A recent report published by Ark Investment Management, discusses bitcoin’s price drawdowns and the capitulation periods. The report shows that the bear market of 2022 was the weakest bear market in bitcoin’s history.

Bitcoin Price Drawdowns Bigger and Longer Than Ever

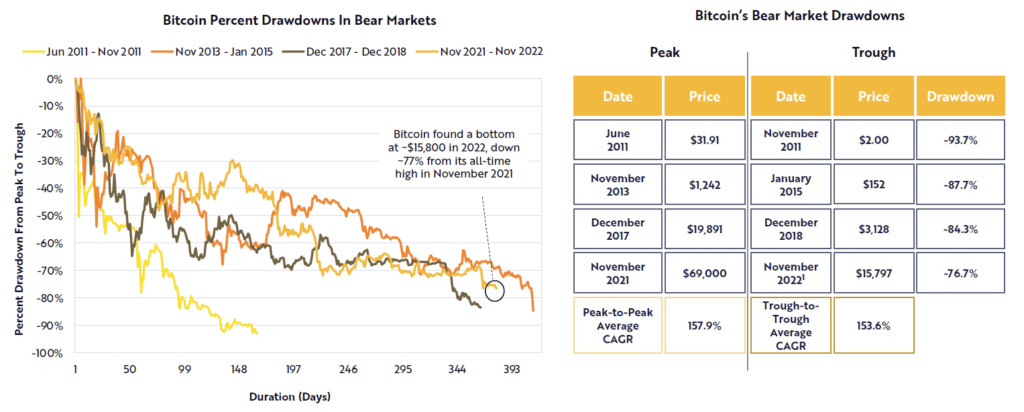

The report states that the recent decline from bitcoin’s peak value was the weakest in magnitude but lasted the second longest period in its history.

Source : Ark Investment Management

Bitcoin found a bottom at ~$15,800 in 2022, down ~77% from its all-time high in November 2021. The longest bear market bitcoin has experienced so far brought the price of bitcoin down by 87%, from an all-time-high of $1,242 in November 2013 to $152 in January 2015, lasting about 430 days.

The shortest downtrend of the price — which was also the most intense as measure in percent fall from peak — happened between June to November 2011, bringing bitcoin’s price down 93% from $31.91 to $2.00, lasting around 150 days.

Bitcoin Capitulation Reaches Historic Levels

Source : Ark Investment Management

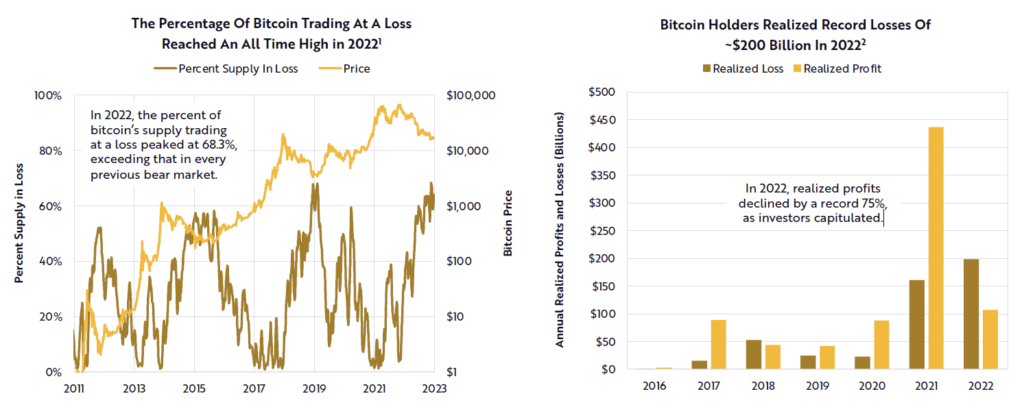

According to the report, bitcoin capitulation has recently reached levels that are reminiscent of price troughs observed in the past. In the year 2022, the capitulation of bitcoin holders was found to be proportionate to previous market cycles. This suggests that investors were relinquishing their holdings in a similar manner as they did during previous downturns in bitcoin’s price.

Read more on the subject : Bitcoin’s Price Fell. So…What?

Moreover, the percentage of bitcoin’s supply being traded at a loss reached an all-time high in 2022. Specifically, 68.3% of the total bitcoin supply was being traded at prices lower than their acquisition cost, surpassing the levels observed in every previous bear market. This indicates that a significant majority of bitcoin holders were facing negative returns on their investments during that period.

In addition, the year 2022 also saw a substantial decline in realized profits. This decline was particularly noteworthy, as it reached a record-breaking 75%.

The report concludes that this decline in realized profits can be attributed to the phenomenon of investor capitulation, where individuals sold their bitcoin holdings at lower prices due to prevailing market conditions.