New Hampshire is making news as it joins the growing list of US states considering a bitcoin strategic reserve for their treasuries.

A new bill by State Rep Keith Ammon would allow the state treasury to invest in digital assets like bitcoin and precious metals like gold, silver and platinum as part of the public funds. This is a forward thinking move to diversify state investments and get ahead of the curve.

The bill would create a “strategic reserve” for NH , allowing up to 10% of the state’s funds to be invested in alternative assets, including bitcoin. With the state treasury having $3.6 billion as of June 30, that would be up to $360 million.

According to the bill, the funds would be held in “secure custody solutions”, such as cold secure wallets and qualified custodians.

Rep Ammon says the proposal fits with the New Hampshire ethos. He said in an interview:

“The ethos in New Hampshire is ‘Live Free or Die’ […] The state needs to be ready for the future of finance.”

Under the bill, only digital assets with a market capitalization of over $500 billion averaged over the previous calendar year would be eligible.

Currently only Bitcoin meets that criteria so it’s the only one that would be included in the state’s reserves. Stablecoins like Tether (USDT) and USD Coin (USDC) could also be considered as options.

The bill also allows for staking and lending of digital assets, so the state can earn passive income.

New Hampshire’s proposal comes as bitcoin reserves are gaining traction across the US and globally. Texas, Ohio, Pennsylvania and Alabama have introduced similar legislation.

Pennsylvania State Representative Mike Cabell proposed using the state’s $7 billion emergency fund to buy bitcoin, starting with a 1-5% allocation. Texas lawmakers are looking into accepting taxes, fees and donations in bitcoin.

At the federal level, Senator Cynthia Lummis and others have been advocating for a national bitcoin reserve.

Former President Donald Trump has also supported the idea, suggesting the federal government should hold more bitcoin. Globally, Brazil, Poland and Bhutan are looking into using bitcoin in their treasuries as well.

The New Hampshire bill stresses the importance of secure storage solutions to protect against theft or loss.

By working with qualified custodians and using latest technology, the state will ensure the safety of its digital assets. The bill also requires regular disclosures and examinations of bitcoin holdings just like traditional assets.

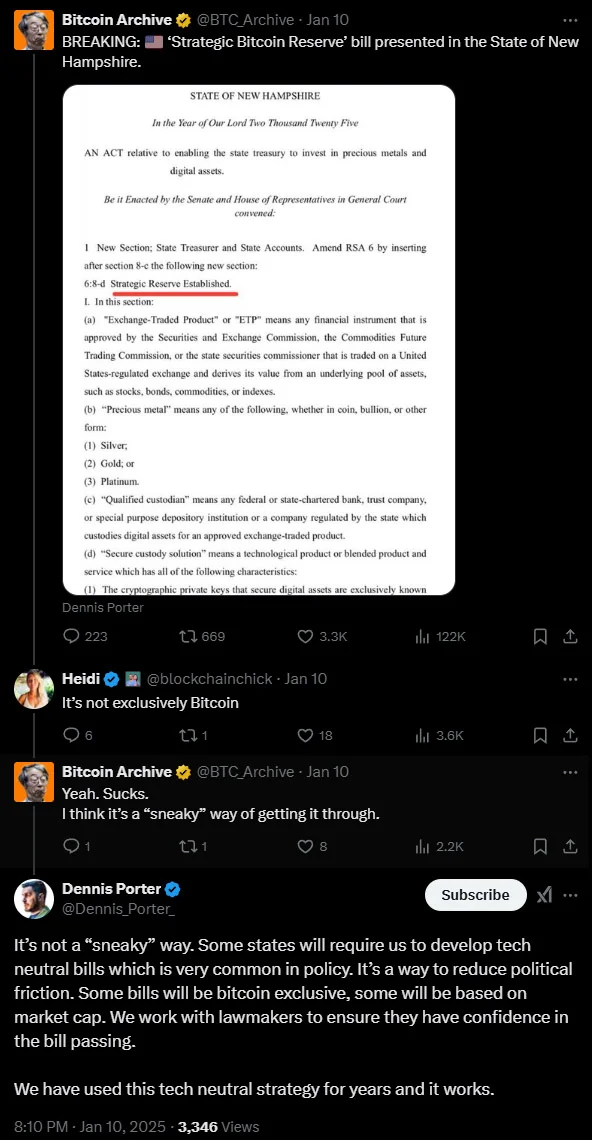

Some still are skeptical about the bill. They stated that it does not exclusively state “Bitcoin”, but mentions “digital assets” in general. They believe this will leave the door open for adoption of less favorable “shitcoins”.

But supporters like Dennis Porter, CEO of the Satoshi Action Fund, defend the proposal saying the high market cap requirement limits the risk. “It’s not a ‘sneaky’ way to get Bitcoin” he said. “Some states will require us to develop tech-neutral bills… It’s a way to reduce political friction.”

If this passes, it will set the precedent for how other states and countries approach Bitcoin in public finance. “The state that is last to build bitcoin reserves will lose,” Ammon warned, saying states need to act now not later.