In a noteworthy development that underscores the growing acceptance of Bitcoin among traditional financial institutions, South Korea’s National Pension Service (NPS), the world’s third-largest public pension fund, has invested nearly $34 million in MicroStrategy shares.

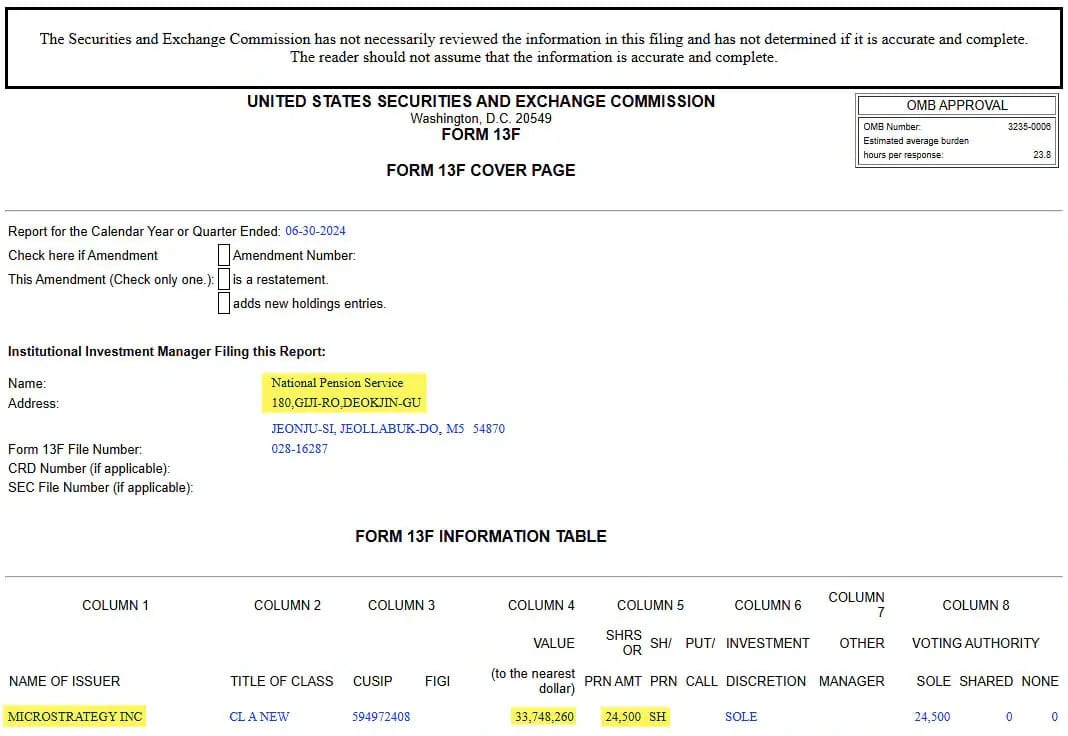

This move, which was disclosed in a recent filing with the U.S. Securities and Exchange Commission (SEC), represents a significant step toward increasing the fund’s exposure to bitcoin, albeit indirectly.

The NPS’s investment in MicroStrategy—a business intelligence firm renowned for its massive bitcoin holdings—has attracted considerable attention. The pension fund purchased 24,500 shares in the second quarter of 2024, at an average price of $1,377.48 per share.

South Korea’s National Pension Services 13F filing with the SEC — SEC.gov

Following MicroStrategy’s 10-for-1 stock split in early August, these shares have now been converted into 245,000 shares. Based on MicroStrategy’s recent closing price of $131.93, this investment is currently valued at approximately $32.32 million.

The NPS’s decision to invest in MicroStrategy can be seen as an indirect bet on bitcoin. MicroStrategy, under the leadership of its Chairman Michael Saylor, has transformed itself from a business analytics company into the largest corporate holder of bitcoin.

As of the latest reports, the company owns 226,500 BTC, valued at around $13.19 billion. This makes MicroStrategy a major player in the Bitcoin market and an attractive option for institutional investors looking to gain exposure to bitcoin without directly purchasing the asset itself.

This move by the NPS is not an isolated incident but part of a broader trend among global pension funds and institutional investors who are increasingly looking to diversify their portfolios by including digital assets.

The NPS, which manages assets worth over $777 billion, has previously made investments in other digital-asset-related companies.

In the third quarter of 2023, the NPS purchased 282,673 shares of Coinbase, a leading digital assets exchange, at an average price of $70.5 per share. The value of these shares has since surged, with the NPS currently holding over $51 million worth of the exchange’s shares.

The success of its Coinbase investment likely influenced the NPS’s decision to invest in MicroStrategy.

As the price of bitcoin continues to rise, and with companies like MicroStrategy leading the charge in corporate Bitcoin adoption, the NPS appears to be positioning itself to benefit from the growing mainstream acceptance of the scarce digital asset.

MicroStrategy holds the largest amount of bitcoin among public companies, possessing about 13 times more bitcoin than Marathon Digital, the top Bitcoin miner in the world.

The NPS is not alone in recognizing the potential of Bitcoin as a significant asset class.

Other major institutional investors, including Norway’s central bank and the Swiss National Bank, have also disclosed holdings in MicroStrategy.

This institutional interest is further validated by the performance of MicroStrategy’s stock, which has more than doubled in value this year, gaining 200.6% since the beginning of 2024.

This surge in MicroStrategy stock price reflects the growing confidence in the company’s Bitcoin strategy and the broader acceptance of Bitcoin among traditional financial institutions.

Moreover, the approval of a leveraged MicroStrategy ETF by the U.S. SEC, which offers 1.75x exposure to the company’s stock price, highlights the increasing demand for investment products that provide amplified exposure to bitcoin via MicroStrategy.

This ETF, issued by Defiance ETFs, allows investors to benefit from MicroStrategy’s daily stock returns, further boosting the company’s profile in the financial world.

The NPS’s investment in MicroStrategy is more than just a financial maneuver; it is a statement about the evolving landscape of global finance.

South Korea has been known for its progressive stance on digital technologies, and this move by its national pension fund could signal a broader shift in attitude toward Bitcoin.

While the country has implemented strict regulations on digital assets trading in recent years, the NPS’s investment in MicroStrategy may indicate a more nuanced approach to digital assets at the institutional level.

The move also comes at a time when other state and national pension funds around the world are exploring similar strategies.

For instance, Japan’s Government Pension Investment Fund, the world’s largest pension fund with nearly $1.5 trillion in assets, has floated the idea of exploring investments in bitcoin.

Meanwhile, the State of Michigan Retirement System recently disclosed a $6.6 million investment in the ARK 21Shares Bitcoin ETF, and the State of Wisconsin Investment Board and Houston Firefighters’ Relief and Retirement Fund has been purchasing Bitcoin ETFs for two consecutive quarters.

For the NPS, the decision to invest in MicroStrategy and, by extension, bitcoin, appears to be a calculated bet on the future of the digital asset.

Michael Saylor, the executive chairman of MicroStrategy, has been a vocal advocate for Bitcoin, describing it as the “most reliable store of value” in the digital age.

Under his leadership, MicroStrategy has continued to accumulate bitcoin, even taking on debt to finance its purchases. This aggressive strategy has paid off, as evidenced by the company’s substantial bitcoin holdings and the corresponding rise in its stock price.

The NPS’s investment can be seen as a vote of confidence in Saylor’s vision and the broader potential of bitcoin as a significant financial asset.

By investing in MicroStrategy, the NPS is not just betting on the success of a single company but on the long-term viability of Bitcoin as a cornerstone of the global financial system.

The NPS’s move into digital assets also highlights the importance of regulatory clarity in shaping the future of bitcoin investments.

South Korea has made significant strides in this area, most notably with the enactment of the Virtual Asset User Protection Act, which provides a legal framework for digital asset investments.

This regulatory progress has likely played a role in encouraging institutions like the NPS to explore opportunities in the digital asset space.

As regulations continue to evolve, it is expected that more institutional investors will follow in the footsteps of the NPS, seeking to diversify their portfolios with digital assets.

The increasing acceptance of Bitcoin ETFs and other regulated investment products is likely to further accelerate this trend, providing traditional investors with safer and more accessible ways to gain exposure to the burgeoning Bitcoin market.