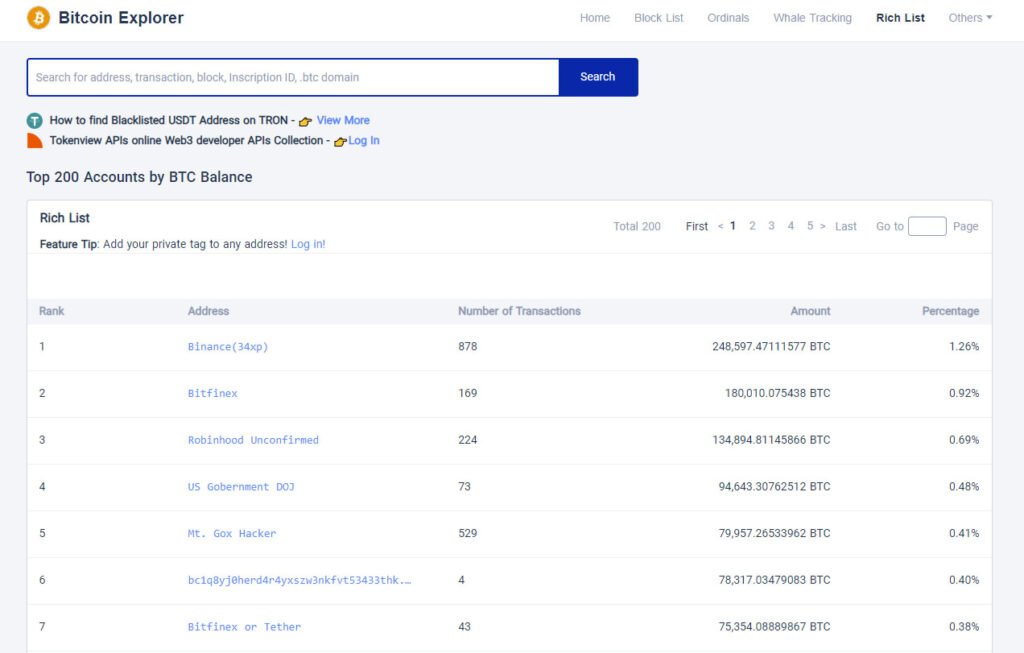

In a groundbreaking move within the digital assets sphere, Tether, the renowned stablecoin issuer, has made waves by significantly expanding its bitcoin reserves. This strategic decision, involving a hefty $600 million acquisition, has sent ripples through the digital asset landscape, marking a pivotal moment for Tether and the broader digital asset community. Tether bitcoin purchase has made the company the owner of the seventh-richest address on the blockchain.

Tether Bitcoin Acquisition Strategy

Tether’s journey into the realm of Bitcoin began in 2022, with initial purchases signaling its strategic pivot towards diversification. Over subsequent quarters, Tether reiterated its commitment to accumulating bitcoin, citing the digital asset’s potential for growth and its role in reducing reliance on traditional assets like U.S. Treasury bonds.

The recent acquisition, totaling 8,888 BTC, underscores Tether’s steadfast dedication to bolstering its bitcoin reserves. With this purchase, Tether’s bitcoin holdings now exceed 75,000 BTC, valued at a staggering $5.3 billion.

This acquisition not only reinforces Tether’s position as a major player in the digital asset space but also highlights its confidence in the long-term viability of Bitcoin. The acquisition positions it above a Binance cold wallet holding 75,117 BTC valued at $5.22 billion, per Arkham Intelligence. According to data from CoinStats, the wallet has seen a remarkable increase of over 128%, resulting in an unrealized profit of $2.94 billion at present.

Tether’s Strategic Vision

Paolo Ardoino, Chief Technology Officer of Tether, shed light on the rationale behind the company’s bitcoin investment strategy, stating, “The decision to invest in bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset.” This strategic vision reflects Tether’s forward-thinking approach and its commitment to staying ahead of the curve in the ever-evolving digital asset landscape.

He added:

“Its [Bitcoin’s] limited supply, decentralized nature, and widespread adoption have positioned Bitcoin as a favored choice among institutional and retail investors alike. Our investment in Bitcoin is not only a way to enhance the performance of our portfolio, but it is also a method of aligning ourselves with a transformative technology that has the potential to reshape the way we conduct business and live our lives.”

This purchase comes at a crucial time of bitcoin price fluctuations. Rekt Capital, an anonymous analyst, suggests that bitcoin’s correction before the halving may have ended as it turned $69,000 into support. He said:

“Bitcoin is now peaking beyond this old all-time high, potentially positioning itself for this pre-halving retracement to be over.”

Despite this, bitcoin price saw heavy fluctuations yesterday evening. The price has since fallen 6%, and is currently trading at about $65,700.

Market Impact and Regulatory Considerations

Tether’s significant presence in Bitcoin markets, coupled with institutional investors’ participation, has implications for market dynamics and supply dynamics. Despite regulatory scrutiny surrounding Tether’s stablecoin operations, its strategic diversification into Bitcoin signals a broader trend within the industry towards embracing digital assets as legitimate investment vehicles.

Looking ahead, Tether’s latest acquisition of $600 million worth of bitcoin is poised to have far-reaching implications for the company and the broader digital asset ecosystem. As Tether continues to solidify its position in Bitcoin markets, its influence is expected to grow, further shaping the future trajectory of the digital asset landscape.

Tether not only invests in bitcoin but also engages in mining, energy production, and AI ventures, saying it aims “to pioneer the development of open-source, multimodal AI models to set new industry standards, driving innovation and accessibility within AI technology.”

Conclusion

Tether’s bold move to bolster its bitcoin reserves with a $600 million acquisition marks a significant milestone in the company’s journey towards diversification and innovation. This strategic decision not only reaffirms Tether’s position as a leading player in the digital assets space but also underscores the growing convergence between traditional finance and the digital asset realm.

Overall, Tether’s foray into Bitcoin reflects broader trends within the industry, highlighting the increasing acceptance and adoption of bitcoin as viable investment options, even for other digital assets. As the market continues to evolve, Tether’s strategic investments and involvement in Bitcoin, energy and AI ventures, positions it for continued success and growth in the dynamic and ever-changing landscape of digital finance.