Norway’s sovereign wealth fund, the world’s largest state pension fund, recently made headlines by significantly increasing its indirect exposure to bitcoin.

This development has sparked discussions about the growing integration of bitcoin into mainstream financial systems, even as experts debate whether this move was a deliberate strategy or an unintended consequence of broader investment practices.

Norway’s sovereign wealth fund, officially known as the Government Pension Fund of Norway (NBIM), is a financial powerhouse with assets under management totaling approximately $1.7 trillion.

This massive fund was established to reinvest the country’s considerable oil revenues for the benefit of its citizens. With a population of 5.5 million, this translates to nearly $310,000 in assets per Norwegian resident.

The fund has a global investment portfolio, which includes stakes in thousands of companies across various sectors.

In recent years, as part of its diversification strategy, the fund has increased its exposure to companies involved in the Bitcoin industry. This has inadvertently led to a significant rise in its bitcoin holdings.

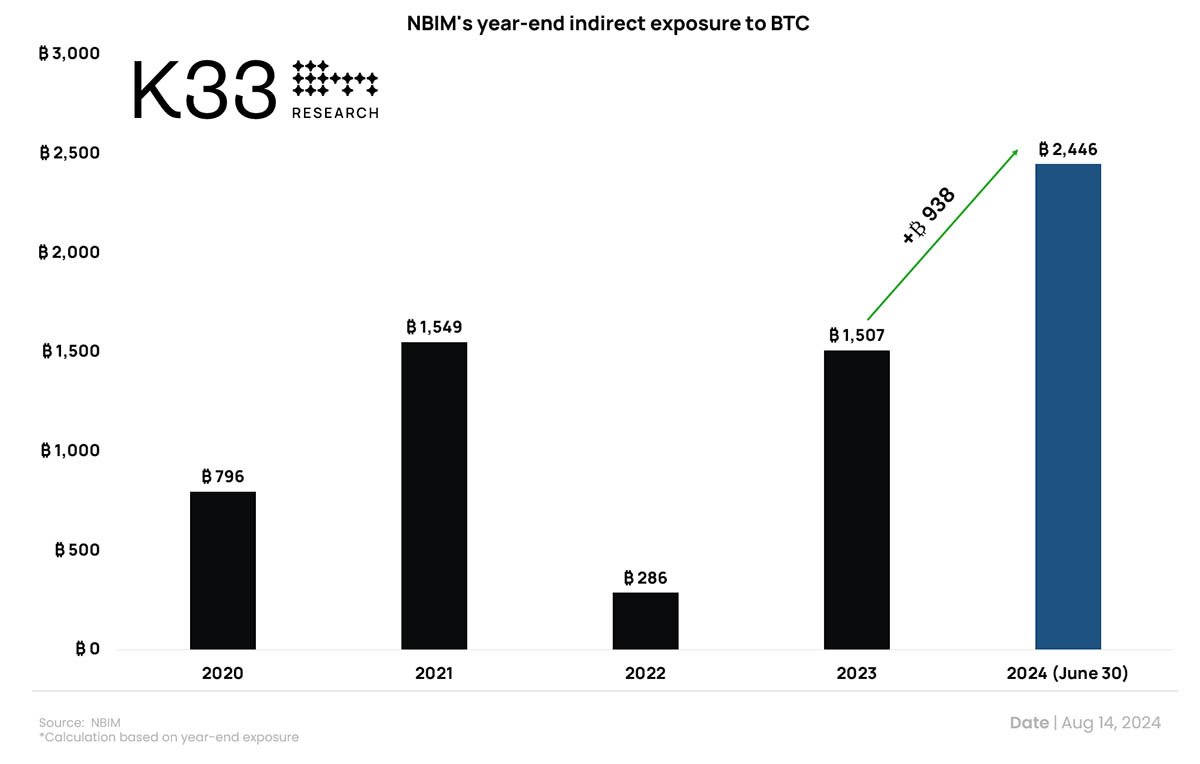

According to data from K33 Research, as of the first half of 2024, the Norwegian sovereign wealth fund holds an indirect exposure to 2,446 bitcoin, which is currently valued at around $144 million.

This represents a significant increase from the fund’s bitcoin holdings at the end of 2023, which stood at 1,507 BTC. The increase of 938 BTC marks a growth of approximately 62% in just six months.

On a per capita basis, this means that every Norwegian citizen indirectly “owns” about $27 worth of bitcoin through the fund’s investments. While this might seem like a modest amount, it underscores the growing role that Bitcoin is playing in global investment strategies.

One of the key questions surrounding the Norwegian sovereign wealth fund’s increased bitcoin exposure is whether it was a deliberate decision.

According to Vetle Lunde, a senior analyst at K33Research, the increase is likely not the result of a conscious effort by the Norwegian government to boost its bitcoin holdings. Instead, it appears to be a byproduct of the fund’s broader investment strategy. Lunde explains:

“The growth likely originates from pre-determined algo-based sector weighting and risk diversification. It’s unlikely to stem from an intentional choice to amass exposure.”

Lunde suggests that if the fund had intentionally aimed to increase its bitcoin exposure, there would be more evidence of direct investment initiatives targeting Bitcoin specifically.

The increase in the fund’s bitcoin exposure primarily came through its investments in companies that hold significant amounts of bitcoin in their corporate treasuries.

One of the most notable examples is MicroStrategy, a software firm led by Michael Saylor, which is one of the world’s largest single holders of bitcoin.

During the first half of 2024, Norway’s sovereign wealth fund increased its stake in MicroStrategy from 0.67% to 0.89%. Over the same period, MicroStrategy itself expanded its bitcoin holdings by 37,181 BTC.

Related: Central Banks of Norway and Switzerland Increase Investments in MicroStrategy

In addition to MicroStrategy, the fund also increased its investments in other companies with significant bitcoin exposure.

These include Block Inc., a fintech firm led by Jack Dorsey; Marathon Digital, a Bitcoin mining company; and Coinbase, a major digital asset exchange.

Specifically, the fund’s stake in Marathon Digital grew from 0% to 0.82%, its investment in Coinbase increased from 0.49% to 0.83%, and its holdings in Block Inc. rose from 1.09% to 1.28%.

Norway’s indirect bitcoin holdings are part of a broader trend among governments around the world. According to a report by Coingecko, governments globally now hold approximately 2.2% of the total bitcoin supply, which equates to around 462,000 BTC.

The United States is the largest governmental holder of bitcoin, with more than 212,000 BTC, primarily acquired through seizures related to criminal activity. The UK government holds around $3.5 billion worth of bitcoin, also mostly from confiscations.

In contrast to these countries, where bitcoin holdings are often the result of legal actions rather than investment strategies, El Salvador has taken a different approach.

The Central American nation, where bitcoin is legal tender, has deliberately built up a reserve of 5,800 BTC, worth approximately $339 million. This equates to almost $54 per citizen, highlighting El Salvador’s unique commitment to integrating bitcoin into its economy.

The increase in Norway’s bitcoin exposure, whether intentional or not, is significant for several reasons.

First, it reflects the growing maturity of Bitcoin as an asset class. As Lunde pointed out:

“It perfectly illustrates how Bitcoin is maturing as an asset and getting woven into any well-diversified portfolio.”

This maturation is evident in the way bitcoin is becoming a part of mainstream investment portfolios, even among conservative institutional investors like Norway’s sovereign wealth fund.

Second, the fund’s increased bitcoin exposure underscores the importance of diversification in investment strategies. By investing in a wide range of companies across different sectors, the fund has inadvertently increased its exposure to bitcoin.

This highlights the interconnectedness of the global economy and the way in which emerging asset classes like bitcoin are becoming more integrated into traditional financial systems.

Finally, the growth in the fund’s bitcoin holdings raises questions about the future of the digital asset in institutional portfolios. While the current exposure represents a small fraction of the fund’s total assets, it could signal the beginning of a broader trend.

As more companies integrate bitcoin into their corporate treasuries, institutional investors may find themselves with increasing exposure to bitcoin, even if it’s not a deliberate part of their investment strategy.

The increase in Norway’s sovereign wealth fund’s bitcoin exposure comes at a time when the digital asset itself has been experiencing significant price fluctuations.

As of the first half of 2024, bitcoin’s value had surged by more than 30%, buoyed by the performance of tech stocks and new regulations that allow bitcoin to be included in exchange-traded funds (ETFs).

However, despite these positive developments, bitcoin’s price remained below the psychologically important $60,000 mark, trading at around $58,000 at the time of the report.

The price action, set against the backdrop of increasing institutional adoption and user engagement, presents an intriguing narrative in the ongoing evolution of the market.