In Switzerland, a country known for its neutrality and financial innovation, the interest in diversification with bitcoin as part of the national reserves is increasing. Formal petition filed with Swiss Federal Chancellery is pushing the Swiss National Bank (SNB) to hold bitcoin alongside gold in its coffers.

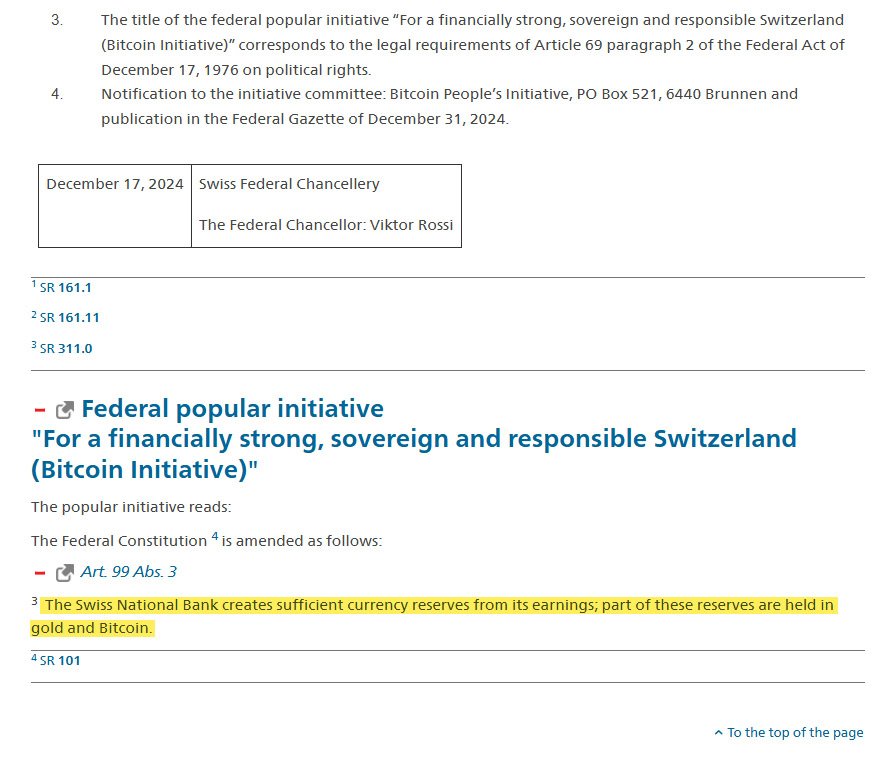

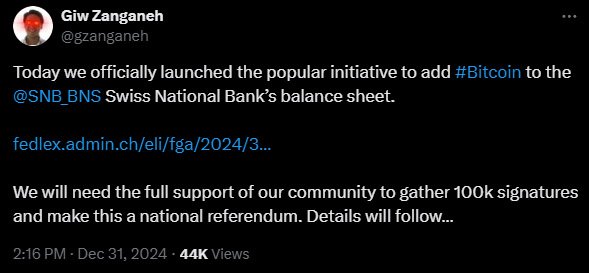

In a recent development moving the plan to the next level, the initiative for a “Financially Strong, Sovereign, and Responsible Switzerland” was registered in the Swiss Federal Gazette on December 31, 2024. The act now has 18 months to collect 100,000 signatures to trigger a national vote.

The proposal wants to change Article 99 of the Swiss Federal Constitution:

“The Swiss National Bank creates sufficient currency reserves from its earnings; part of these reserves are held in gold and Bitcoin.”

The initiative is supported by well known Bitcoin advocates, Yves Bennaïm, founder of the non profit think tank 2B4CH, and Giw Zanganeh, Tether’s Vice President of Energy and Mining.

Bennaïm said: “We were waiting for the right timing. Now, everything is falling into place, and this is why we submitted the documents and will start collecting the signatures.”

This is in line with the Swiss tradition of public votes, in a country that is very fond of direct democracy. If the 100,000 signatures are collected by June 30, 2026 the initiative will go to a public vote and Swiss citizens will have their say.

Supporters of the initiative argue that Bitcoin’s decentralized and deflationary nature makes it an asset for financial stability. Having bitcoin in the SNB’s reserves would give Switzerland more sovereignty and independence especially in times of external economic pressure.

Lawmakers like Dr. Paolo Pamini, however, want clarity: “We seek clarity on whether the Swiss National Bank has the legal framework to include bitcoin as an asset to back the money supply and what adjustments would be needed if it doesn’t.”

It’s also a way, say Bitcoin fans, to cement Switzerland’s reputation as a global hub for financial innovation.

But there are opponents. SNB Chairman Martin Schlegel is skeptical, calling digital assets like Bitcoin volatile and energy hungry. The SNB has always been wary of digital assets, because of the perceived risk to financial stability.

The Swiss Financial Market Supervisory Authority (FINMA) also mentions money laundering risks with digital assets.

Switzerland is not alone. Other countries like the US, Russia and Japan are considering bitcoin reserves too. In the US, Senator Cynthia Lummis has proposed a federal bitcoin reserve bill, and in the meantime, Russian officials are looking into Bitcoin for international payments.

Related: Russia Turns to Bitcoin to Bypass Sanctions in International Trades

El Salvador and Bhutan are the only two countries with significant bitcoin reserves at the moment, but the interest in digital assets is changing financial strategies all over the world.

In Switzerland, Bitcoin adoption is already happening at the grassroots level. In Lugano, over 260 merchants accept bitcoin and the annual “Plan ₿” conference attracts Bitcoin enthusiasts from all over the world.

Next step is to build public support. With 8.92 million people in Switzerland, only 1.12% of the population are need to back the initiative to fill its 100,000 vote quota.

If successful, the Federal Assembly will review the proposal to check if it complies with Swiss law before a referendum is held.

Supporters think this could be a global precedent. Tyler Durden, a digital assets entrepreneur, highlighted the impacts of such a move:

“If one country implements a Bitcoin strategic reserve, you can kiss goodbye to your four-year cycles.”

The timeline for the referendum is unknown but the proposal is already sparking a lot of debate. If approved, it will change how central banks all over the world approach bitcoin and manage their reserves in the digital age.