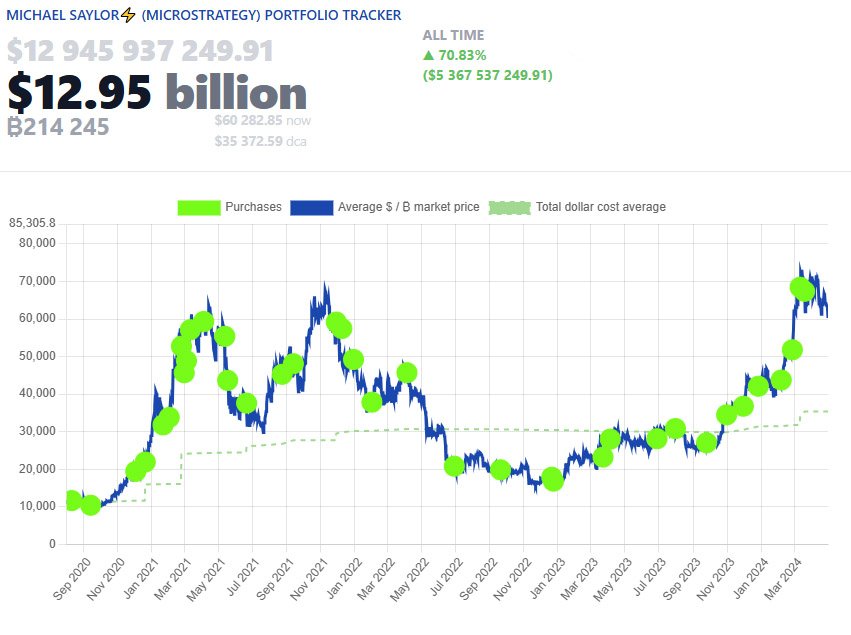

MicroStrategy, a prominent business intelligence firm, keeps committed to its aggressive bitcoin accumulation strategy. According to reports, the company has bought another 122 BTC in April, bringing its total bitcoin reserves to over 214,000 BTC.

MicroStrategy Bitcoin Acquisition Spree

With a steadfast commitment to Bitcoin, MicroStrategy has been consistently bolstering its holdings, making headlines with each acquisition. Since August 2020, MicroStrategy has been on a relentless journey of accumulating bitcoin, positioning itself as a major player in the Bitcoin market.

According to the company’s quarterly reports, MicroStrategy acquired an additional 122 BTC in April alone, bringing its total bitcoin purchases in 2024 to over $1.65 billion. Despite bitcoin’s recent price fluctuations, MicroStrategy remains undeterred, seizing opportunities to expand its bitcoin portfolio.

The latest reports reveal that the company’s bitcoin holdings now stand at a staggering 214,400 BTC, valued at over $15.2 billion. This remarkable feat underscores MicroStrategy’s unwavering dedication to digital assets.

Notably, this massive reserve was purchased at an average price of $35,180 per BTC.

A Testament to Long-Term Vision

MicroStrategy’s Chairman, Michael Saylor, has been vocal about the company’s long-term vision regarding Bitcoin. In a statement, he emphasized MicroStrategy’s commitment to the “continued development of the Bitcoin network”.

He highlighted the company’s unique Bitcoin strategy, which has enabled it to amass a substantial reserve of BTC.

Phong Le, the CEO of MicroStrategy, stated:

“As the world’s first Bitcoin Development Company, MicroStrategy is committed to the continued development of the Bitcoin network through our activities in the financial markets, advocacy and technology innovation.

It is through our unique Bitcoin strategy and solid track record as an operating company that we now hold 214,400 Bitcoin at an average purchase price of $35,180 per Bitcoin.”

Navigating Financial Terrain

Despite MicroStrategy’s bullish stance on bitcoin, the company has encountered challenges on the financial front.

The first quarter of 2024 saw a slight decline in overall revenue, dropping by 5.5% to $115.2 million. Additionally, the company reported a net loss of $53.1 million, primarily due to a digital asset impairment loss of $191.6 million.

However, MicroStrategy’s CFO, Andrew Kang, remains optimistic about the company’s financial outlook. Kang highlighted the success of MicroStrategy’s capital markets strategy, which included two convertible debt offerings, raising over $1.5 billion in the first quarter.

Kang stated:

“In the first quarter we raised over $1.5 billion by executing again on our capital markets strategy including two successful convertible debt offerings, we acquired 25,250 additional bitcoins since the end of the fourth quarter, our 14th consecutive quarter of adding more bitcoin to our balance sheet.”

He emphasized that their operational setup, Bitcoin approach, and emphasis on tech innovation offer a distinct chance for shareholder value growth.

Kang also noted a significant rise in bitcoin’s price this year, driven by increased institutional interest due to approved spot Bitcoin exchange-traded products and clearer regulations.

Market Response and Future Prospects

MicroStrategy’s aggressive bitcoin acquisition strategy has not gone unnoticed by the market.

Despite the financial challenges, the company’s stock (MSTR) has showcased remarkable growth, outperforming the S&P 500 with a jaw-dropping 937% price increase since adopting its Bitcoin-focused approach in 2020.

The market response to MicroStrategy’s cloud-native software solutions has also been positive, with subscription services revenue demonstrating growth and resilience, climbing by 22% year-over-year.

Saylor noted this growth, pointing out that the revenues from subscription services and the amount billed for subscriptions “both grew again at double-digit growth rates.”

Looking ahead, MicroStrategy shows no signs of slowing down its bitcoin investments. With institutional demand on the rise and regulatory clarity improving, the company remains poised to capitalize on future opportunities in the Bitcoin space.

Conclusion

MicroStrategy’s relentless pursuit of Bitcoin underscores its commitment to innovation and long-term value creation.

Despite facing financial headwinds, the company remains steadfast in its belief in the potential of Bitcoin. As the digital asset landscape continues to evolve, MicroStrategy stands at the forefront, shaping the future of finance one Bitcoin at a time.

With each acquisition, MicroStrategy solidifies its position as a dominant force in the Bitcoin market, paving the way for a new era of financial inclusion and technological advancement.

In the realm of Bitcoin, MicroStrategy is not just an investor but a visionary, leading the charge towards a decentralized future.