Vancouver, known for its scenic beauty and progressive outlook, is stepping into the world of Bitcoin.

Mayor Ken Sim has announced plans to explore bitcoin as part of the city’s financial strategy, aiming to position Vancouver as a leader in Bitcoin adoption.

The initiative reflects a growing global interest in bitcoin as a reserve asset, fueled by increasing institutional acceptance and its potential as a hedge against inflation.

During a city council meeting on November 26, Sim presented a motion titled “Preserving the city’s purchasing power through diversification of financial resources: Becoming a Bitcoin-friendly city.”

This proposal, set to be formally introduced on December 11, seeks to explore adding bitcoin to the city’s reserves as a way to diversify financial resources.

According to Mayor Sim, “Bitcoin offers a unique opportunity to protect against the erosion of value.”

The motion aligns with a broader trend of governments and institutions considering bitcoin as a viable asset. Legislators in Pennsylvania and the U.S. Senate have discussed similar ideas, highlighting bitcoin’s potential role in public financial strategies.

Related: Strategic Bitcoin Reserve Bill Introduced to Brazil’s Chamber of Deputies

Jeff Booth, a well-known Bitcoin advocate, described the proposal as a significant step toward establishing bitcoin as a reserve asset for Vancouver.

Mayor Sim’s interest in Bitcoin isn’t new. During his 2022 mayoral campaign, his political party, A Better City, accepted digital asset donations, signaling an early interest in digital assets. However, since taking office, Sim has rarely addressed Bitcoin or broader digital asset policies.

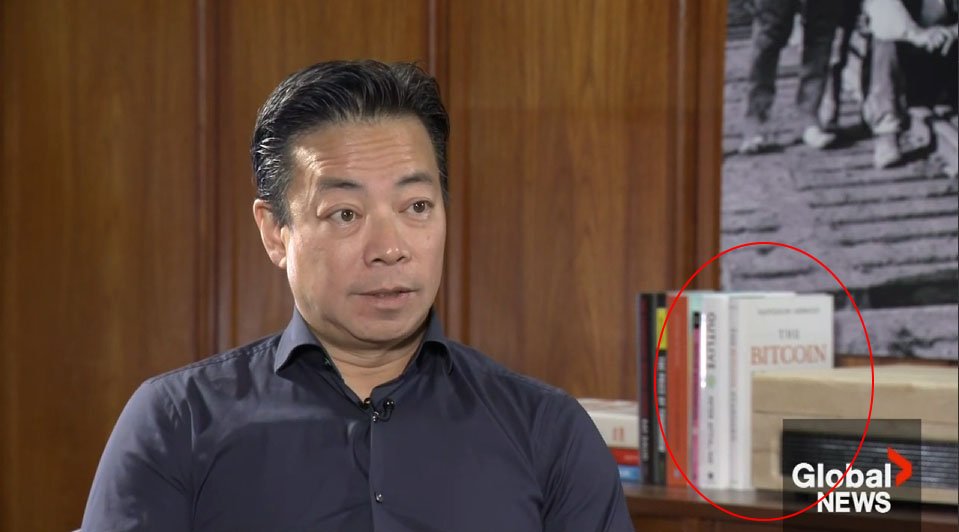

Interestingly enough, during a recent interview with Global News, a copy of The Bitcoin Standard by Saifedean Ammous could be seen in Sim’s office.

While the book is a cornerstone for Bitcoin advocates, its presence doesn’t confirm any specific policy intentions. Still, it underscores Sim’s engagement with the subject.

Despite Sim’s enthusiasm, the proposal faces uncertainties. It remains unclear whether it will gain sufficient support in the city council. The mayor has stated that over 70% of his campaign promises have been fulfilled, but the reception to this bold move toward Bitcoin remains to be seen.

Critics argue that integrating bitcoin into city finances could expose Vancouver to significant volatility risks. Bitcoin’s price has historically fluctuated dramatically, which may pose challenges for municipal budgeting and long-term financial planning.

Sim’s proposal comes at a time when bitcoin is gaining traction among major institutions and governments. Companies like MARA Holdings and MicroStrategy have made aggressive moves to acquire bitcoin, viewing it as a valuable asset for the future.

MARA recently announced the purchase of an additional 703 bitcoin, increasing its treasury to 34,797 BTC, currently valued at over $3.3 billion.

MicroStrategy, a pioneer in corporate bitcoin investment, now holds 386,700 BTC after a series of acquisitions funded by convertible debt. Despite criticism of their debt-heavy strategies, these companies see bitcoin as a long-term asset with immense potential.

Institutional adoption of Bitcoin has also been fueled by regulatory advancements.

In November, U.S. exchanges began offering options on Bitcoin exchange-traded funds (ETFs), creating new opportunities for investors. Analysts believe these developments could further boost bitcoin’s price and adoption in the coming years.

The macroeconomic landscape also appears favorable for bitcoin.

Analysts predict a potential bull run in 2025, driven by a weakening U.S. dollar, increased liquidity, and growing adoption. Daily active Bitcoin addresses are approaching one million for the first time since 2019, signaling strong user engagement.

As the December 11 vote approaches, all eyes are on Vancouver’s city council.

If passed, the motion could make Vancouver a pioneer in municipal bitcoin adoption, potentially inspiring other cities to follow suit. However, success will depend on addressing concerns about volatility and ensuring the move aligns with the city’s long-term financial goals.

Mayor Sim’s proposal is ambitious, but it reflects the changing times.

With Bitcoin’s growing role in global finance, Vancouver has a chance to lead the way. Whether the city takes this bold step or treads cautiously, the conversation itself marks a significant moment in the journey toward broader Bitcoin adoption.