In a surprising move that signals a shift in the global financial landscape, the central banks of Norway and Switzerland have taken significant stakes in MicroStrategy, a U.S.-based business intelligence firm best known for its substantial bitcoin holdings.

This strategic investment by Norges Bank and the Swiss National Bank (SNB) indirectly provides these institutions with exposure to bitcoin, marking an important development in the adoption of Bitcoin by traditional financial institutions.

The decision by these central banks to invest in MicroStrategy is noteworthy, given that the company has become a prominent player in the Bitcoin market due to its large BTC reserves.

MicroStrategy, under the leadership of its co-founder Michael Saylor, has made headlines for its aggressive acquisition of bitcoin, positioning itself as the largest corporate holder of the digital asset.

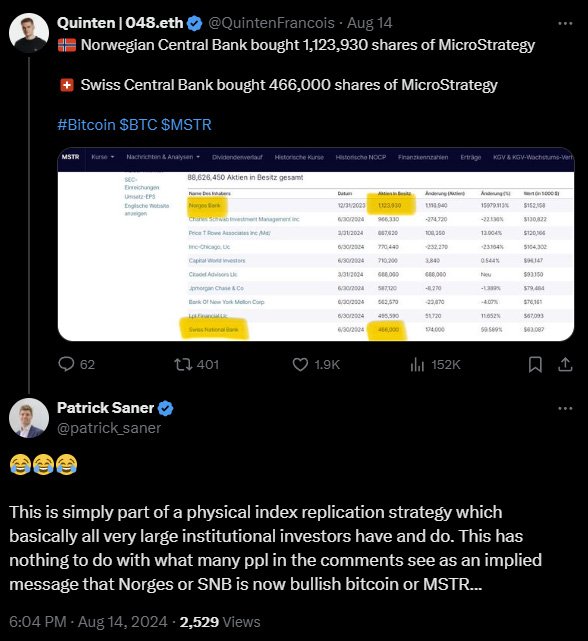

According to recent filings, Norges Bank, responsible for managing Norway’s state pension fund, now holds 1.578 million shares of MicroStrategy, while the Swiss National Bank has acquired 466,000 shares.

This represents a significant 60% increase in the SNB’s holdings compared to the previous quarter. These investments have sparked considerable interest and speculation about the motivations behind the central banks’ actions.

The reasons for these investments are multifaceted, but two primary theories have emerged. One suggests that the central banks are interested in gaining indirect exposure to bitcoin, viewing it as a strategic reserve asset.

As Bitcoin continues to gain acceptance as a legitimate financial asset, central banks may be exploring ways to diversify their reserves beyond traditional assets like government bonds and foreign currencies.

Since MicroStrategy is a significant purchaser of bitcoin, it’s plausible that the central banks of Norway and Switzerland sought to gain bitcoin exposure by investing in MSTR.

This approach allows the central banks to participate in the potential growth of bitcoin without directly purchasing the asset, which might be considered too risky or controversial for a central bank to hold directly.

Another perspective is that the central banks see MicroStrategy as a strong investment in its own right, independent of its bitcoin holdings.

Patrick Saner, head of macro strategy at Swiss Re institute, noted that neither Norges Bank nor the Swiss National Bank showed any signs of a positive outlook for Bitcoin, suggesting that the purchases could be part of a broader strategy of investing in high-performing companies rather than a direct bet on Bitcoin.

Regardless of the specific motivations, the fact that two of Europe’s most prominent central banks have invested in a company so closely tied to Bitcoin is a significant development.

It reflects a growing acceptance of Bitcoin-related assets within the traditional financial system, a trend that has been gaining momentum over the past few years.

Historically, Switzerland has been more open to Bitcoin adoption than many other countries. The city of Lugano, for example, has become a hub for Bitcoin-related activities, and citizens can even pay their taxes using bitcoin or the USDT stablecoin.

This liberal approach to digital assets aligns with the SNB’s investment in MicroStrategy and suggests a strategic move to further integrate Bitcoin into the country’s financial ecosystem.

Norway, on the other hand, has taken a more cautious approach to digital assets. The country recently introduced regulations requiring Bitcoin mining companies to register with local municipalities, giving authorities the power to block their operations.

Despite this, Norges Bank’s investment in MicroStrategy indicates a recognition of the growing importance of Bitcoin and the broader digital asset market.

MicroStrategy has positioned itself as a key player in the Bitcoin market, holding an impressive 226,500 bitcoin as part of its corporate strategy. This massive holding dwarfs that of other companies, such as Marathon Digital Holdings, which holds around 20,818 BTC.

The company’s stock has effectively become a leveraged play on Bitcoin, allowing investors to gain exposure to the digital asset without the need for direct ownership.

Michael Saylor, MicroStrategy’s co-founder, has been a vocal advocate for Bitcoin, often describing it as a superior digital asset and a hedge against inflation.

His bold strategy has paid off, with MicroStrategy’s stock outperforming most of the S&P 500 since the company began its bitcoin acquisitions in 2020.

The stock now functions as a way to invest in bitcoin with leverage, and it comes with no fees. This unique position makes MicroStrategy an attractive option for institutions like central banks that are looking to dip their toes into the world of digital assets.

The investments by the Norwegian and Swiss central banks raise interesting questions about the future role of Bitcoin in global financial systems.

While these purchases represent indirect exposure to bitcoin, they could signal a broader trend toward the integration of digital assets into national reserves.

At The Bitcoin Conference 2024 in Nashville, various political figures, including former President Donald Trump and Wyoming Senator Cynthia Lummis, discussed the potential of bitcoin as a strategic reserve asset for the United States.

The idea of using bitcoin to help the U.S. government repay its debts was floated, reflecting growing interest in bitcoin as more than just an investment vehicle.

In Europe, the discussion around bitcoin’s role in national reserves is also gaining traction.

The SNB’s investment in MicroStrategy, for instance, has been interpreted by some as a step toward considering bitcoin for Switzerland’s currency reserves, potentially enhancing the country’s financial independence.

Despite the enthusiasm, it’s important to recognize that investing in bitcoin, even indirectly through companies like MicroStrategy, carries significant risks.

Bitcoin’s price is notoriously volatile, and while it has seen substantial growth over the past decade, it has also experienced sharp declines.

For central banks, which are traditionally risk-averse institutions, the decision to gain exposure to bitcoin through MicroStrategy suggests a cautious but growing interest in the digital asset.

By investing in a company rather than directly in bitcoin, they can hedge their bets, gaining potential upside from bitcoin’s growth while mitigating some of the risks associated with direct ownership.