Bitcoin fees have become a hot topic, triggering diverse opinions as the cost of sending BTC reaches abnormal heights. BitInfoCharts, a statistics resource, reports an average transaction fee nearing $38 as of December 17, stirring a debate among bitcoin enthusiasts.

The surge in fees is attributed to the recent influx of Bitcoin Ordinals inscriptions, causing a spike in transaction costs for all network users. According to the BitInfoCharts report, the current on-chain costs are the highest since April 2021.

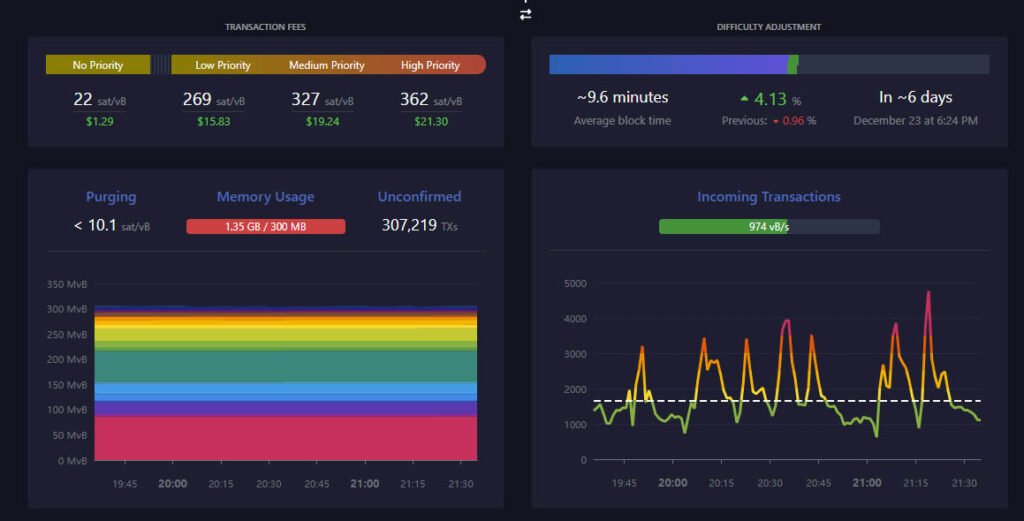

On the other hand, Mempool.space reveals the vastness of Bitcoin’s mempool, with around 300,000 transactions awaiting confirmation, with some paying a fee as low as $2. Notably, mempool is a virtual pool, collecting all unconfirmed on-chain transaction backlog.

Hight Bitcoin Fees: A Heated Debate

Notably, the high on-chain fees make spending impractical for small investors, resulting in a heated debate among bitcoin proponents. While some are critical of the impact of Ordinals on fees, influential Bitcoin figures argue that double-digit transaction costs are a glimpse into the future. Popular bitcoin analyst and advisor Hodlaut commented on the matter on X, stating:

“Kinda blows my mind that so many people seemingly have never reflected on the obvious fact that fees will be high with high demand for block space. Fees are currently artificially and temporarily high due to JPEG clownery, but it is nothing more than a glimpse into the future.”

The debate extends to the core principles of Bitcoin, with arguments against demanding low fees for Level 1 transactions, considering it an attack on the network’s fundamentals. Some suggest investors use layer-2 solutions like the Lightning Network, designed for mass adoption, as a shield against rising fees.

Despite the ongoing controversy, Bitcoin continues to function as intended, claims commentator Beautyon. He posted on X:

“If Ordinals bring the high on chain world to everyone earlier than expected, it will act like a scythe, cutting down everyone who did not accept a Layer 2 solution to the network fee problem.”

Bitcoin veteran and co-founder of Blockstream, Adam Back, supports the expansion of layer-2 capabilities as a solution, highlighting that attempting to hinder the trend would only result in potentially worse alternatives. He stated:

“You can’t stop JPEGs on bitcoin. Complaining will only make them do it more. Try to stop them, and they’ll do it in worse ways. The high fees drive adoption of Layer 2 and force innovation. So relax and build things.”

JPEGs Won’t Be There in the Future: Commentator

Notably, the United States National Vulnerability Database (NVD) recently raised concern over Ordinals, classifying them as an “exploit” of the Bitcoin code. Commenting on the bitcoin ordinals inscriptions, Hodlaut stated:

“JPEGs are very regarded. They will not be there in the future. Priced out. Well, in reality, they are priced out now, but grifters and attackers seem prepared to lose a lot of money temporarily.”

Record High Miners’ Revenue

Meanwhile, data from Blockchain.com reveals miners’ revenue—value in block rewards and transaction fees paid to miners—reaching levels close to those of bitcoin’s previous $69,000 all-time high in November 2021.

Interestingly, miners’ revenue currently sits around $63 million as of December 17. While these elevated revenue levels reflect a thriving industry, they also result in increased investment in mining operations, advancements in technology and infrastructure, and the strengthening of the overall mining sector.

Additionally, the positive financial outlook may attract more participants to the mining space, contributing to the continued growth and evolution of the industry. Notably, the digital asset is trading around $42,000.