In a bold and strategic move, Japanese investment and consulting firm Metaplanet has announced plans to raise approximately $70 million through a stock rights offering, with a substantial portion earmarked for bitcoin investment.

This significant financial maneuver mirrors the strategy employed by the American business intelligence company MicroStrategy and signals a transformative shift in Japan’s financial landscape.

On August 6, Metaplanet revealed its ambitious plan to raise ¥10.08 billion (around $70 million) through its 11th series of stock acquisition rights.

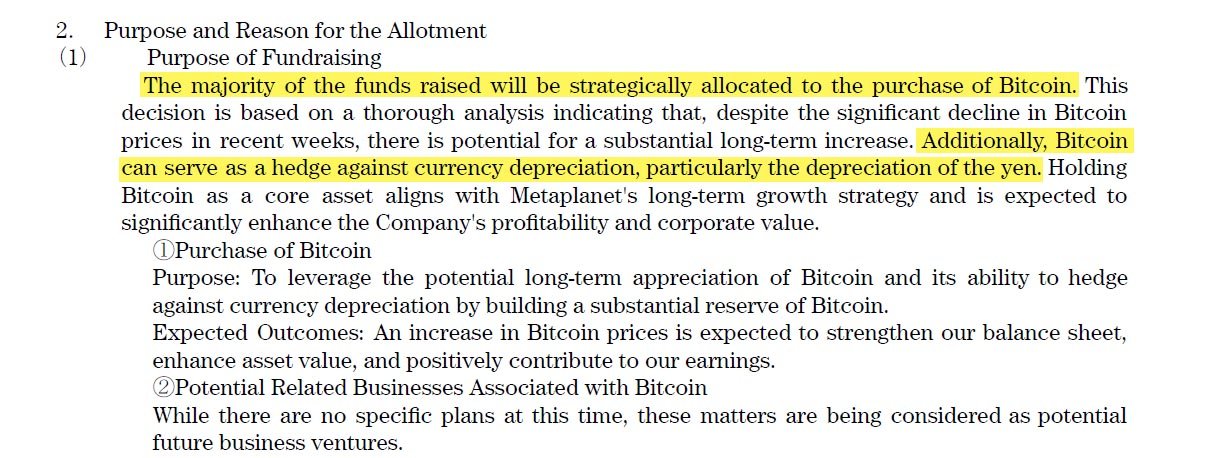

The majority of these funds, approximately ¥8.5 billion ($58.76 million), will be allocated to purchasing additional bitcoin. This decision follows a recent board meeting where the company approved a gratis allotment of stock acquisition rights to all common shareholders.

Starting from September 6 and running through October 15, 2024, shareholders of record as of September 5 will receive one stock acquisition right per common share, allowing them to acquire Metaplanet common stock at an exercise price of 555 yen (approximately $4) per share.

This strategy is heavily influenced by MicroStrategy, a Nasdaq-listed company that has made headlines since 2020 for its aggressive bitcoin acquisitions.

MicroStrategy has accumulated over 220,000 bitcoin, utilizing a mix of debt and equity raises, and currently holds one of the largest corporate bitcoin treasuries globally.

Related: Bitcoin Treasuries |A Growing Trend Among Corporations

Metaplanet’s CEO, Simon Gerovich, described the firm’s new direction by stating:

“We realized that Bitcoin is the apex monetary asset and would make a great element for the company’s treasury.”

This sentiment echoes MicroStrategy’s approach, positioning bitcoin not only as an investment with long-term appreciation potential but also as a hedge against currency depreciation.

One of the key motivations behind the company’s investment in Bitcoin is the volatility of the Japanese yen and Japan’s massive debt burden.

Japan’s net debt to GDP ratio was the highest among G7 countries in 2023, at around 159%. The depreciation of the yen against the US dollar has prompted Metaplanet to seek alternative ways to protect its assets.

“An increase in bitcoin prices is expected to strengthen our balance sheet, enhance asset value, and positively contribute to our earnings,” Metaplanet stated.

The company believes that bitcoin’s long-term appreciation potential makes it a suitable reserve asset that can offer stability amid the fluctuating fiat currencies.

The pivot towards Bitcoin also comes with a strategic exit from its struggling hotel business. The firm has faced declining revenue and recurring losses over the past five periods.

However, the company sees potential in transforming its hotel business to cater to Bitcoin enthusiasts and businesses. By offering unique services targeted at the Bitcoin community, the investment firm hopes to rejuvenate this division and create new revenue sources.

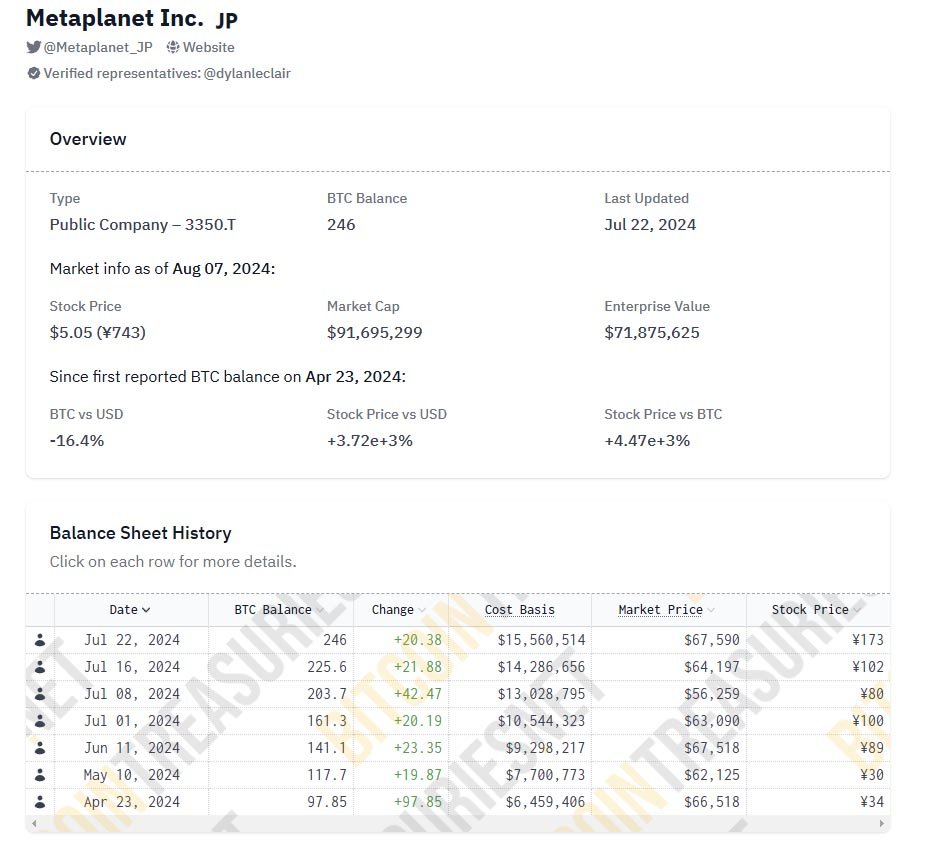

Currently, the Japanese company holds around 246 bitcoin, valued at approximately $13.4 million.

The additional $58.76 million investment will significantly expand this treasury. This move marks a substantial increase in the company’s bitcoin holdings, aligning with its long-term growth strategy.

Metaplanet began its bitcoin investment journey in April 2024, making an initial purchase worth $6.5 million. By July 8, the company had acquired an additional $2.5 million worth of bitcoin, bringing its total to 203.7 bitcoin at an average price of roughly $62,000 per bitcoin.

The announcement of Metaplanet’s stock rights offering and bitcoin investment plan has been well-received by the market.

According to Yahoo Finance, Metaplanet’s stock price jumped by 12% during Tokyo trading hours following the announcement. This positive market reaction underscores the confidence investors have in Metaplanet’s new strategic direction.

Furthermore, Metaplanet is exploring additional ways to generate income from its bitcoin holdings. The company is considering selling covered calls on its digital assets, a strategy that could provide additional revenue streams.

This move demonstrates Metaplanet’s commitment to maximizing the potential of its bitcoin investments.

Metaplanet’s decision to heavily invest in bitcoin positions the company as a pioneer among Japanese publicly traded firms. By adopting bitcoin as a reserve asset, Metaplanet aims to become Japan’s leading publicly traded bitcoin holder, setting a precedent for other companies in the region.

This move is expected to reshape Japan’s financial landscape, encouraging more companies to consider bitcoin for growth and stability. As Metaplanet continues to build its bitcoin treasury, it is paving the way for a new era of financial innovation in Japan.

Metaplanet’s $70 million bitcoin investment plan is a bold and strategic move that reflects a growing trend among companies seeking to diversify their assets and protect against currency volatility.

As more Japanese companies look to digital assets for stability and growth, Metaplanet’s pioneering efforts could indeed change Japan’s financial landscape forever.