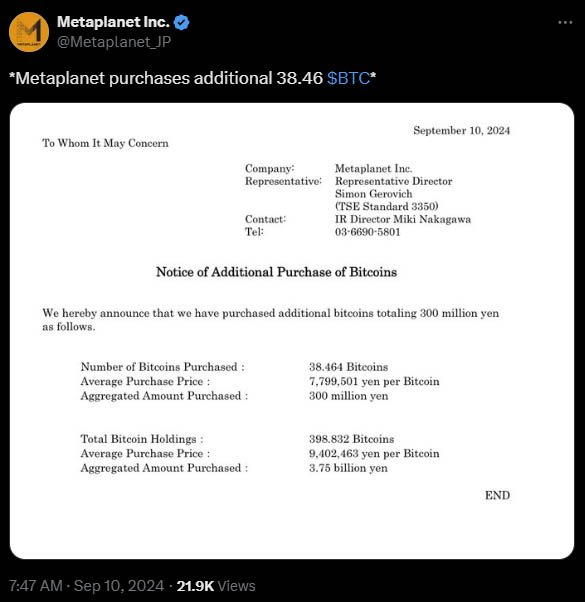

Metaplanet, a publicly listed Japanese investment firm often referred to as “Asia’s MicroStrategy,” has made headlines again by purchasing an additional ¥300 million ($2.2 million) worth of bitcoin.

This latest Metaplanet bitcoin acquisition brings the company’s total bitcoin holdings to approximately 398.8 BTC, valued at around $27.6 million.

Metaplanet’s decision to buy more bitcoin comes at a time when Japan is facing economic challenges, including high government debt, a weak yen, and prolonged periods of negative real interest rates.

These conditions have prompted many investors, including Metaplanet, to seek alternative ways to preserve capital and hedge against economic instability.

Metaplanet first adopted bitcoin as a reserve asset earlier this year, following a similar strategy to that of U.S.-based MicroStrategy, which has also accumulated a large amount of bitcoin.

Since then, the Tokyo-listed firm has been on a bitcoin buying spree, purchasing 38.4 additional bitcoin with this latest investment.

The company’s strategy has been clear: use bitcoin to protect against currency depreciation and economic uncertainty. Even with the recent decline in the bitcoin market, Metaplanet remains committed to holding it as a key asset in its treasury.

By holding bitcoin, Metaplanet aims to provide domestic investors with exposure to the digital asset, potentially benefiting from favorable tax treatments and a hedge against the weakening yen.

To enhance its bitcoin trading and custody services, Metaplanet recently partnered with SBI VC Trade, the digital asset investment arm of the Japanese financial conglomerate SBI Group.

Related: Metaplanet Partners with SBI Group to Strengthen Bitcoin Strategy

This collaboration is designed to provide compliant corporate custody services, tax efficiency, and the ability to use bitcoin as collateral for financing. The partnership also includes access to SBI’s tax exemption services, which support long-term corporate bitcoin holdings.

SBI Group will assist Metaplanet’s Bitcoin strategy with trading, storage, and operational needs, highlighting bitcoin’s role as a non-political financial asset.

This partnership reflects Metaplanet’s broader strategy of maximizing the benefits of holding bitcoin while minimizing the costs associated with its storage and use.

The latest purchase of bitcoin comes just after Metaplanet announced plans to raise 10.08 billion yen to buy more bitcoin, underscoring its commitment to the digital asset.

Metaplanet’s aggressive accumulation strategy seems to be paying off. Its stock has surged more than 636% year-to-date, buoyed by the increasing appeal of bitcoin as an alternative asset amid Japan’s ongoing financial uncertainty.

This positive market response suggests that investors are confident in Metaplanet’s strategy to use bitcoin as a key component of its treasury reserve.

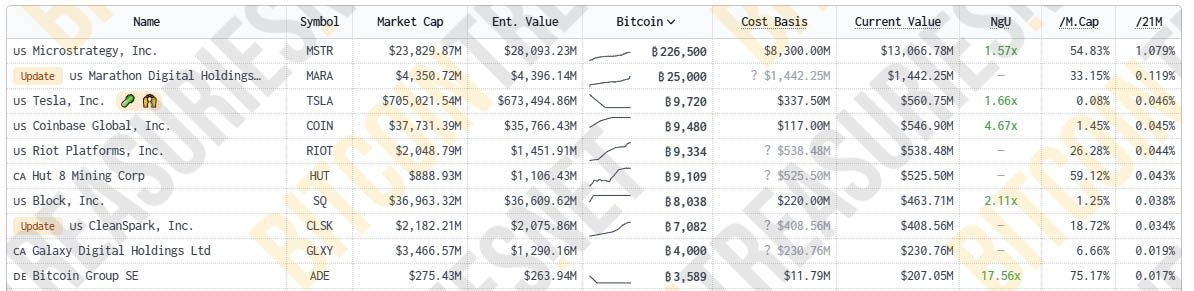

Metaplanet is not alone in its strategy. Many other public companies are following a similar approach, using bitcoin as a treasury reserve asset.

Notably, MicroStrategy remains the largest corporate holder of bitcoin, with over 226,500 BTC. Other companies, like Marathon Digital Holdings, have also raised significant capital to purchase more bitcoin.

By borrowing fiat currency at low interest rates to buy bitcoin, these companies hope to capitalize on bitcoin’s potential appreciation. This approach allows them to gain exposure to bitcoin without needing to liquidate existing assets, thereby maintaining flexibility in their financial strategies.

Despite the recent downturn in the bitcoin market, Metaplanet remains optimistic about the future of the digital asset. The company believes that bitcoin will continue to be a valuable asset, particularly in an environment of economic uncertainty.

Metaplanet’s persistent investment in bitcoin has drawn considerable interest, highlighting its strategy of creating a strong digital asset reserve.

As Japan navigates its economic challenges, Metaplanet’s bold move to accumulate more bitcoin could position the firm as a leader in bitcoin investments.

The company’s strategy mirrors that of other forward-thinking firms worldwide, betting on the long-term value of bitcoin as a hedge against economic instability.

While it remains to be seen how the market will react in the long term, Metaplanet’s continued investment in bitcoin is a clear signal of its belief in its potential to provide stability and growth in uncertain times.