The US national debt has surpassed $35 trillion for the first time in history, marking a significant milestone that has prompted discussions about the potential of Bitcoin to alleviate the mounting financial burden.

As the debt continues to rise, experts and policymakers are exploring unconventional strategies to manage the crisis, with some proposing Bitcoin as a viable solution.

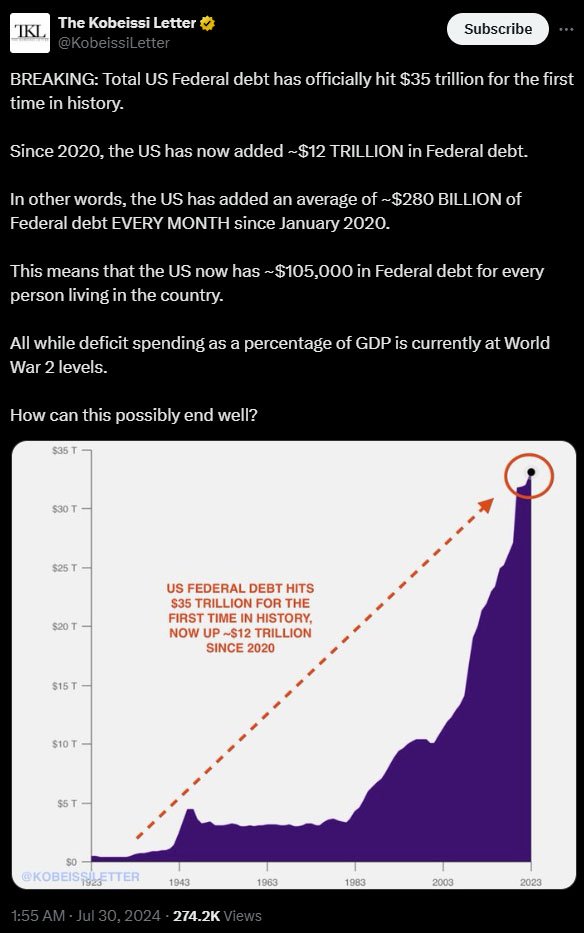

The national debt has been steadily increasing over the past few decades, but recent years have seen an unprecedented surge.

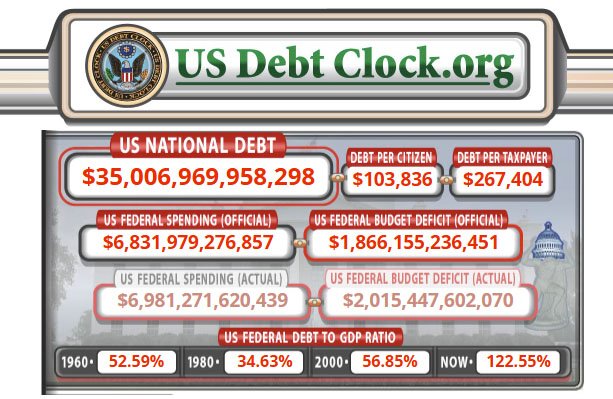

Since January 2020, the U.S. has added approximately $12 trillion to its federal debt, averaging $280 billion of federal debt per month. This rapid escalation has resulted in each American effectively shouldering $105,000 of federal debt.

Michael Peterson, chief executive of the Peter G. Peterson Foundation, highlighted the urgency of addressing this issue:

“We can’t keep pretending this is not a problem. The election is less than 100 days away, and we’re projected to add another $1 trillion more in debt even during this short period.”

The Congressional Budget Office predicts that national debt will reach $56 trillion by 2034, driven by rising spending and interest expenses outpacing tax revenue.

The high debt level is a threat to fiscal policy and economic stability, especially with the upcoming presidential elections in November.

The government’s ability to respond to economic downturns or emergencies is impaired by such high debt levels, which also limit fiscal flexibility and potentially increase borrowing costs.

Based on data from usdebtclock.org, the federal debt is expected to soar to an astounding $46 trillion by 2028. The Kobeissi Letter remarked on the severity of this crisis in an X post, stating:

“Every year, there are calls for spending cuts and they never happen. The debt ceiling crisis never truly ended, it was simply swept under the rug.”

In light of the escalating debt crisis, some experts believe that Bitcoin could play a crucial role in mitigating the financial burden.

Rich Rosenblum, co-founder of trading firm GSR, sees the burgeoning national debt as an opportunity for Bitcoin. He argues that unlike other times in history, today’s investors have the chance to invest in Bitcoin as a hedge against inflation and currency devaluation.

Rosenblum explained, “The fact that much of the world has ballooning debt and is arguably in a ‘debt trap’ is the part that’s really good for Bitcoin.”

He added that investors usually look to alternative assets like gold when debt rises and inflation increases. However, unlike in the past, Bitcoin now exists and is known as digital gold.

Rosenblum argues that Bitcoin’s decentralized nature and limited supply make it an attractive option for investors seeking protection against inflation and currency devaluation. Consequently, he believes investors will increasingly favor Bitcoin.

Historically, increasing national debt has led to inflationary pressures and a decline in confidence in traditional fiat currencies.

Jeff Yew, CEO of asset manager Monochrome, said, “When traditional risk-free assets like fixed income are backed by a currency engineered to depreciate at an unprecedented pace, investors are reconsidering their risk-free status and look towards alternatives like Bitcoin.”

Bitcoin adoption solutions firm JAN3 noted that the debt amount is 1.6 million times greater than the entire supply of Bitcoin, adding, “The end of fiat is imminent […] A Bitcoin Strategic Reserve is needed more and more with every passing moment.”

Some policymakers have proposed more radical solutions involving Bitcoin.

Senator Cynthia Lummis of Wyoming has been a vocal advocate for creating a strategic bitcoin reserve to help manage the national debt. Lummis believes that acquiring bitcoin as a reserve asset could significantly reduce the national debt over time.

“A strategic bitcoin reserve could stop this runaway train and help pay down the national debt for our future generations,” Lummis stated.

Lummis has even suggested a plan for the Federal Reserve to acquire one million bitcoin over five years, holding it for at least two decades. She argues that such a reserve would secure the dollar’s position as the world’s reserve currency and provide a hedge against inflation.

Despite the optimism from Bitcoin proponents, not everyone is convinced that Bitcoin is the answer to the national debt crisis.

Gold proponent Peter Schiff has criticized the idea, arguing that it is contradictory to believe that bitcoin’s price could skyrocket due to inflation and simultaneously use it to settle debt without further inflating the U.S. dollar.

Schiff has long been skeptical of Bitcoin’s potential to “save the world,” pointing out its volatility and susceptibility to geopolitical events.

When Bitcoin faced a price decline in April, during the Iran-Israel conflict, Schiff used the opportunity to highlight its speculative nature rather than its status as a haven asset.

Despite the rising debt, U.S. economy has shown signs of growth. In Q2 2024, the U.S. real GDP grew at an annual rate of 2.8%, up from 1.4% in Q1.

This growth, driven by increased consumer spending, inventory investment, and business investment, is considered relatively healthy for a developed economy like the U.S.

However, the total public debt as a percentage of GDP remains elevated, posing challenges for fiscal policy and economic stability.

The budget office predicts that annual interest costs will rise to $1.7 trillion by 2034, from $892 billion this year. At that point, the U.S. would be spending about as much on interest payments as it does on Medicare.

The national debt has become a contentious issue in the political arena, with leading presidential candidates Kamala Harris and Donald Trump acknowledging the issue, but offering no concrete solutions.

Both candidates have largely avoided discussing the nation’s deficits on the campaign trail, suggesting that the problem may worsen in the coming years.

The Biden administration has proposed $3 trillion in deficit reduction over a decade, primarily through raising taxes on high earners and corporations. However, this proposal has been met with resistance from Republicans, who argue that such measures would harm economic growth.

Republican lawmakers have proposed curbing federal spending and blame Democrats for failing to embrace such policies.

Representative Jodey C. Arrington of Texas, the Republican chairman of the House Budget Committee, emphasized the need for fiscal responsibility: “Republican leadership next year is our last best hope to restore fiscal responsibility before it’s too late.”

As the national debt continues to rise, the debate over how to manage it intensifies.

The idea of a BTC reserve as a solution to the debt crisis is gaining traction, but it remains highly controversial. While Bitcoin offers potential benefits as a hedge against inflation and currency devaluation, many argue that its volatility and speculative nature pose significant risks.

Senator Lummis remains hopeful that a strategic bitcoin reserve could help stabilize the national debt and secure the dollar’s global dominance.

However, it is clear that addressing the national debt will require a multifaceted approach, involving both traditional fiscal policies and innovative solutions.

In the meantime, the U.S. will need to navigate the challenges posed by its growing debt while ensuring economic stability and growth.

Whether Bitcoin will play a significant role in this process remains to be seen, but it is undoubtedly a topic of increasing interest and debate among policymakers and economists alike.