North Dakota is looking into putting bitcoin in its treasury, joining the growing list of US states planning to update their investment strategies and protect against inflation.

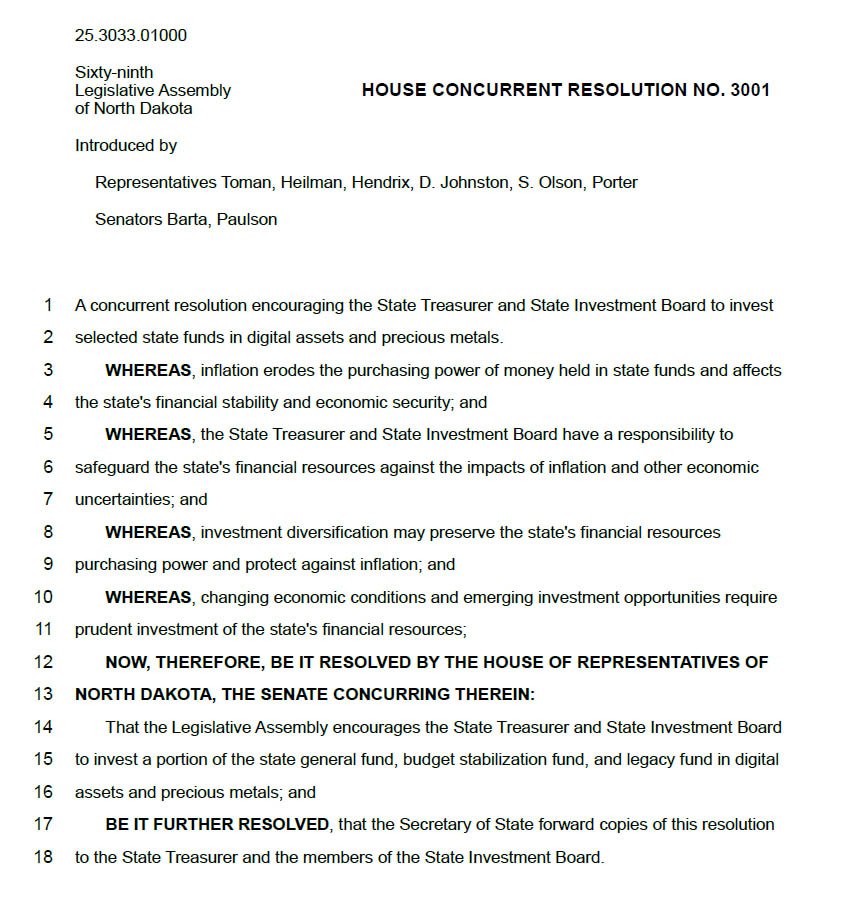

The North Dakota State Legislature introduced Resolution 3001, a bill to have the state diversify its portfolio by investing in digital assets and precious metals.

The resolution, sponsored by 6 reps and Senators Jeff Barta and Bob Paulson, is the latest sign of state governments getting into bitcoin as a hedge against economic uncertainty.

The government must adapt to changing economic trends and new investment opportunities, the resolution says, citing the need for “prudent investment of the state’s financial resources”.

Resolution 3001 asks the North Dakota State Treasurer and the State Investment Board to move funds from the general fund, budget stabilization fund and legacy fund into digital assets and precious metals.

But it’s important to note this is an advisory resolution and not binding.

“The resolution is simply encouraging the State Treasurer and the State Investment Board to look at investing in different types of assets rather than what they currently do” said John Bjornson, Director of the North Dakota Legislative Council.

Unlike other state’s proposals, North Dakota’s doesn’t mention Bitcoin by name. Supporters of the resolution say keeping the language tech-neutral helps reduce political friction and makes it easier to pass.

The same thing happened with the recent bill introduced by New Hampshire.

Related: New Hampshire to Create Bitcoin Reserve for State Treasury

Dennis Porter, Bitcoin policy advocate, acknowledged this, saying:

“Some states will require us to develop tech-neutral bills, which is very common in policy. It’s a way to reduce political friction. Some bills will be Bitcoin-exclusive, while others will be based on market cap.”

North Dakota’s proposal follows a trend of US states looking at Bitcoin for their investment strategies. New Hampshire, Texas, Florida , Pennsylvania and Alabama have introduced or are exploring similar measures.

In New Hampshire, legislation introduced the same week has specific criteria favoring Bitcoin, requiring eligible digital assets to have a market cap of over $500 billion. That means Bitcoin is the only asset that qualifies under that proposal.

New Hampshire Representative Keith Ammon said: “The state that is last to build bitcoin reserves will lose. It’s urgent that states act sooner than later, and that takes some education on the part of state officials.”

Florida’s Chief Financial Officer, Jimmy Patronis and Alabama’s State Auditor Andrew Sorrell have also advocated for Bitcoin in their state reserves to protect public funds from inflation.

Supporters of these measures say Bitcoin’s store of value makes it a perfect hedge against inflation.

By diversifying into bitcoin and precious metals, North Dakota wants to protect its finances and reduce the loss of purchasing power from economic volatility. Having a value stable asset like Bitcoin will protect the state treasury’s assets.

The resolution focuses on the benefits of digital assets but also emphasizes evaluation and transparency.