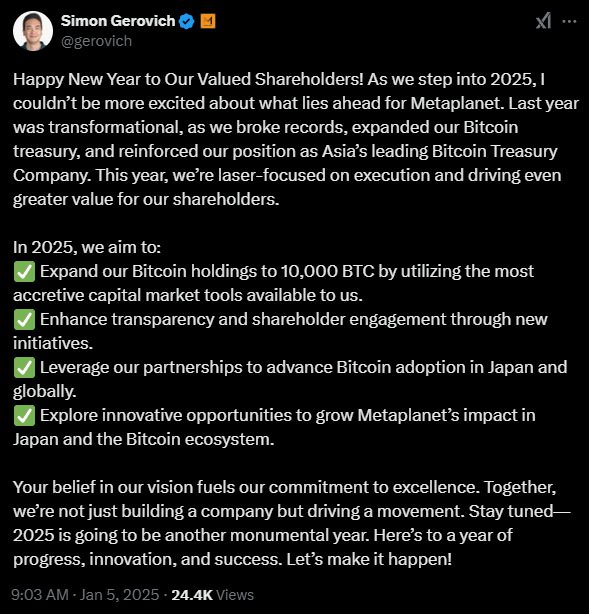

Since Metaplanet started holding bitcoin as a core treasury asset in April 2024 they have grown fast. CEO Simon Gerovich recently posted on social media about their goal of “utilizing the most accretive capital market tools available.”

The company’s Bitcoin focused approach is similar to the US based MicroStrategy, which is well known for buying large amounts of bitcoin.

Gerovich said the company’s mission goes beyond just buying bitcoin. “We’re not just building a company but driving a movement,” he said.

To fund its big expansion, Metaplanet used various financial instruments such as loans, equity and convertible bonds. In December 2024, they raised 9.5 billion yen ($60.6 million) through bond issuances and used it to buy 619.7 BTC in a single transaction.

The company has also diversified its revenue streams. By selling bitcoin put options, Metaplanet earned 520 million yen ($3.5 million) in 2024.

Its hotel subsidiary Wen Tokyo Co. also helped the company turn profitable. For the year ending December 31, 2024 Metaplanet forecasted 890 million yen ($5.8 million) in revenue, up from 261 million yen the previous year.

This is the first time the company has been profitable since 2017.

Metaplanet is going all in on bitcoin at a time when institutional adoption is accelerating. VanEck and Bitwise analysts predict bitcoin will hit $180,000 to $200,000 by 2025 due to institutional interest and bitcoin’s supply scarcity.

Gerovich thinks if the US adopts bitcoin as a reserve asset under a Bitcoin-friendly admin, it will trigger a “global domino effect”. He said:

“Countries around the world will follow. Japan is one of those countries where they do look to the US as their big brother, following their footsteps.”

2024 was a big year for Metaplanet.

The company’s stock price went up 2000% as it became the leading bitcoin treasury company in Asia. It also did a 10-to-1 stock consolidation and a rights offering that raised ¥10 billion ($63.7 million).

The company’s bitcoin holdings grew significantly during the year, especially in the last quarter. From October to December, Metaplanet added over 900 BTC to the treasury, almost doubling in 3 months.

Gerovich said “Last year was transformational, as we broke records, expanded our bitcoin treasury, and reinforced our position as Asia’s leading Bitcoin Treasury Company.”

In 2025 Metaplanet will be executing the next phase of its bitcoin expansion plan. By using a systematic accumulation approach and strengthening its balance sheet, the company aims to become a big player in the global bitcoin space.

“This year, we’re laser-focused on execution and driving even greater value for our shareholders,” Gerovich said. Bitcoin is moving and traditional markets are taking notice, and Metaplanet is not sitting idle to miss the opportunities that have risen.