Renowned investor and author Robert Kiyosaki, has recently been vocal about his preference for Bitcoin over traditional assets like gold, silver, and oil. This may come as a surprise, because many knew Kiyosaki as an advocate for investments in gold and real estate. He has previously shown interest in bitcoin, but favoring the digital asset and his comparison of gold vs bitcoin is a fresh perspective.

Bitcoin’s Limited Supply Advantage

Kiyosaki has pointed out a fundamental difference between Bitcoin and traditional assets such as gold, silver, and oil. While he acknowledges owning gold, silver mines, and oil wells, he highlights the problem of increasing supply with these commodities as their prices rise.

In contrast, Bitcoin’s capped supply of 21 million coins ensures its scarcity, regardless of its price fluctuations. Kiyosaki emphasizes:

“I love gold and silver. I own gold and silver mines. The problem with gold and silver is…the higher the prices go, the more gold and silver is found. Same with oil. I own oil wells also. That is not true with Bitcoin. No matter how high the price of Bitcoin goes there will only be 21 million ever. That’s why I love Bitcoin.”

Gold vs Bitcoin: Renewed Interest in Bitcoin

Kiyosaki’s remarks come amidst a surge in interest in Bitcoin, fueled by factors such as the growing acceptance of the digital asset and concerns about inflation. Many investors see bitcoin as a hedge against traditional financial systems and a store of value in uncertain times. Notably, Michael Saylor has repeatedly stated that bitcoin is a shield against inflation.

Bitcoin’s Digital Gold Narrative

Bitcoin’s appeal extends beyond its limited supply. Advocates often refer to it as “digital gold,” highlighting its qualities that mimic those of the precious metal. Michael Saylor, the executive chairman of MicroStrategy, has compared Bitcoin to gold, noting its superior qualities such as digital transferability and scarcity. This narrative has gained traction as investors seek alternatives to traditional safe-haven assets like gold.

Fidelity Investments executive, Jurrien Timmer, recently echoed this perspective, calling bitcoin “exponential gold.”

Spot Bitcoin ETFs vs. Gold ETFs

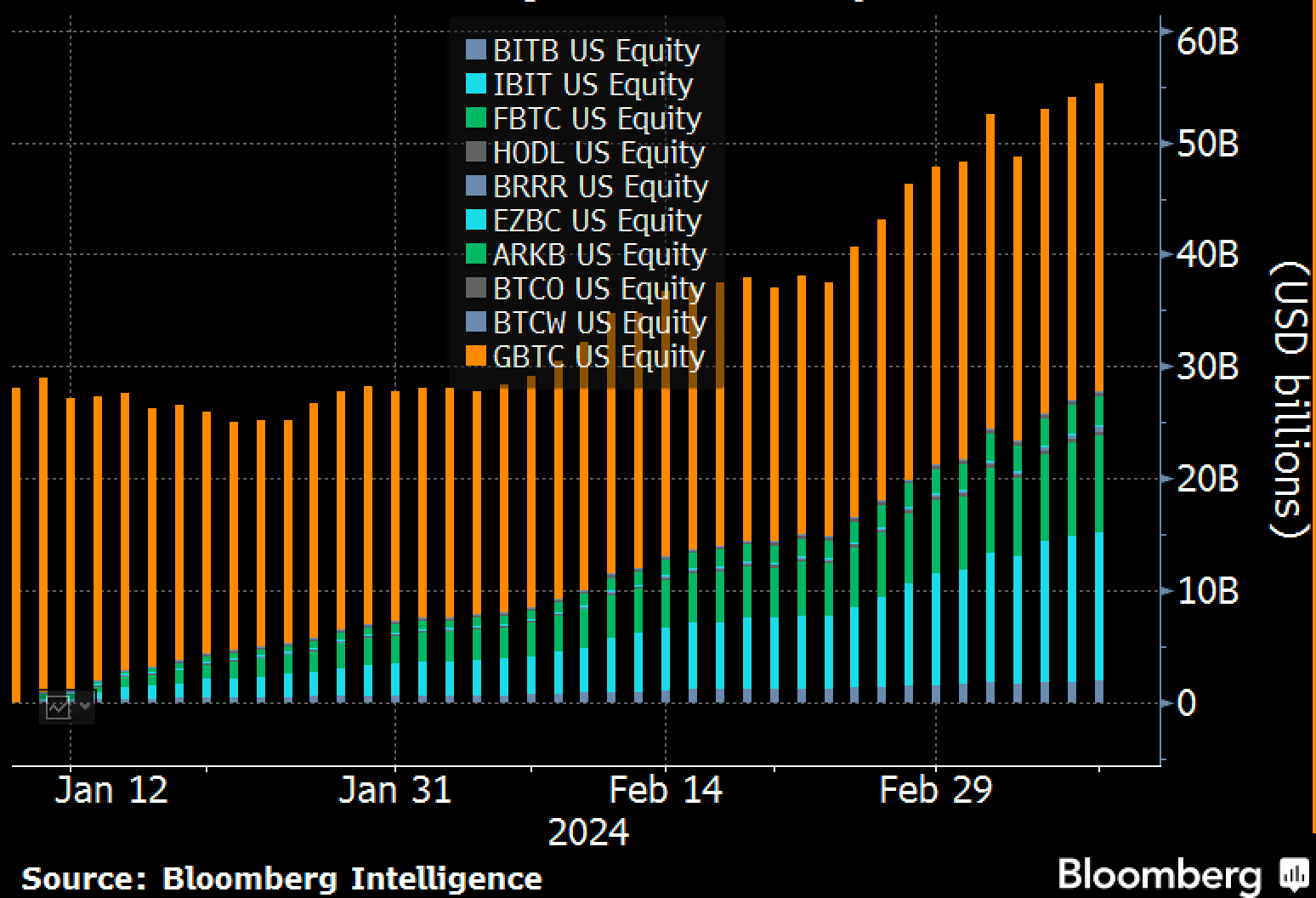

Recent developments in the financial markets further underscore Bitcoin’s growing dominance. Analysts predict that spot Bitcoin Exchange-Traded Funds (ETFs) could surpass gold ETFs in terms of popularity and investment flows. The ease of investing in Bitcoin through ETFs, coupled with its potential for substantial gains, has attracted significant attention from investors seeking exposure to the digital asset.

Interestingly, recent analyses has shown funds leaving gold ETFs and pouring into bitcoin ETFs. Although not all analysts believe this to be the case, with recent reports from JPMorgan Chase asserting that the funds leaving gold ETFs are not necessarily finding their way into Bitcoin ETFs.

Nate Geraci, The ETF Store’s founder, highlighted Bitcoin’s rising influence. He revealed that investments in nine new Bitcoin ETFs in two months surpassed flows into all gold ETFs in five years. Balchunas reports that the introduction of spot Bitcoin ETFs in the US has attracted substantial investor interest, resulting in $55 billion in assets under management and enabling $110 billion in trades since January.

Kiyosaki’s Long-term Bullish Stance

Kiyosaki’s preference for Bitcoin aligns with his long-term bullish outlook on the digital asset. He has consistently advised investors to accumulate bitcoin, projecting significant price increases in the future. Despite short-term market fluctuations, Kiyosaki remains optimistic about Bitcoin’s prospects, suggesting that it could reach $300,000 by the end of 2024.

Conclusion

Robert Kiyosaki’s endorsement of Bitcoin reflects a broader trend of increasing interest in the digital asset as a viable investment option. Bitcoin’s limited supply, digital nature, and potential for substantial returns make it an attractive asset for investors seeking alternatives to traditional investments like gold, silver, and oil. As the bitcoin market continues to evolve, Kiyosaki’s views serve as a reminder of the changing landscape of finance and the growing relevance of bitcoin in investment portfolios.