In the Bitcoin community, personalities often clash over contrasting views. This weekend, a heated exchange unfolded between two renowned figures regarding the digital asset: Peter Brandt, a staunch advocate, and Peter Schiff, a vocal skeptic.

The dispute spilled onto social media platform X, where Schiff, a long-time proponent of gold who recently turned his attention to silver, highlighted silver’s impressive 20% price surge compared to bitcoin’s more modest 2% gain.

Schiff boldly claimed that silver outshined bitcoin in terms of investment potential, by stating:

“That’s more than 10x the bang for your buck with silver. Bitcoin is dead. Long live silver!”

Brandt, known for his unwavering support of Bitcoin, quickly dismissed Schiff’s remarks as a mere ploy for attention. He stated that Schiff’s comments lacked substance and were aimed at bolstering his social media presence rather than contributing to informed financial information. He writes:

“I am giving [Schiff] the benefit of the doubt — saying that he is actually not as dumb as he sounds. He knows he has been betting on dead horses. Just because one horse (Silver) decided to take a jog, Schiff is having a social media orgasm.”

The clash sparked a wave of reactions from Bitcoin supporters, echoing Brandt’s sentiments and questioning the practicality of investing in physical silver compared to Bitcoin’s liquidity and transferability.

Responding to the criticism, Schiff said that the people’s claims that he criticizes Bitcoin for social media attention are “ridiculous.”

He stated: “If my goal was to maximize engagement I’d come out in favor of Bitcoin. But I’m not willing to sacrifice my integrity just to attract followers or increase engagement.”

Beyond the social media theatrics, the debate over Bitcoin’s role as a hedge against inflation often occurs. With concerns about rising inflation, some investors view Bitcoin as a potential safeguard for preserving value.

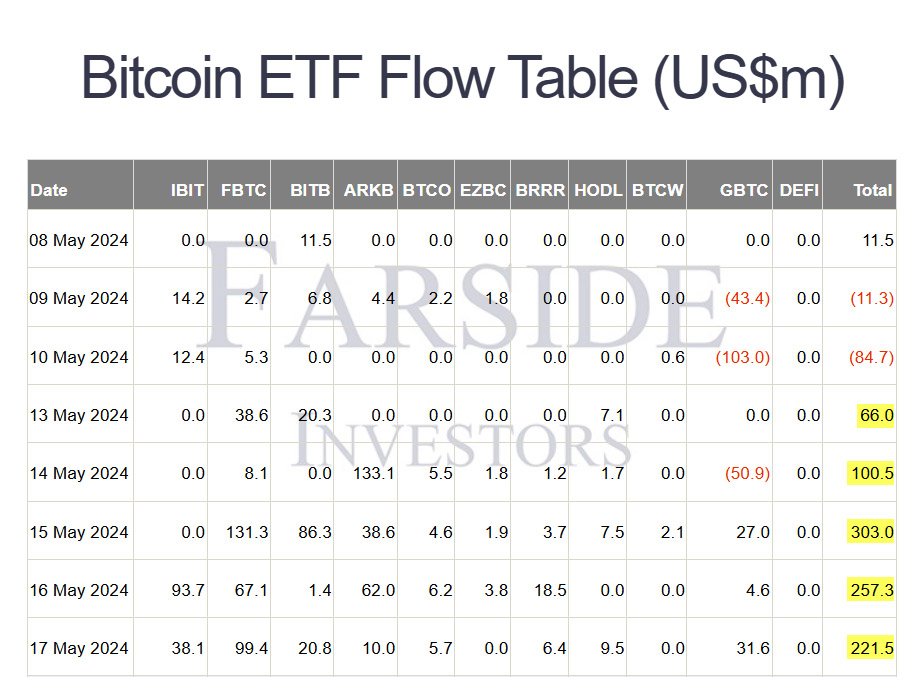

Recent trends, such as significant net inflows into Bitcoin ETFs after a period of outflows, suggest growing investor confidence in Bitcoin’s resilience amid economic uncertainties.

Notably, on May 15, inflows into spot Bitcoin ETFs in the United States surged to $303 million, marking the highest level since May 3. This increase coincided with a significant rise in BTC prices, driven by institutional investors turning bullish following the release of the US Consumer Price Index (CPI) data.

It’s worth noting that bitcoin has experienced a surge of 10% in the past seven days, trading around the $67,000 level.

Despite these bullish indicators, Schiff remains steadfast in his skepticism. He has constantly shared his concerns about Bitcoin’s slow transaction speeds and high fees, arguing that these factors undermine its utility as a daily-use currency.

In January, he called bitcoin a collective pretense, stating: “Here is how bitcoin works. We create something with no value, then artificially limit its supply. Then we all pretend it has value and buy it.”

As the discussion rages on, Bitcoin continues to be a hot topic on social media with fundamental questions regarding its status as inflation hedging, its transaction efficiency, and long-term viability.