In a recent X conversation initiated by Caitlin Long, Founder/CEO of Custodia Bank and a seasoned Bitcoin (BTC) investor, the digital asset community engaged in a heated debate about the intrinsic value of bitcoin and its potential as a means of exchange with critic Samantha LaDuc.

Long’s tweet, featuring the hashtag #NotYourKeysNotYourCoins, emphasized the importance of holding one’s private keys for ultimate control over one’s BTC.

Samantha LaDuc’s Comment

The conversation took an intriguing turn when Bitcoin critic Samantha LaDuc questioned the rationale behind hoarding BTC. She questioned why the digital asset is often “squirreled away & doesn’t trade” when traditional currencies and commodities actively circulate. LaDuc challenged BTC’s classification as a currency, commodity, or asset, labeling it an illiquid asset with no utility beyond speculation.

She stated:

“Since Bitcoin is most certainly not a currency nor commodity nor asset enabling TRANSACTIONS, it is therefore an illiquid asset that has no utility or value beyond speculation that it will be a liquid asset someday in the future, or a plaything for those who manipulate the emotions of those who believe it will be.”

Her remarks could be likened to dismissing the significance of the internet in the early ’90s. One might imagine her asking, “Why use this World Wide Web thing when you can send letters by mail?” However, history has shown that, what may seem impractical or speculative at first, can evolve into something transformative.

Bitcoin Advocates Reply

Returning to the debate, LaDuc’s comments stirred controversy within the community, drawing criticism and responses from prominent figures. Bitcoin advocate Lyn Alden, founder of Lyn Alden Investment Strategy, entered the fray with a detailed response, outlining BTC’s unique properties and use cases.

Alden highlighted the digital asset’s ability to facilitate global transactions and protect against financial de-platforming. Her argument showcased BTC’s optionality and global availability, especially in regions facing economic challenges. She also cited a speech by J. Travis Laster, Vice Chancellor at the Court of Chancery of the State of Delaware, where he stated:

“Someone is going to do this. If a judge can see it, the opportunity is pretty obvious. It’s also monetizable. Although bitcoin is a public protocol that anyone can use, and whose changes depend on the community’s adoption, you can have “permissioned” distributed ledgers.”

While Alden offered a well-reasoned and nuanced response, one could almost hear the collective eyerolls from the community in response to LaDuc’s dismissal of BTC’s current use cases. It’s as if LaDuc entered a modern tech expo and questioned the need for personal computers, insisting typewriters were sufficient. Bitcoin enthusiast Walker replied to the critic by stating:

“I hope at some point in the future you are able to open your mind to the possibility that you have more to learn.”

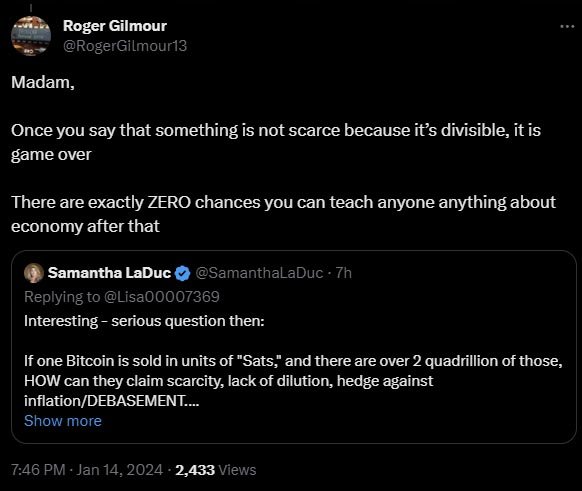

Math isn’t Mathing

LaDuc is also bashed for stating that BTC is not scarce because it is divisible. She writes:

“If one Bitcoin is sold in units of “Sats,” and there are over 2 quadrillion of those, HOW can they claim scarcity, lack of dilution, hedge against inflation/DEBASEMENT.”

The community questioned her understanding of scarcity, prompting one to wonder if basic economics had become an elusive concept for her.

As the conversation unfolded, the critic and advocates found common ground, both agreeing that the pioneering digital asset has devoted followers. She stated:

“I don’t share their world view on how BTC fixes our broken system, but I have agreed this ROGUE MONEY payment system is well supported by a devote following.”

LaDuc finally arrived at the conclusion that this matter needs a get-together for a deeper debate.