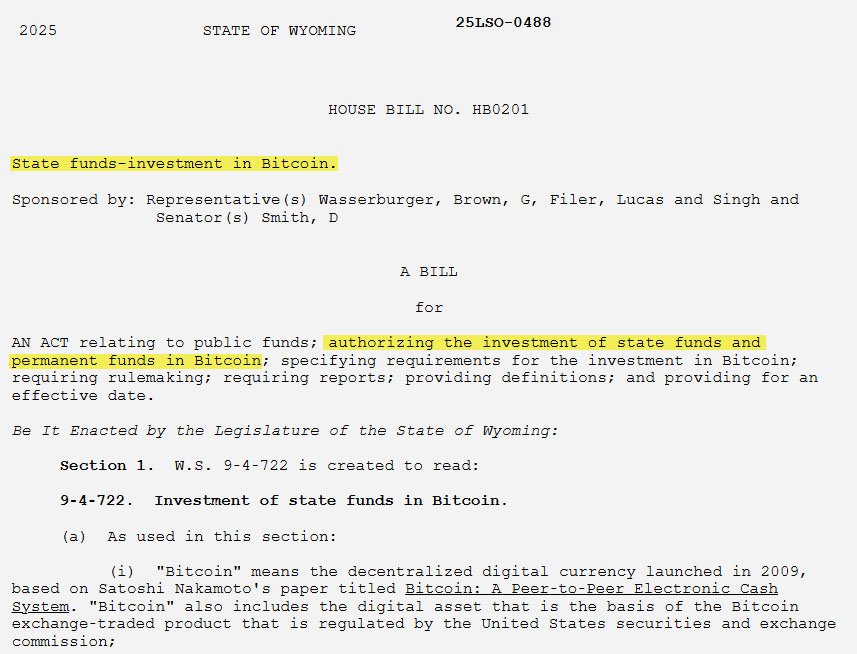

Wyoming joins the other states proposing to invest state funds in bitcoin. The presented bitcoin strategic reserve bill—HB0201—outlines the plan to allocate up to 3% of state funds to bitcoin to make Wyoming the financial innovation leader.

This is part of a national trend of US states looking at Bitcoin in their financial plans. Sponsor of HB0201 Representative Jacob Wasserburger said:

“Wyoming has always been a pioneer […] HB0201 ensures that Wyoming remains the leading state for legislative innovation in Bitcoin, while providing our citizens with the long-term benefits of sound money and financial sovereignty.”

HB0201 would allow bitcoin investments through the general fund, Permanent Wyoming Mineral Trust Fund, and Permanent Land Fund.

Direct purchases of bitcoin or investments through regulated exchange-traded products (ETPs) would be allowed. Annual reports from the state treasurer would be required on the performance and security of the bitcoin.

Senator Cynthia Lummis, a Bitcoin enthusiast, called it a “forward-thinking approach” and said Wyoming is now the leader in financial innovation.

Rep. Wasserburger ties it to national goals, saying, “Building a strategic bitcoin reserve isn’t just about securing financial strength—it’s about ensuring that both Wyoming and America remain leaders on the global stage.”

Lummis has introduced similar legislation at the federal level.

Her BITCOIN Act proposes the US government buy one million bitcoin over 5 years. This is part of the growing speculation of a federal bitcoin reserve under the Trump administration which will take office on January 20, 2025.

Wyoming’s proposal is strict on security. Bitcoin investments will need secure custody solutions and encrypted storage among geographically dispersed data centers. Bill also requires robust governance, disaster recovery plans and regular security audits to protect state’s digital assets.

Related: University of Wyoming Bitcoin Research Institute | A Word with the Director

Interestingly, the allocation of 3% of state funds is not a strict requirement, meaning the state treasurer wouldn’t have to sell any bitcoin if the market value goes above 3% of the portfolio.

Wyoming isn’t the only state interested in bitcoin. Texas, Pennsylvania and Massachusetts are also exploring bitcoin for public funds.

Massachusetts’ SD422 allows up to 10 % of state funds to be invested in bitcoin or other digital assets. Massachusetts even allows for bitcoin lending to earn more.

Dennis Porter, CEO of the Satoshi Action Fund, noted that up to 15 states will have bitcoin reserve legislation by end of 2025.

Proponents argue that investing in bitcoin could protect people’s funds from inflation, strengthen state funds during economic downturns, and maintain the dominance of the United States in the global digital economy.

Wasserburger said, “We can’t afford to sit on the sidelines while other states […] move forward with their own Bitcoin reserve bills. Passing HB0201 quickly ensures that Wyoming remains the leader among the states, setting the standard for financial innovation and sovereignty.”

If the bill is passed, Wyoming will be one of the first states to put bitcoin into its financial infrastructure. “Investing in Bitcoin is not just smart policy—it’s Wyoming’s way of saying we’re ready for the future,” Wasserburger said.