Ohio could soon be making waves in the world of Bitcoin once again. State Senator Niraj Antani recently introduced a bill that would allow Ohioans to pay state and local taxes using digital assets.

This is not the first time Ohio has explored such a measure, but Senator Antani’s bill represents a renewed effort to place Ohio at the forefront of digital currency innovation.

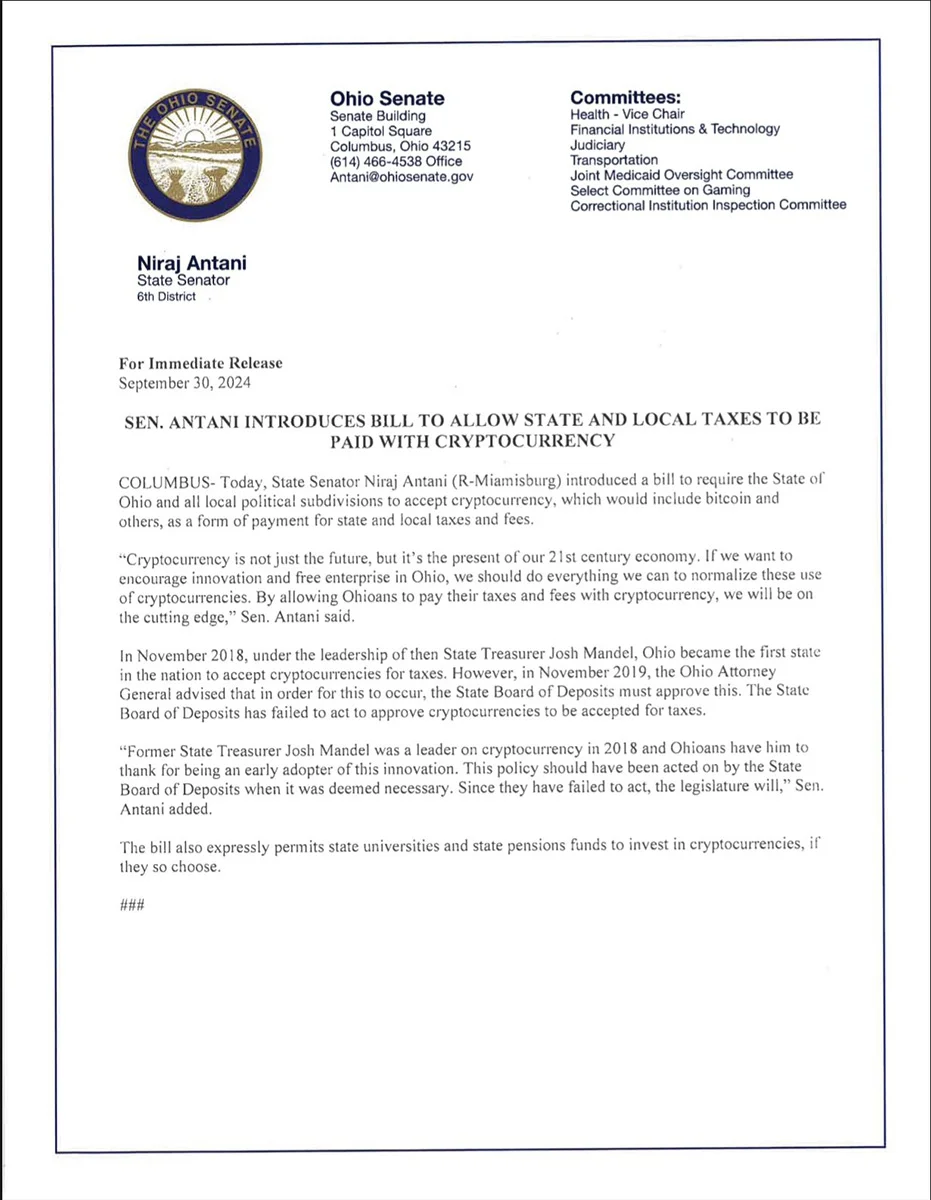

On September 30, Senator Antani filed a bill that, if passed, would mandate the acceptance of digital assets for tax payments across Ohio.

According to the bill, state and local governments would be required to accept bitcoin and other digital assets for taxes and fees, although the specific digital assets eligible for payment have not yet been fully defined. Antani stated:

“Cryptocurrency is not just the future — it’s the present of our 21st-century economy […] If we want to encourage innovation and free enterprise in Ohio, we should do everything we can to normalize the use of cryptocurrencies.”

This sentiment emphasizes the importance of embracing emerging technologies and ensuring Ohio remains competitive in the modern economy.

This isn’t Ohio’s first attempt to integrate digital assets into its tax payment system.

In 2018, the state became the first in the U.S. to allow businesses to pay their taxes using bitcoin. The initiative, led by then-State Treasurer Josh Mandel, was seen as a groundbreaking move at the time.

However, the program was short-lived, lasting just one year. The Ohio Attorney General ruled that the State Board of Deposits needed to approve the initiative, and due to the Board’s inaction, the program was ultimately terminated in 2019.

Reflecting on the missed opportunity, Antani said, “Former State Treasurer Josh Mandel was a leader on cryptocurrency in 2018, and Ohioans have him to thank for being an early adopter of this innovation.”

He added, “This policy should have been acted on by the State Board of Deposits when it was deemed necessary.”

Beyond tax payments, Senator Antani’s bill seeks to broaden the role of digital assets in Ohio’s financial landscape.

The proposed legislation would allow state universities and public pension funds to invest in bitcoin, giving these institutions more financial flexibility and potentially unlocking new investment opportunities. Antani mentioned:

“The State Board of Deposits should have acted, and since they haven’t, we will.”

This move follows a growing trend among public pension funds and institutions showing interest in the leading digital asset.

For example, earlier this year, Jersey City’s pension plan announced it would invest in bitcoin through exchange-traded funds (ETFs). In addition, South Korea’s Public Pension Fund recently acquired shares in MicroStrategy, a U.S.-based company that holds significant BTC reserves.

By allowing Ohio universities and pension funds to invest in digital assets, Antani’s bill positions the state as a potential leader in bitcoin adoption at the institutional level.

While this new legislation aims to push Ohio toward the forefront of bitcoin adoption, it is not without its challenges. The cancellation of the 2018 initiative highlighted some of the bureaucratic hurdles that may arise.

However, Antani’s bill seeks to prevent similar issues by explicitly requiring that digital asset payments be accepted for taxes and fees, leaving no room for ambiguity regarding approval.

Antani believes that by making these provisions clear in the bill, Ohio can avoid the pitfalls of the previous attempt and successfully integrate bitcoin into the state’s payment systems.

“By allowing Ohioans to pay their taxes and fees with cryptocurrency, we will be on the cutting edge,” he said, emphasizing the need to stay ahead in the rapidly evolving digital economy.

Despite the enthusiasm surrounding the bill, some critics have raised concerns about privacy.

Critics argue that using digital assets for tax payments could enable the government to link wallet addresses to individual taxpayers, potentially compromising the privacy of bitcoin users.

Given that privacy is a cornerstone of Bitcoin for many users, these concerns are worth considering as the bill moves forward.

The proposed legislation is currently awaiting committee assignment and will need to pass through Ohio’s bicameral legislature before becoming law. While the timeline for review remains uncertain, there is growing interest in the potential of Bitcoin for government payments.

Should the bill pass, Ohio would join other U.S. states, such as Colorado, that have already adopted similar measures.

In 2022, Colorado became the first state to officially accept bitcoin for various tax payments, and other states like Wyoming and Arizona have also explored similar initiatives.

At the federal level, progress has been slower. Congressman Matt Gaetz recently introduced a bill to permit digital asset payments for federal taxes, signaling the potential for wider adoption at the national level.

However, the federal government has been more cautious in its approach to digital assets, particularly under the current administration.

Ohio’s renewed push for bitcoin tax payments is part of a broader trend across the United States, where states are increasingly considering the role of digital assets in government transactions.

While federal regulations remain a hot topic of debate, state-level initiatives like those in Ohio, Colorado, and others demonstrate growing interest in integrating Bitcoin into mainstream financial systems.