Susquehanna International Group (SIG), a leading quantitative trading firm, has disclosed a substantial investment in Bitcoin Exchange-Traded Funds (ETFs). The company’s filings with the United States Securities and Exchange Commission (SEC) reveal holdings exceeding $1.8 billion across various Bitcoin ETFs.

According to the filings, SIG’s largest position is in Grayscale’s spot Bitcoin ETF (GBTC), with investments totaling over $1 billion alone. This significant allocation may underscore SIG’s confidence in Bitcoin’s long-term potential as a financial asset.

The disclosed investments highlight SIG’s strategic diversification across multiple Bitcoin ETF offerings, including those from Fidelity, ProShares, Bitwise, Valkyrie, Invesco Galaxy, and WisdomTree, among others.

This comprehensive approach showcases SIG’s commitment to capitalizing on different aspects of Bitcoin’s investment landscape.

Julian Fahrer, CEO and co-founder of Apollo, expressed enthusiasm about SIG’s move, stating:

“HUGE: Susquehanna International Group is the biggest Bitcoin ETF whale yet! $1.2 Billion held across 10 ETFs! The monsters are here.”

This sentiment reflects the broader sentiment of growing institutional interest in bitcoin investments.

SIG’s investment in these ETFs marks a significant milestone in the traditional financial realm. With over $480 billion in assets under management, SIG’s move signals a strategic shift towards embracing bitcoin as part of a diversified investment strategy.

SIG’s notable investment is in Grayscale’s GBTC, which alone constitutes a significant portion of SIG’s total Bitcoin ETF holdings. Additionally, SIG has strategically diversified its portfolio with investments in other prominent Bitcoin ETFs, such as Fidelity’s FBTC and ProShares’ BITO.

Moreover, SIG’s disclosure comes amidst a broader trend of institutional adoption of Bitcoin. Market analysts anticipate more institutions to follow suit and disclose their Bitcoin ETF holdings, further validating the legitimacy of this new asset class.

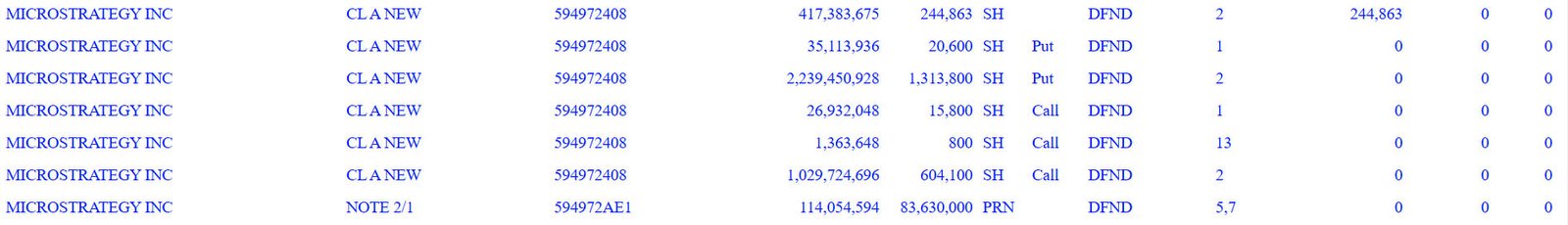

Susquehanna International Group’s Investment in MicroStrategy

The reported holdings also include indirect exposure to bitcoin’s spot price through investments in MicroStrategy stock, a company known for its significant bitcoin reserves.

SIG’s investment in MicroStrategy indicates a dynamic approach to portfolio management, aligning its exposure with strategic objectives.

With traditional players like Legacy Wealth Management and United Capital Management of Kansas also investing in Bitcoin ETFs, this new asset is increasingly becoming a part of mainstream investment portfolios.

The recent performance of Bitcoin ETFs further underscores the growing interest from institutional investors.

After a period of outflows, Bitcoin ETFs have recorded net gains, with inflows totaling $217 million on a single day. This renewed interest signals a potential shift in sentiment towards bitcoin among institutional investors.

Robert Mitchnick of BlackRock predicts increasing demand for Bitcoin ETFs from institutional investors, citing a growing interest in the asset class.

Major institutions are reportedly conducting due diligence and preparing to enter the Bitcoin market, further validating Bitcoin’s status as a legitimate investment option.

As SIG and other institutions continue to embrace bitcoin, the digital asset market is entering a new phase of maturity and legitimacy.

With regulatory approval and increasing institutional participation, Bitcoin ETFs are becoming an accessible and regulated way for investors to gain exposure to bitcoin’s price movements, paving the way for broader adoption and acceptance of the scarce digital asset in the financial mainstream.