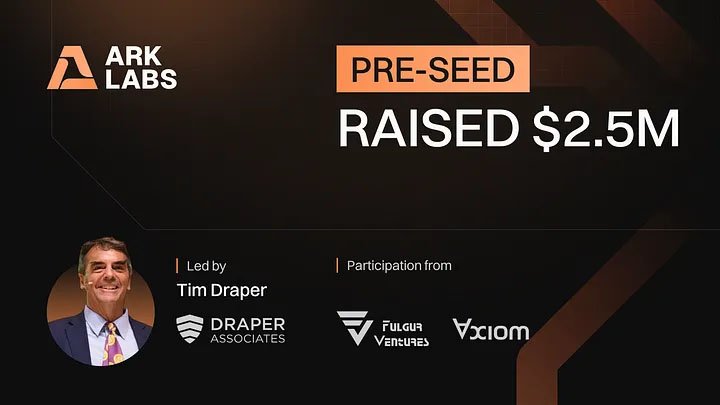

Ark Labs, a budding startup dedicated to enhancing Bitcoin transactions, has raised $2.5 million in a pre-seed funding round.

The round was spearheaded by billionaire investor Tim Draper, known for his track record in supporting groundbreaking technologies. The funding also saw contributions from Fulgur Ventures, Axiom Capital, and angel investor Stephen Cole.

Ark Labs, which was founded recently, is on a mission to make Bitcoin transactions faster, cheaper, and more accessible. This investment highlights the growing interest in transforming Bitcoin from a speculative asset into a practical medium for everyday transactions.

Bitcoin has established itself as a dominant force in the financial world, attracting billions of dollars in investments.

However, for Bitcoin to move beyond its role as an investment and become a widely used payment method, it needs to overcome challenges related to transaction speed and cost. Ark Labs aims to address these issues with its innovative approach.

Tim Draper, a prominent venture capitalist with a history of backing high-profile companies like SpaceX and Tesla, expressed his enthusiasm for the project. Draper said:

“Soon many people around the world will live on the Bitcoin standard. Today, we have to focus not only on how to buy and store bitcoin but how to use it as a medium of exchange for everyday purposes.”

He emphasized that Ark Labs’ technology aligns with Bitcoin’s core principles of decentralization and self-custody.

Ark Labs is developing the Ark protocol, which seeks to improve Bitcoin’s scalability and make transactions more user-friendly. The protocol is designed to work with Bitcoin’s Lightning Network, a Layer 2 solution that enhances Bitcoin’s ability to handle transactions quickly and at lower costs.

Co-founder of Ark Labs, Marco Argentieri, explained:

“This funding will accelerate our efforts to make Bitcoin transactions as simple and user-friendly as possible, making fast, low-cost user-friendly transactions powered by Bitcoin a reality for potentially billions worldwide.”

He noted that while Bitcoin’s Lightning “has made tremendous strides recently,” Ark Labs aims to build on this success by improving the experience for users who want to leverage Bitcoin in their daily lives.

Argentieri highlighted that many current approaches to Bitcoin introduce trade-offs that compromise its original vision, but believes Ark has the potential to address these challenges at scale without compromising trust.

He noted that many concepts are underdeveloped and that discussions often overlook the protocol’s flexibility, particularly regarding liquidity.

Argentieri mentioned that different users can utilize Ark’s features, with pre-signed transactions being a viable alternative for online servers, especially as mobile clients are currently more challenging.

He also stated that once Ark is fully operational and widely adopted, it could strengthen the case for implementing covenants.

Currently, operating Bitcoin’s Lightning Network infrastructure can be complex and challenging for users without deep technical knowledge.

To tackle this, Ark Labs is introducing a system that uses trustless servers known as Ark Service Providers (ASPs) to manage transactions. This approach is intended to reduce the technical barriers and lower the costs associated with Bitcoin payments.

“Ark allows for seamless Bitcoin payments,” Draper added. “The architecture stays true to its core principles of decentralization and self-custody.” This focus on maintaining Bitcoin’s foundational principles while enhancing its practical usability is a key aspect of Ark Labs’ strategy.

The investment in Ark Labs comes at a time when interest in Bitcoin is growing. Earlier this year, the approval of exchange-traded funds (ETFs) tracking bitcoin’s price has led to significant inflows into the market.

This trend underscores the increasing maturity of digital assets and highlights the need for solutions that make bitcoin more practical for everyday use.

Henry Robinson, co-founder of bitcoin mining firm Decimal Digital Currency, pointed out the challenges that still exist in Bitcoin adoption. “Bitcoin adoption faces a strong headwind until any non-technical person can safely achieve exposure,” Robinson said.

He believes that as mature investors and substantial capital continue to back Bitcoin, the asset class will mature and become more accessible to a broader audience.

With the recent funding, Ark Labs plans to expand its team and further develop its technology.

The startup is also set to release an alpha version of its covenant-less implementation and introduce the Ark Node, a wallet that will allow users to send, receive, and swap bitcoin over the Lightning Network.

This product is expected to enter closed beta testing in early September, with a wider release planned for later in the year. The focus on user experience and practical applications of Bitcoin is central to Ark Labs’ vision.

Participating in this funding round are Bitcoin-centric funds Axiom and Fulgur Ventures, alongside well-known angel investor Stephen Cole. Allen Farrington, a general partner at Axiom, expressed his excitement about the project.

He stated: “We are excited to support what appears to be a substantial breakthrough in broadening Bitcoin’s utility as a means of payment and bringing increased sophistication to the financial infrastructure of the network.”

The backing of Ark Labs by Tim Draper and other prominent investors reflects a broader trend in the Bitcoin industry.

As Bitcoin continues to gain mainstream acceptance, there is a growing emphasis on developing solutions that enhance its usability and integrate it into everyday financial activities.

Draper’s involvement in Ark Labs is part of a larger pattern of investment in Bitcoin startups that aim to solve critical challenges in the space.

His previous investments in companies like Coinbase and Robinhood highlight his commitment to supporting innovative projects that advance the adoption of the scarce digital asset.