- Michael Saylor’s leadership at MicroStrategy has led to impressive results through a pioneering bitcoin treasury strategy.

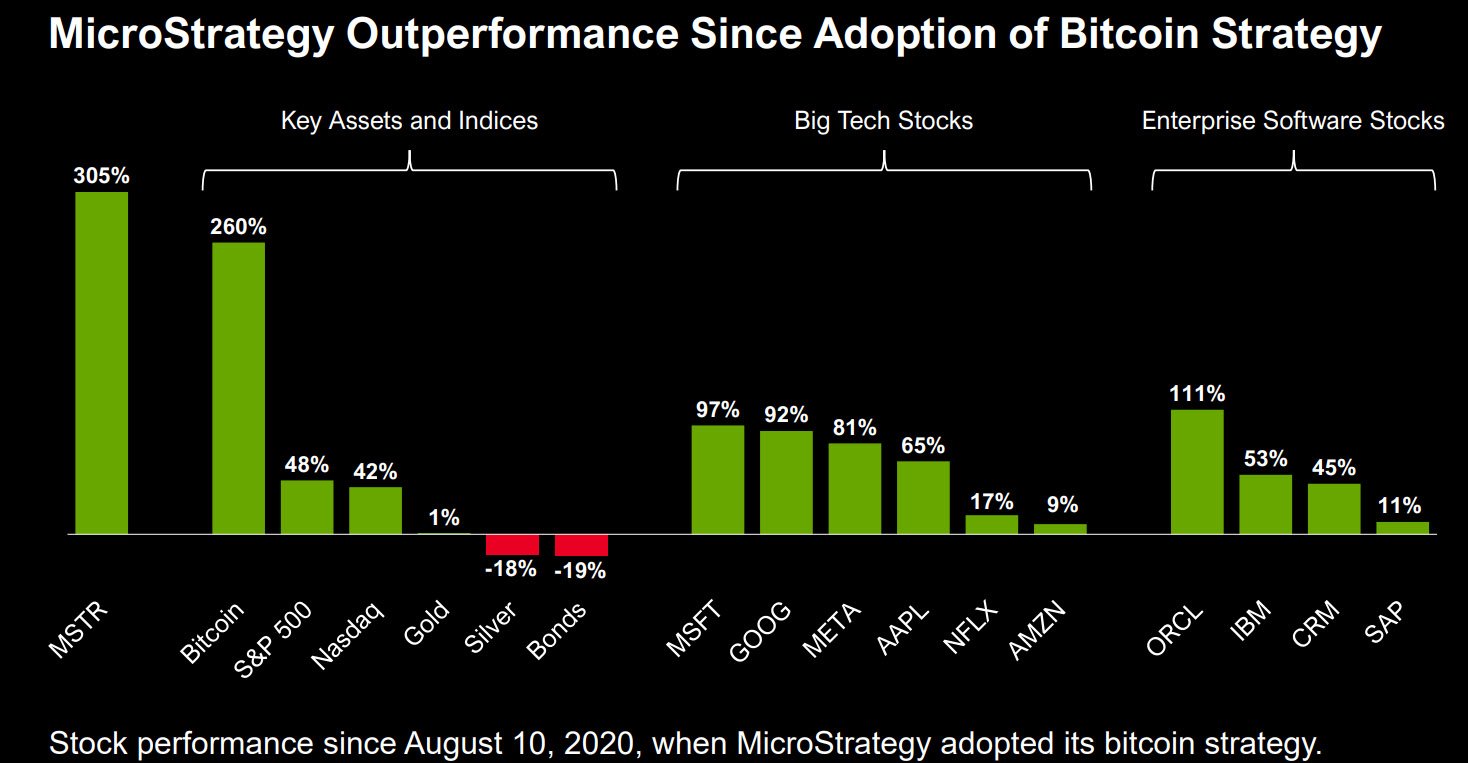

- MicroStrategy’s stock value has surged by 305%, outperforming traditional assets, making it the largest corporate holder of bitcoin.

- Last week Saylor unveiled the next phase of this strategy with a pivot towards Bitcoin development, leveraging their expertise in business intelligence software to position MicroStrategy as a global leader in the Bitcoin space.

MicroStrategy’s Bold Bitcoin Treasury Strategy

Over the last four years Michael Saylor has been putting on a global master class for executives with shockingly little fanfare considering the results.

In the spring of 2020 MicroStrategy (MSTR) implemented a one of one Bitcoin treasury strategy, using a mixture of free capital, equity, and debt to accumulate and hold bitcoin as a balance sheet asset to offer their shareholders a secondary upside investment, while protecting the company from ongoing currency debasement.

The results have been staggering.

Since August 2020, MSTR, up 305%, has outperformed Bitcoin, six of the seven magnificent 7 tech stocks, and routed the indexes, precious metals, and the bond market. The firm’s aggressive buying strategy has propelled it to become the world’s largest corporate holder of bitcoin, with a treasury totaling 190,000 BTC valued at around $9 billion.

Saylor’s conviction in Bitcoin is legendary. Last week, during the company’s Q4 earnings call, he unveiled a strategic pivot that will position them to become a leader in the emerging Bitcoin development space.

MicroStrategy’s Unique Position

Unlike traditional trust companies, MicroStrategy has active control over its capital structure, enabling it to venture into areas beyond the purview of spot Bitcoin ETFs. This pivot positions MicroStrategy not only as an alternative to investing in bitcoin or bitcoin ETFs but also as a new kind of bitcoin growth stock.

MicroStrategy’s venture into Bitcoin development will entail the creation of applications and software designed to extract value from the Bitcoin Network. Saylor’s enthusiasm for exploring opportunities across various layers, including the base layer and Layer 2 protocols such as the Lightning Network, highlights MicroStrategy’s comprehensive vision for Bitcoin development.

This strategic evolution aligns seamlessly with MicroStrategy’s existing bitcoin strategy, leveraging its investors’ confidence in the company’s familiarity with Bitcoin and business intelligence software. The convergence of these factors creates a compelling narrative for long-term bitcoin investors. An apt analogy is the approach of land developers who accumulate vast land holdings before initiating large-scale development projects.

Saylor’s Unwavering Conviction

For Saylor, this is yet another example of having the requisite intellectual fortitude to envision and enact such a change. While the majority of Fortune 500 executives might find it challenging to articulate the value proposition of bitcoin, MicroStrategy has managed to accumulate nearly 1% of the entire global supply.

If Bitcoin continues its trajectory of adoption, MicroStrategy stands to build a treasury that appreciates in dollar terms indefinitely, all while leading the charge in enterprise software for the next era of digital commerce. Saylor has once again written a new chapter in what will be regarded as one of the most audacious strategic corporate decisions in history.