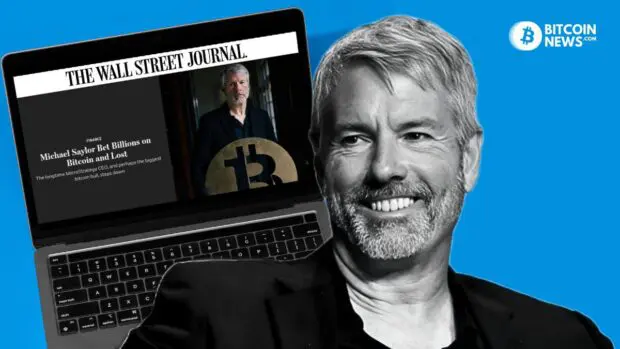

In August 2022, The Wall Street Journal published an article titled “Michael Saylor Bet Billions on Bitcoin and Lost.” Bitcoin was trading under $25,000.

Fast forward to December 2023. Bitcoin is trading over $40,000. A headline from Coindesk reads “Michael Saylor’s Bitcoin Bet Profit Tops $2 B.”

Michael Saylor and MicroStrategy’s Journey into Bitcoin

After acquiring nearly 175,000 bitcoin over the course of more than three years, MicroStrategy (MSTR) has made what could easily be the biggest, most profitable bet on bitcoin ever. Shares of MSTR have also benefited. Saylor has vowed that the company will continue to acquire as much bitcoin as possible, using a combination of cash flows, equity, and debt.

It’s interesting to note that publications like the WSJ remained silent during 2021, when MicroStrategy’s bitcoin investment was very much in profit. They remain silent today as well.

Some have joked that the Journal owes Saylor an apology.

Needless to say, we could be waiting a long time for that.

Financial Media Fails to Grasp the Bitcoin Revolution

All of this comes as no surprise. It’s par for the course. Anyone who has been in the Bitcoin space for long enough has gotten used to the endless criticism from skeptics that never seems to end.

Related reading: Jamie Dimon Would “Close Down” Bitcoin If He Had Government Role

Like so many others, the journalists at the WSJ, and many other mainstream financial outlets, fail to understand Bitcoin. All they seem to care about is that the fiat price goes up and down, and holders win or lose on short-term timeframes.

In reality, bitcoin is best analyzed from a four-year perspective, at least. And there’s so much more to the story than people betting on the price. People sell their fiat for bitcoin because it’s a superior savings technology, yes. And in first-world countries, that’s the most common use case today.

What so many in the media never seem to talk about, however, are the things that make Bitcoin unique: self-sovereignty over individual wealth, the ability to combat censorship, cross-border transactions, and more.

Related reading: Becoming Economic Independent in the Age of Fiat

It’s almost like they jump at the chance to spread FUD and refuse to speak of anything positive in this realm. Of course, doing so becomes more difficult by the day. Perhaps that’s why there have only been 7 Bitcoin Obituaries published in 2023 – the lowest number since the year 2012.

There’s a good chance that 2024 will see even fewer.

Looking forward to 2024 and beyond

What might the new year bring?

With so many bullish catalysts converging, 2024 could be historic for Bitcoin. Some noteworthy events include:

- The halving in April 2024

- Potential approval of a Spot Bitcoin ETF in January

- The Federal Reserve potentially lowering interest rates beginning in March

Michael Saylor has noted that the next 12 months will be a transformative period for bitcoin as an asset.

Perhaps next year will also see mainstream news outlets praise investors like Saylor for their prescience, persistence, and fortitude, rather than making failed attempts at shaming them.

Perhaps.