Table of Contents

The Spent Output Profit Ratio (SOPR) is a significant on-chain indicator in the Bitcoin ecosystem, providing insights into the market’s behavior concerning profitability. This metric is fundamentally based on the historical analysis of each Bitcoin transaction to ascertain whether it was moved at a profit or a loss.

Calculation of SOPR

Bitcoin SOPR ratio essentially analyzes values between bitcoin movements. It compares the value at which Bitcoin is acquired (as an output to an already existing transaction) to its value when it is moved again or spent (as an input to a new transaction).

By calculating the realized value of a Bitcoin transaction (the price at which the bitcoin is sold) and dividing it by the value of bitcoin at the time it was last moved or acquired, this metric provides an understanding of the overall profit or loss status of Bitcoin transactions over a certain period.

Interpretation of SOPR Values

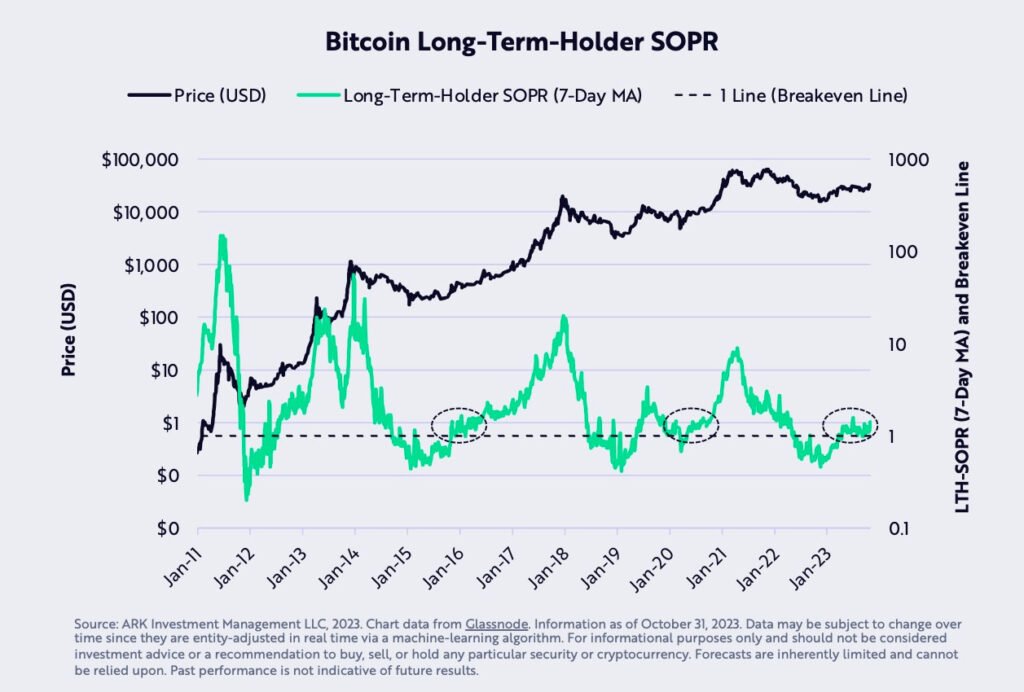

In simpler terms, the SOPR can indicate whether Bitcoin holders are selling their Bitcoin at a profit or a loss. When it is greater than 1, it typically implies that sellers are realizing a profit on their transactions, as the selling price is higher than the cost price. Conversely, a rating of less than 1 suggests that sellers are transacting at a loss.

Bitcoin SOPR Chart

SOPR as a Reflection of Market Sentiment

This metric is particularly useful in analyzing market sentiment and behavior.

For instance, during bull markets, the metric tends to remain above 1 as most sellers are in profit, while in bear markets, the metric might dip below 1, indicating that sellers are capitulating or selling at a loss. However, it’s important to note that while it is a valuable tool, it should be used alongside other indicators for a more comprehensive understanding of market trends.

While Spent Output Profit Ratio can assist in identifying profitable trading opportunities, it’s important to recognize that successful trading often requires exceptional skill and experience. For the vast majority, a more prudent approach is to focus on self-custody of their bitcoin and long-term holding.

Spent Output Profit Ratio in the Context of Bitcoin’s Positioning

In Bitcoin’s journey as a robust alternative to traditional fiat currencies like the U.S. dollar and the euro, this metric plays a vital role.

Bitcoin’s decentralized nature and its contribution to financial autonomy highlight the significance of understanding metrics like Spent Output Profit Ratio. However, for most individuals, the best strategy is often to take control of their bitcoin and hold it over extended periods, particularly over spans of five years or more.

Historical data suggests that those who hold bitcoin for such durations are almost guaranteed to experience a Spent Output Profit Ratio of significantly above 1, indicating profitable outcomes. Embracing a low time preference, investing in high-quality assets like Bitcoin and refraining from selling, typically outperforms trading strategies for the overwhelming majority of individuals.

This approach is especially crucial for those who view Bitcoin as a key player in the future global monetary landscape, offering a path to capitalize on its potential while minimizing risks associated with frequent trading.

FAQ

u003cstrongu003eWhat is SOPR in Bitcoin?u003c/strongu003e

The Spent Output Profit Ratio (SOPR) is a crucial on-chain metric in the Bitcoin ecosystem that offers insights into the profitability of market transactions.

u003cstrongu003eHow is SOPR calculated?u003c/strongu003e

SOPR is calculated by comparing the value at which Bitcoin is acquired to its value when it is moved or spent again. This involves analyzing historical data of each transaction to determine whether it resulted in a profit or a loss.

u003cstrongu003eWhat does SOPR reveal about Bitcoin transactions?u003c/strongu003e

It indicates whether Bitcoin holders are selling at a profit or a loss. A value greater than 1 suggests profit, while a value less than 1 implies a loss.

u003cstrongu003eHow is SOPR interpreted in terms of market sentiment?u003c/strongu003e

It serves as a reflection of market sentiment. During bull markets, it typically stays above 1, indicating most sellers are in profit, while in bear markets, it may dip below 1, signaling potential losses.

u003cstrongu003eIs SOPR a definitive indicator for trading decisions?u003c/strongu003e

While it is a valuable tool, it should be used in conjunction with other indicators for a more comprehensive understanding of market trends.

u003cstrongu003eWhy is holding a favorite strategy in Bitcoin?u003c/strongu003e

Historical data suggests that holding Bitcoin for extended periods, particularly over five years or more, often results in a Spent Output Profit Ratio of significantly above 1, indicating profitable outcomes.

u003cstrongu003eWhat strategy is recommended for Bitcoin trading?u003c/strongu003e

While Spent Output Profit Ratio can identify trading opportunities, a more prudent approach for most individuals is self-custody and long-term holding, emphasizing the potential benefits of embracing a low time preference.

Why is SOPR important in investment?

It is an essential metric for identifying profitable outcomes, emphasizing the importance of investing in high-quality assets like Bitcoin and refraining from frequent trading.

Is long-term holding a good strategy in Bitcoin investment?

Holding Bitcoin over the long term is recommended to minimize risks associated with frequent trading and capitalize on its potential, especially for those who view it as a key player in the future global monetary landscape.