Microsoft shareholders rejected a proposal to invest in bitcoin at the company’s annual shareholder meeting on December 10. The decision is a sign of cautious approach to digital assets from one of the biggest tech companies in the world.

The proposal, titled “Assessment of Investing in Bitcoin”, suggested Microsoft allocate 1% of its $78 billion cash to bitcoin as an inflation hedge.

The proposal was put forward by the National Center for Public Policy Research and backed by Bitcoin advocate and MicroStrategy co-founder Michael Saylor. But Microsoft’s board voted against it, citing bitcoin’s price volatility and the need for stable investments.

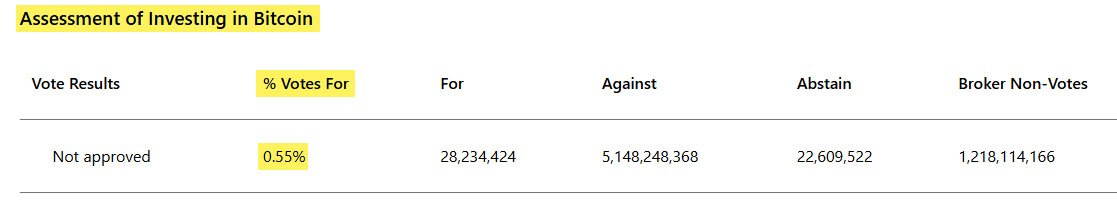

According to voting results published on Microsoft’s website, only 0.55% agreed to inclusion of bitcoin in the company’s treasury.

Microsoft’s board says while bitcoin investments are interesting, they are also risky. A company statement said bitcoin’s short term price fluctuations make it not suitable for treasury reserves that need “stability and predictability”.

The board also mentioned that Microsoft’s Global Treasury and Investment Services team reviews various investment options, including digital assets, to ensure financial stability. “Past evaluations have included Bitcoin and other cryptocurrencies among the options considered”, the board noted.

While some see bitcoin as a transformative asset that will grow exponentially, others warn of its unpredictability.

Bitcoin recently surpassed the $100,000 mark, with its market cap going above $2 trillion before dropping slightly. Executive Chairman of MicroStrategy, Michael Saylor, believes bitcoin will reach a market cap of $200 trillion by 2045 and it’s an opportunity of a lifetime for corporations.

Many in the Bitcoin space slammed Microsoft’s cautious approach.

Not all tech companies are like Microsoft. Amazon is looking to invest a part of its cash into bitcoin, so there’s a possibility of divergence in how tech giants approach the digital asset.

But analysts note that institutional investors who own the majority of Microsoft’s shares often prioritize stability over risk. Companies like Vanguard Group who hold a big chunk of Microsoft’s shares may prefer traditional investments over bitcoin.

Related: Vanguard Blocks Bitcoin ETF, Sparking Criticism Among Users

Microsoft’s priorities also came into play. The company has invested $13 billion in AI since partnering with OpenAI in 2019. With AI as its top strategic focus, digital asset investments may not fit into the company’s near term goals.

Some see Microsoft’s decision as a missed opportunity especially with more and more companies adding bitcoin to their treasuries. MicroStrategy has added over 400,000 BTC to its treasury and is making a killing during this rally.

Bitcoin fans say companies that get in early will have a big advantage as it grows globally. They point out that bitcoin has given long term gains despite its volatility and some call the price swings a feature, not a bug.

Those who criticize Microsoft’s approach compare it to the skepticism Bitcoin faced in its early days, noting the times when Bitcoin was called a bubble and now it’s near $100,000 and the doubters were wrong.

Although the proposal was rejected, Microsoft may still consider bitcoin in the future.

The board said they will continue to monitor the digital asset space to guide future decisions. Analysts think calmer markets and clearer regulations will make bitcoin more attractive to cautious companies like Microsoft.

For now, Microsoft said no. As the gap between old finance and new finance widens, one can expect this decade-old debate to only get louder.