Samara Asset Group, a German company focused on digital assets and alternative investments, has made waves with its latest move in the Bitcoin world.

Samara AG, which is publicly listed on German electronic stock exchange Xetra, recently announced a €30 million investment in bitcoin, positioning itself as a major player in the race to build large bitcoin reserves, much like MicroStrategy.

This bold decision comes as bitcoin continues to show signs of strength, with many predicting its price to soar even higher in the coming months.

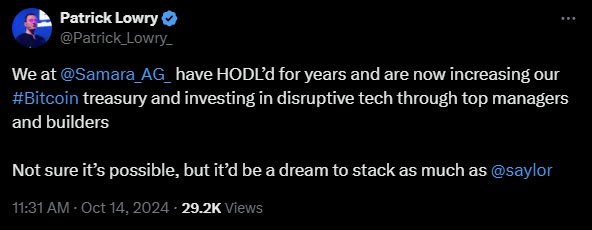

The company’s CEO, Patrick Lowry, made it clear that the firm is betting big on bitcoin, announcing plans to issue up to €30 million in bonds, with the goal of increasing the company’s bitcoin holdings while also expanding into innovative technologies.

Lowry stated that the company aims to follow in the footsteps of MicroStrategy, which is led by the Bitcoin bull Michael Saylor. He added:

“[…] We look forward to using the proceeds to acquire more bitcoin and continue to seed the world’s best emerging managers. The proceeds will allow Samara to further expand and solidify its already robust balance sheet […] With Bitcoin as our primary treasury reserve asset, we also enhance our liquidity position with bond proceeds.”

Lowry also said in a statement, “Not sure it’s possible, but it’d be a dream to stack as much as Saylor,”

His firm is looking to not only hold bitcoin long-term but also to grow its reserves as part of a broader strategy to lead the future of finance. “We are forever HODL’ers and believe technology best drives humanity forward” he added.

The bond issuance, set at €30 million, will help Samara raise funds for their aggressive bitcoin strategy. By using bonds, they can leverage their existing resources while giving investors a chance to participate in their growth.

The bond, which will be issued on the Oslo and Frankfurt Stock Exchanges, will be available to investors with a minimum subscription of €100,000. This private placement is designed to attract investors interested in high-end investments, such as alternative assets and digital currencies.

The company intends to use bitcoin as its primary treasury reserve asset, further solidifying its position in the digital asset space. With the bond proceeds, Samara will also acquire limited partnership stakes in alternative investment funds, diversifying its portfolio.

Christian Angermayer, a member of Samara’s Advisory Committee, added:

“Our mission at Samara is to drive humanity forward through innovation by seeding the world’s best managers and builders. With this new dry powder, we are excited to invest in and partner with the builders of tomorrow’s most disruptive technologies and grow our bitcoin position.”

Samara AG’s move to invest heavily in bitcoin comes at a time when institutional adoption of the digital asset is growing. Bitcoin is becoming more mainstream, with companies like MicroStrategy leading the charge by amassing huge amounts as part of their corporate strategy.

Related: MicroStrategy Boosts Bitcoin Holdings with Whopping 18,300 BTC Purchase

MicroStrategy’s success in the Bitcoin space has inspired other companies, like Samara AG, to follow suit. Lowry has expressed admiration for MicroStrategy’s approach and has stated that he would love to achieve similar success.

With bitcoin’s price continuing to rise, Samara AG’s decision to expand its bitcoin treasury is not only timely but also strategic. Many analysts are predicting a further increase in bitcoin’s price, with some even suggesting it could hit $92,000 in the coming months.

Samara AG’s investment is part of a larger trend of institutional interest in Bitcoin.

More and more companies are seeing the value in holding bitcoin as part of their corporate strategy. As bitcoin becomes a primary reserve asset for more firms, its influence in the financial world continues to grow.

Lowry’s vision for Samara includes more than just bitcoin. The company is also focused on investing in cutting-edge technologies through top-tier managers.

By issuing bonds, Samara can leverage its balance sheet to make high-end investments available to a broader audience, democratizing access to innovative technologies.

This move is expected to not only increase the firm’s bitcoin holdings but also contribute to the growth of disruptive technologies.

As Bitcoin continues to gain traction, companies like Samara AG are likely to play a major role in its adoption.

With Bitcoin as their treasury reserve, Samara AG is setting itself up to become a major force in both the Bitcoin space and the broader financial world.

In the race for Bitcoin supremacy, it seems Samara AG is just getting started. Whether or not they will overtake MicroStrategy remains to be seen, but one thing is clear: Samara is making significant strides toward becoming a Bitcoin powerhouse.