Ryan Dellone, a healthcare worker in Fresno, California, has decided to sue the owner of the Bitcoin wallet that allegedly stole his BTC stash on December 14, 2021, via the execution of an unauthorized SIM swap.

As per a report, the SIM swap scam involved an employee working for Dellone’s mobile network operator who switched the California resident’s phone number over to a new device that was controlled by the attacker. It is crucial to note that Dellone claims that roughly $100,000 in digital assets were stolen from his wallet.

A First in the Digital Asset Sector

Interestingly, this is the first case in which a federal court has recognized the use of information included in a Bitcoin transaction. According to the report, the court is likely to provide notice of the lawsuit to the defendant. This gives hopes to other victims of similar Bitcoin scams of getting justice instead of waiting a long time for enforcement agencies to take notice.

Coinbase, the largest digital asset trading platform in the United States, has also been named as a defendant in the lawsuit. Dellone claims that the exchange failed to notice multiple red flags on his account and should’ve acted to stop the theft.

Notice Served Via Bitcoin Address

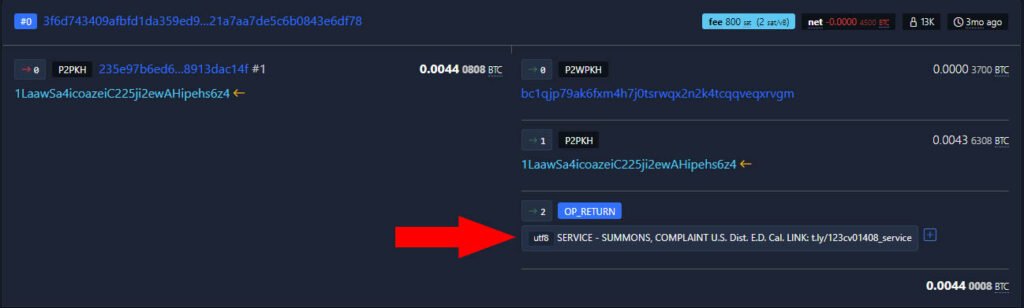

On December 14, the Eastern District of California granted Dellone permission to serve the notice of his lawsuit to the BTC address via a short message in a transaction worth 3700 sats.

Bitcoin transactions are publicly recorded, and each transaction can include an optional brief message. This message utilizes the “OP_RETURN,” a feature in the Bitcoin scripting language enabling users to append metadata to a transaction, subsequently preserving it on the blockchain.

In the BTC transaction sent to the contested address, the OP_RETURN message states: “SERVICE – SUMMONS, COMPLAINT U.S. Dist. E.D. Cal. LINK: t.ly/123cv01408_service,” providing a concise link to access a copy of the lawsuit hosted on Google Drive.

Earlier history of the destination address (bc1qjp79ak6fxm4h7j0tsrwqx2n2k4tcqqveqxrvgm) shows a deposit of 2.05 BTC on December 2021, in a transaction that looks like a withdrawal from an exchange.

“The courts are adapting to the new style of service of process,” stated Mark Rasch, a former federal prosecutor at the United States Department of Justice (DoJ), adding: “And that’s helpful, useful, and necessary.”

Notably, when it comes to Bitcoin scams and exploits, the name of a North Korean hacking group, Lazarus Group, comes to the top. As reported earlier by Bitcoinnews, a study revealed that the hacking group owns a staggering $47 million in various digital assets, the majority of which are in bitcoin.

Related reading: Everyone’s a Scammer

Sim Swap Scam Victim Looks to A Default Judgment

Moreover, the lawyer representing Dellone, Ethan Mora, has worked with experts that track down the movement of assets belonging to scams and exploits in the digital asset sector. Mora successfully tracked the destination wallet that contained Dellone’s funds.

The lawyer pointed out that it is currently unclear if the Bitcoin address holding Mora’s Bitcoin is controlled an anonymous hackers, or if the funds have already been confiscated by the government in a seizure action.

Interestingly, Mora says that he is adopting a new strategy for his client by suing the Bitcoin address that holds Dellone’s money, seeking to potentially win a default judgment to seize the funds contained in the wallet “without knowing the identity of his attackers or anything about the account holder.”

The report said that Mora expects a default judgment in case the owner of the address with Dellone’s funds fails to contest his claims within the specified time.

“The government doesn’t need the crypto as evidence, but in a forfeiture action, the money goes to the government,” Rasch said. “But it was never the government’s money, and that doesn’t help the victim. The government should be providing information to the victims of cryptocurrency theft so that their attorneys can go get the money back themselves.”

This groundbreaking case not only sheds light on the vulnerabilities within the digital asset sector but also pioneers new legal avenues for victims seeking restitution.