The regulatory landscape surrounding Bitcoin is undergoing rapid change as many await a Bitcoin Spot Exchange-Traded Fund (ETF) to be approved by the United States Securities and Exchange Commission (SEC). Recent developments hint at a possible shift in the SEC’s view of Bitcoin, potentially classifying it as a security. This move has rattled the Bitcoin community and legal experts alike, including prominent digital assets attorney John Deaton.

SEC’s Evolving Stance and BlackRock’s Filing

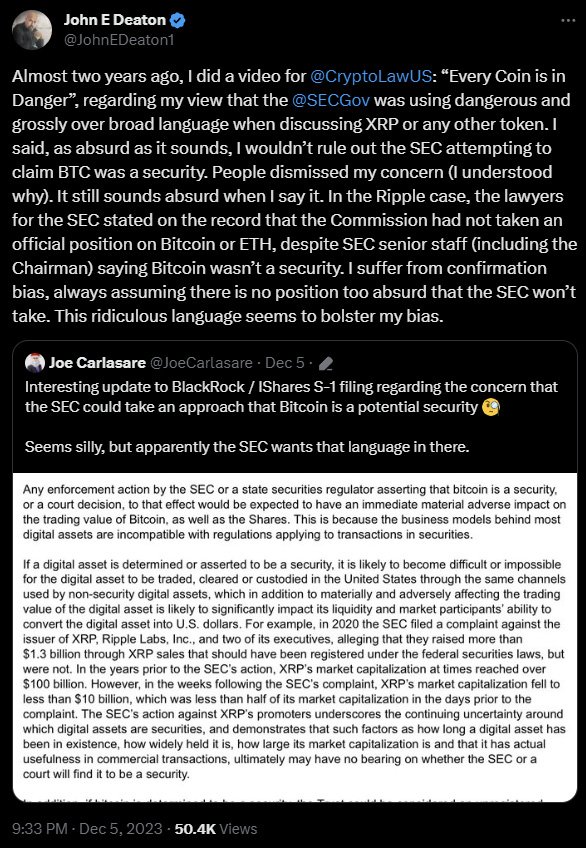

The SEC’s stance on Bitcoin’s classification has been a point of contention. Despite previous assertions from SEC officials, including Chairman Gary Gensler, that Bitcoin is not considered a security, recent events have raised eyebrows. Notably, BlackRock’s amended S-1 filing, guided by the SEC, introduced language regarding anti-money laundering and monitoring unusual price movements. This has led to speculation about the SEC’s inclination to view Bitcoin through a security lens.

Related reading: Bitcoin Is The Only Winner In SEC Clash

John Deaton’s Warnings

John Deaton, a key figure in digital assets law, has been vocal about the risks associated with the SEC’s broad language. His concerns stem from the potential impact on Bitcoin’s trading value and related investments if the SEC were to deem it a security. Deaton’s warnings highlight his skepticism about the SEC’s regulatory consistency, emphasizing the potential bias within the commission.

John Deaton has been actively involved the digital asset Space. He represented over 75,000 XRP holders in the legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). He recently disclosed that his support for the Ripple Labs’ clients was not primarily because he cared about Ripple. Instead, he sees it as a commitment to helping the “crypto industry” combat “government overreach” in general.

In a tweet, Deaton clarified that he has not moved on from Bitcoin and owned significantly more BTC than XRP when he initiated the lawsuit against the SEC. This statement was a response to Bitcoin advocate Caitlin Long, who claimed in an interview that Deaton shifted away from Bitcoin due to scalability concerns within the Bitcoin network. Deaton firmly reaffirmed his unwavering commitment to Bitcoin and dismissed Long’s statement as inaccurate.

Spot Bitcoin ETF Approval and Deaton’s Concerns

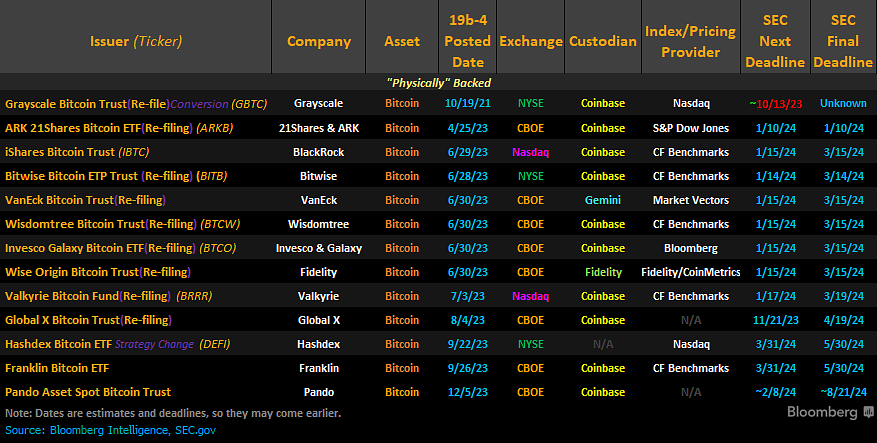

The anticipation surrounding the approval of a Spot Bitcoin ETF by the SEC further intensifies the situation. There’s a surge in optimism among market experts, projecting a potential approval window between December 7-10.

Bloomberg Analyst James Seyffart holds comparable views, forecasting the possible approval of a Spot Bitcoin ETF approximately on December 10. Moreover, he foresees the potential approval of ARK Invest’s Spot Bitcoin ETF by January 10 of the subsequent year.

However, experts like Deaton express concerns over the SEC’s stringent approach. He believes any move to label Bitcoin as a security could reshape its trading landscape, subjecting it to heightened regulatory scrutiny, adding:

“there is no position too absurd that the SEC won’t take.”

Implications and Speculation

The implications of such a classification loom large. It could significantly alter how Bitcoin is traded on exchanges, potentially stalling its current momentum. Analysts and legal experts, including Joe Carlasare and John Reed Stark, echo these worries, pointing to the SEC’s insistence on “security” language in BlackRock’s filing as a crucial signal.

John Reed Stark and Joe Carlasare’s Analysis

In his response to Joe Carlasare’s analysis on the potential SEC classification of Bitcoin as a security and the approval of a Bitcoin Spot ETF, Stark acknowledges the possibility that Carlasare might be correct in his assessment.

Stark questions the SEC’s intention behind providing specific guidelines for applicants, suggesting that it could be a precautionary measure to later justify a rejection by stating that the applicants failed to meet the specified criteria. He also speculates that undisclosed investigations or concerns may be influencing the SEC’s stance, emphasizing the unpredictability of the SEC’s actions behind closed doors.

Stark further speculates on SEC Chair Gensler’s approach, noting his tendency to assert his viewpoints aggressively without much regard for disagreement from other commissioners. He provides examples of Gensler’s assertive actions, such as suing a law firm and implementing a controversial cyber-reporting rule.

Stark expresses fascination with the unfolding situation and acknowledges the complexity of predicting the SEC’s stance on broader “cryptocurrency” concept, agreeing with Carlasare’s views. He suggests that the upcoming events in this regard could be interesting.

Awaiting the Verdict

As the crypto community eagerly awaits the SEC’s decision on the Spot Bitcoin ETF, the uncertainty surrounding Bitcoin’s classification persists. The outcome holds immense significance, with approval potentially propelling Bitcoin beyond $50,000 but a negative ruling, especially labeling it a security, posing substantial hurdles.

Analysts and experts’ warnings and insights underscore the evolving and complex situation of digital-asset regulation in the United States. The SEC’s stance holds immense weight, shaping the future landscape of digital assets. The ongoing debate highlights the need for clearer regulatory guidance that could redefine the path for Bitcoin.

Related reading: