In just six months, Tokyo-based investment firm Metaplanet has emerged as one of Asia’s biggest corporate bitcoin holders. In its latest series of BTC accumulation, the firm announced that it has purchased 156.78 BTC on October 28.

With this purchase, the company has effectively amassed over 1,000 BTC through strategic acquisitions.

This bold move has fueled a surge in the company’s stock price, now up by more than 600% year-to-date, as investors and the broader financial community take notice of its aggressive bitcoin investment strategy.

Metaplanet’s ambitious bitcoin accumulation began in April 2024, as the firm’s leadership saw growing value in bitcoin as a hedge against economic instability and inflation.

Now 6 months later, the company has surpassed the 1,000 BTC mark, putting its name in the same league as major bitcoin holders like U.S.-based MicroStrategy.

The rapid expansion of Metaplanet’s bitcoin holdings is all the more impressive given the disciplined and consistent investment approach the firm has taken. Rather than going all-in with large-scale purchases, Metaplanet has committed to smaller, steady investments over time.

This method, which the company described as “disciplined” and “strategic,” involved making incremental bitcoin buys every other week, with an average price of $61,628 per BTC over its first 17 acquisitions.

As a result, the firm has managed to accumulate a sizable reserve of BTC while maintaining steady growth and stability for its investors.

In its most recent purchase, the firm added another 156.78 BTC at an average price of $66,436, bringing its total bitcoin holdings to around 1,108 BTC, valued at approximately $69 million.

This impressive milestone confirms Metaplanet’s role as a leader in Asia’s bitcoin market.

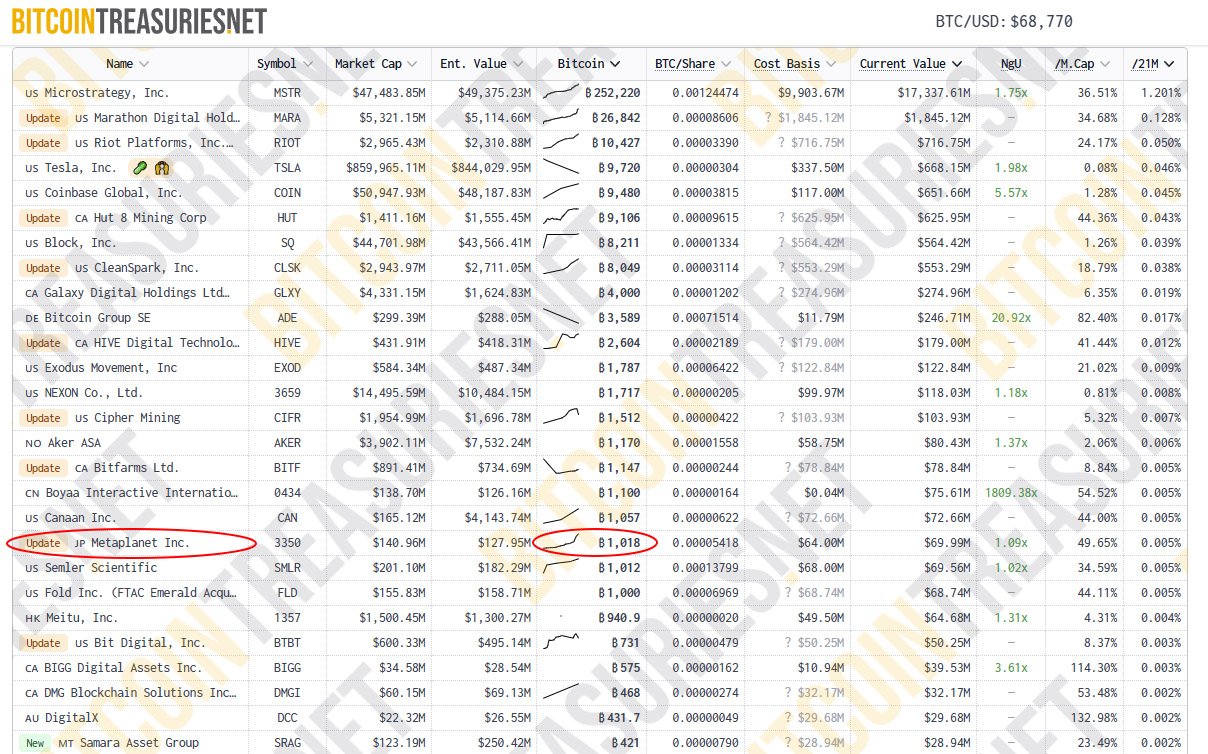

Metaplanet’s significant bitcoin reserves place it within the world’s top 20 companies holding bitcoin, currently positioned at 19th, based on data from Bitcoin Treasuries.

Metaplanet CEO Simon Gerovich celebrated this achievement, stating:

“[Metaplanet] now owns more than 1000 BTC making it one of the largest corporate holders of Bitcoin in Asia.”

Metaplanet’s Bitcoin strategy has paid off beyond its bitcoin holdings, significantly boosting its stock performance.

The firm’s stock price has soared by nearly 610% since the start of the year, outperforming even bitcoin itself on certain days. On October 28, after the latest BTC acquisition announcement, Metaplanet’s stock saw a 7.8% jump, closing at 1,181 yen.

This stock rally hasn’t just been about bitcoin purchases. Metaplanet has also made waves by reinvesting profits into strategic assets, building a robust treasury while choosing not to distribute dividends.

This approach has appealed to investors seeking long-term growth, further driving interest in the stock.

The company recently raised about $66 million through a stock acquisition rights offering, which allowed shareholders to purchase shares at a discounted rate.

The capital raised from nearly 13,800 shareholders will fund Metaplanet’s continued expansion of its bitcoin reserves. Metaplanet’s strategy is to ensure that it has the resources to secure digital assets as a future-proof financial strategy.

In a move to enhance transparency and credibility, Metaplanet has partnered with the Bitcoin verification provider Hoseki. This collaboration allows shareholders and other stakeholders to verify the company’s bitcoin holdings through a secure, blockchain-based process.

This decision reflects an industry-wide trend among corporations adopting blockchain technology to enhance accountability, as institutional investment in digital assets continues to rise.

Related: Bitwise Announces On-Chain Address, Donations Go to Shareholders

With investors increasingly concerned about security and authenticity, Metaplanet’s partnership with Hoseki signals its dedication to protecting investor interests while providing a reliable way to confirm its assets.

In following MicroStrategy’s lead, Metaplanet has adopted a metric known as “BTC Yield,” which measures the return on bitcoin investments and how they contribute to overall shareholder value.

Since October, Metaplanet’s BTC yield reached an impressive 155.8%, with its Q3 yield alone standing at 41.7%.

The concept of BTC Yield highlights the firm’s strategy of using bitcoin as a stable reserve while actively increasing its returns. This focus on BTC Yield is more than just a financial measure—it’s a commitment to demonstrating how Metaplanet’s bitcoin investments add direct value to the company.

Metaplanet’s success story draws inevitable comparisons to MicroStrategy, the U.S. firm known for pioneering large-scale bitcoin holdings among corporations.

Some industry experts even label Metaplanet as “Asia’s answer to MicroStrategy,” noting how the firm’s bitcoin reserves position it as a key player in the region’s digital asset market.

With economic uncertainties still looming, Metaplanet’s focus on Bitcoin underscores a shift in how companies view bitcoin as a viable reserve asset.

It seems like Bitcoin is increasingly becoming a necessary hedge in today’s volatile economic landscape. Metaplanet stated that it is committed to safeguarding its capital and growing shareholder value, and Bitcoin plays an essential role in that.

With over 1,000 BTC on its balance sheet, Metaplanet has solidified its place among the world’s top corporate bitcoin holders.

While the firm’s 1,018 BTC holdings may still trail MicroStrategy’s substantial 252,000 BTC, the Tokyo-listed company’s consistent strategy has allowed it to rise rapidly as a global player.

For many firms in Asia, where economic concerns remain heightened, Metaplanet’s success story serves as both a motivator and a model. Other companies in the region may soon follow its lead, positioning bitcoin not just as a speculative asset, but as a fundamental part of their financial strategy.

In the span of half a year, Metaplanet has managed to rewrite its narrative, transitioning from a traditional investment firm to a leading bitcoin holder and trendsetter.

As it continues to amass BTC, investors worldwide are watching to see if other Asian companies will adopt similar approaches.

Metaplanet’s dedication to transparency, steady investment strategy, and innovative BTC Yield approach are turning heads, hinting that bitcoin might just be the asset of choice for corporations seeking financial security in an uncertain global economy.