Table of Contents

In the ever-evolving landscape of Bitcoin, network fees emerge as a pivotal aspect of the user experience, influencing the cost and efficiency of transactions. Bitcoin transaction fees, which compensate miners for securing the network, can fluctuate significantly, creating a need for strategic planning.

This article explores both preemptive and reactive strategies to minimize Bitcoin network fees, ensuring users can navigate the ecosystem efficiently.

Understanding Bitcoin Transaction Fees

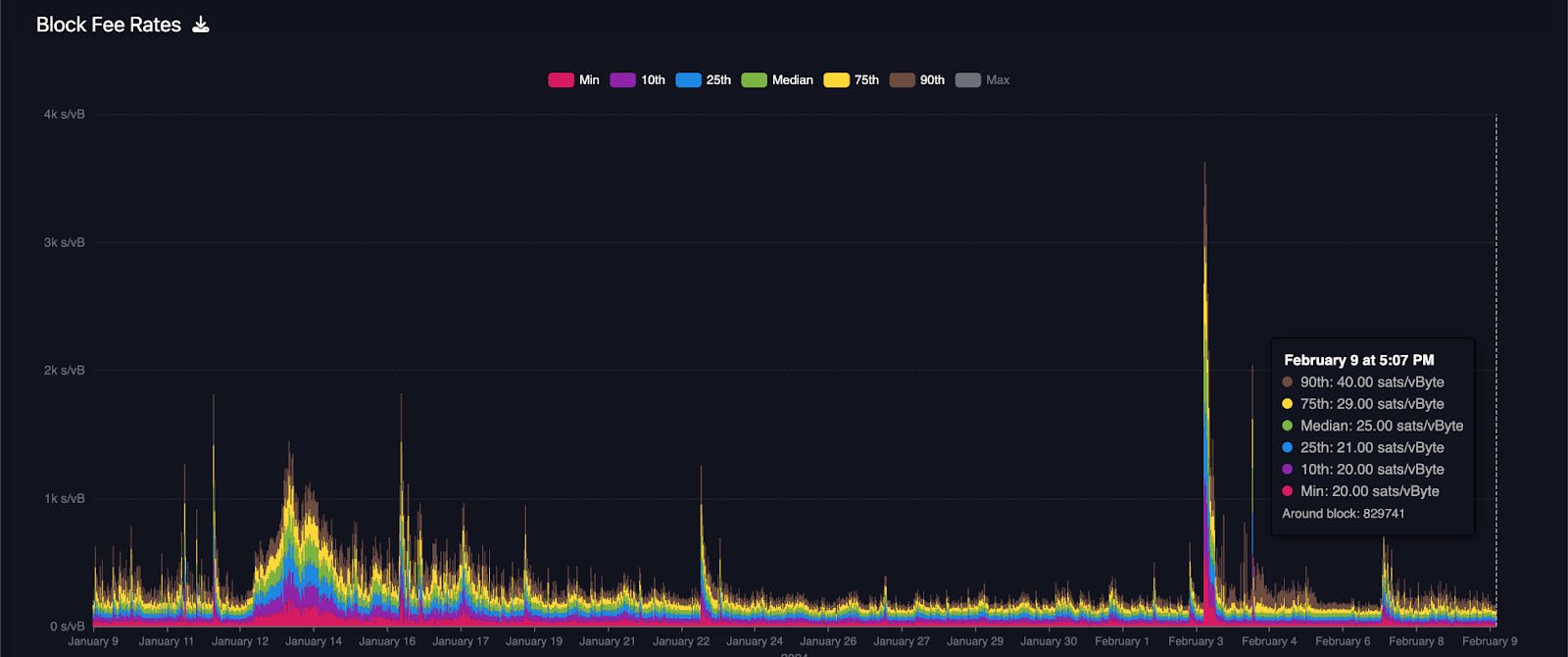

Bitcoin network fees are payments made to miners for including transactions in the blockchain. These fees fluctuate with network demand, leading to higher costs during peak times. Understanding this dynamic is key to minimizing transaction fees.

The UTXO Model and Its Impact on Fees

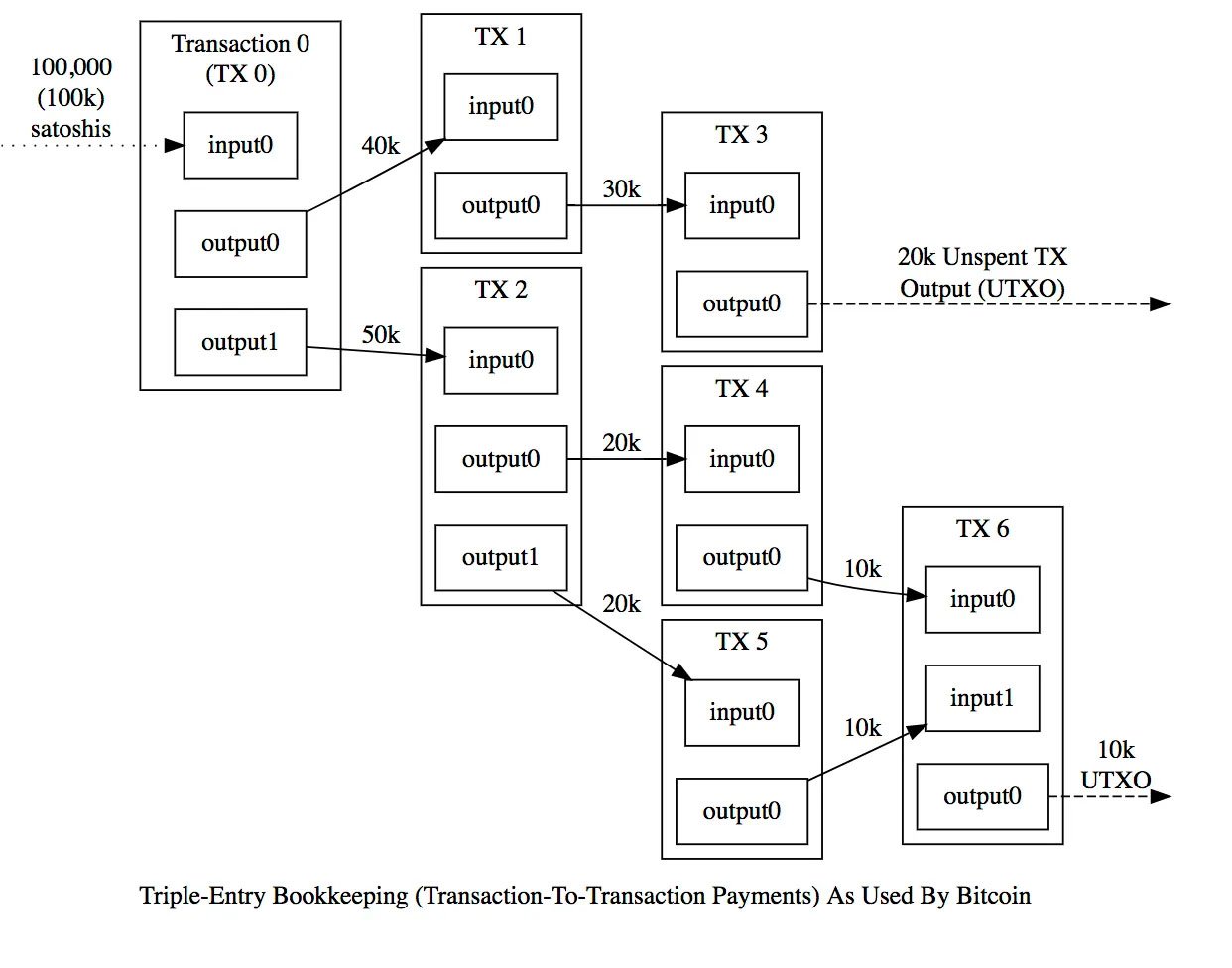

The foundation of Bitcoin transactions lies in the Unspent Transaction Outputs (UTXO) model. Each transaction generates UTXOs, which are the starting point for future transactions. Efficient UTXO management is crucial as it directly influences the size and complexity of transactions, affecting fees. Large, unconsolidated UTXOs can lead to higher fees, while streamlined UTXO pools can reduce transaction costs.

What’s a UTXO?

An Unspent Transaction Output (UTXO) represents the amount of bitcoin someone has left remaining after executing a Bitcoin transaction. Efficient management of UTXOs is crucial for optimizing transaction fees.

Strategies to Reduce Fees

Transaction Timing

Fees tend to be lower during times of decreased network activity, typically on Sundays. Plan your transactions for these off-peak times to take advantage of lower fees. You don’t necessarily need to wait for these specific moments but can instead set a lower transaction fee that would likely pass at those times based on the current network activity.

Timing transactions for lower fees requires patience and may not be suitable for urgent transfers. Users must balance the need for timely transactions against potential savings on fees.

UTXO Management

Efficient UTXO management involves consolidating inputs and planning transactions to minimize their size. Use wallets that support UTXO management features, allowing you to select inputs manually or automatically consolidate UTXOs at opportune times.

Consolidate UTXOs during periods of low network activity. This can be done by sending smaller amounts of bitcoin to yourself when fees are lower, thus reducing the size and complexity of future transactions. This is to avoid spending small UTXOs which would have dispoportionate fees relative to their value.

Effective UTXO management demands a deeper understanding of how Bitcoin transactions work, which might be daunting for beginners. However, the long-term benefits of reduced fees can outweigh the initial learning curve.

Use Fee Estimation Tools

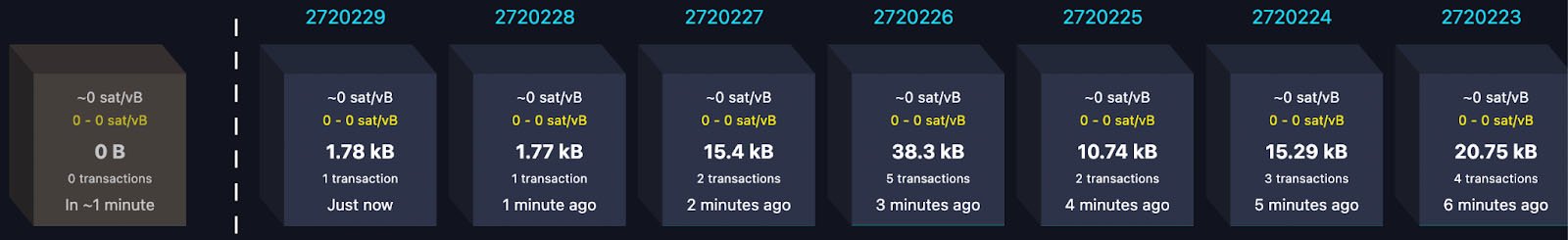

These tools analyze the current state of the Bitcoin network to recommend an optimal fee for timely transaction confirmation.

You can utilize wallets or online services, like mempool.space, that offer fee estimation to adjust your transaction fees according to network conditions. This can also be achieved by running your own Bitcoin node.

While these tools offer guidance on fee rates, they are based on current network conditions and predictions can sometimes be inaccurate. Users must exercise judgment and possibly adjust fees manually if transactions are not confirmed on time.

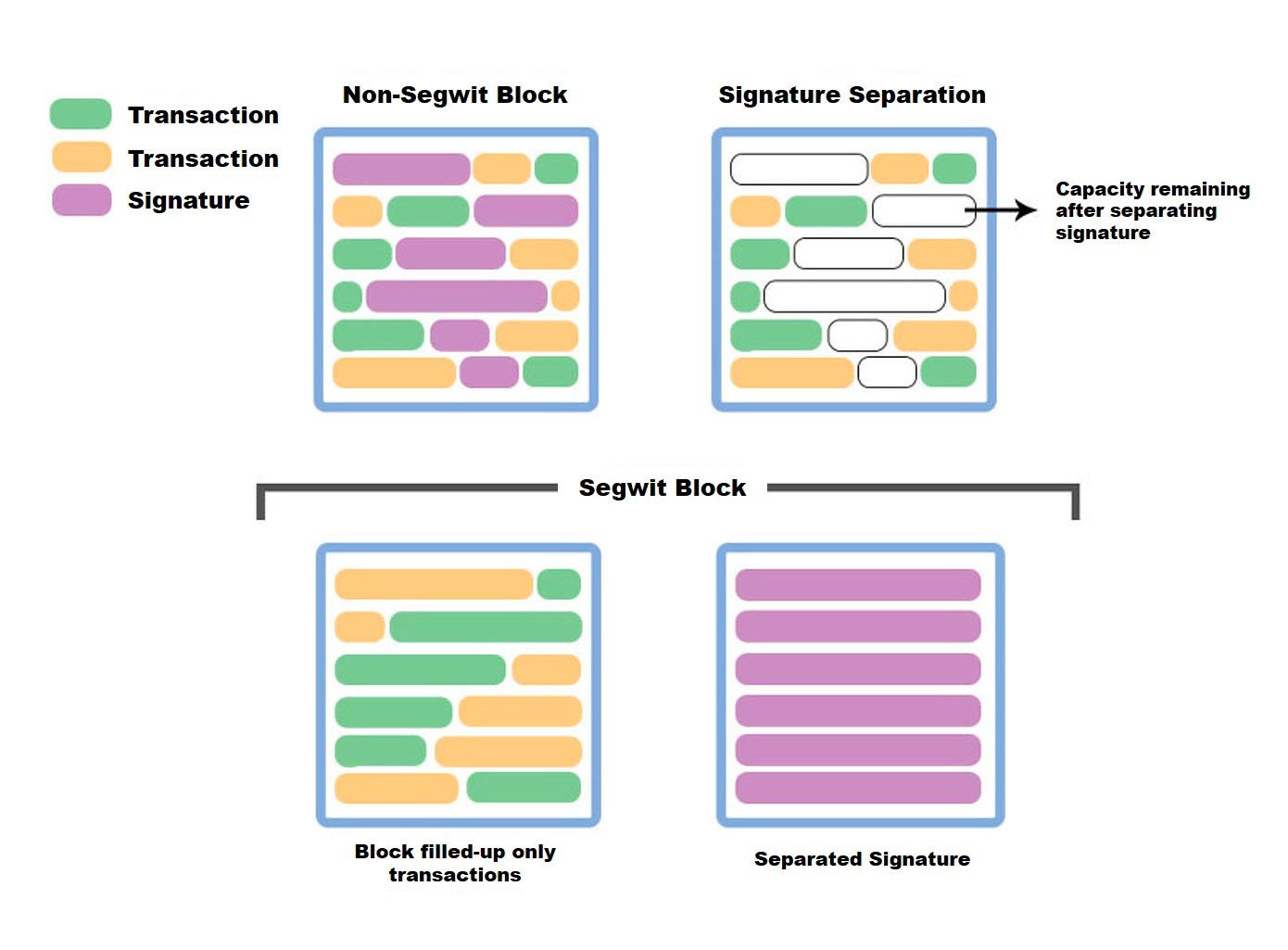

Use SegWit Wallets

Segregated Witness (SegWit) reduces the size of transactions, leading to lower fees. Introduced through BIP91, a SegWit transaction stores information related to your transaction in the witness space in a block, so it’s not considered when calculating the network fee to pay for the transaction to go through.

Ensure your wallet supports SegWit (addresses starting with bc1) for transactions to benefit from smaller transaction sizes.

Batching Transactions

Combining multiple outputs into a single transaction reduces the fee per payment. For businesses or frequent users, use wallets that support batching to combine multiple transactions into one. With batching, it’s possible to save up to 75% in fees, depending on the number of inputs.

Batching is primarily beneficial for businesses or users with the need to send multiple transactions at once. Individual users may find fewer opportunities to batch transactions but can still benefit when the situation allows. There is also a privacy tradeoff since the recipients can see that you have used batching to send to others.

Advanced Techniques

Lightning Network

Lightning Network is a layer-2 solution that enables instant, low-fee transactions by moving them off the main Bitcoin blockchain. Set up a Lightning wallet and use it for small, frequent transactions to avoid high on-chain fees.

The Lightning Network offers significant fee reductions for small, frequent transactions but requires setting up and managing a Lightning wallet. It’s best suited for users willing to engage with newer technologies for the benefits of low fees and instant transactions. Easier Lightning wallets exist but are often custodial.

Liquid Network

The Liquid Network is a sidechain governed by a federation, offering faster block processing—every minute—and private transactions by hiding amounts. Users convert their bitcoin into Liquid bitcoin (L-BTC) minus a small fee, enabling cheaper and more private transactions on this network.

This advanced solution caters to those seeking quicker, cost-effective, and discreet Bitcoin transactions. It is not widely used so you might have trouble transacting with other users, although more and more wallets are integrating it. Here you’ll find the current state of the network.

Choosing the Right Wallet

Selecting a wallet that supports advanced features like fee estimation, SegWit, and custom fee settings is crucial for effective fee management. Wallets that offer a balance of user-friendly interfaces and advanced fee optimization features provide the best of both worlds, allowing users to minimize fees without a steep learning curve.

Conclusion

Navigating Bitcoin network fees doesn’t have to be a daunting task. By employing strategic timing, managing UTXOs efficiently, leveraging technology like SegWit and the Lightning Network, and choosing the right wallet, users can significantly reduce their transaction costs. As the Bitcoin network continues to evolve, staying informed and proactive in managing transactions will ensure users can enjoy the benefits of Bitcoin with minimal expense on fees.

Remember, the key to minimizing fees lies in a proactive approach to transaction management. By understanding and applying these strategies, you can navigate the Bitcoin network more efficiently, ensuring your transactions are both cost-effective and timely.

FAQ

u003cstrongu003eWhat are Bitcoin network feesu003c/strongu003e?

Bitcoin network fees are payments made to miners for processing and including transactions in the blockchain. They vary based on network demand and can significantly influence transaction costs.

What role dou003cstrongu003e UTXOs play in transaction fees?u003c/strongu003e

The Unspent Transaction Outputs (UTXO) model is the foundation of Bitcoin transactions. Efficient UTXO management is crucial, as it directly affects transaction size and complexity, ultimately influencing fees.

u003cstrongu003eWhat is a UTXO?u003c/strongu003e

An Unspent Transaction Output (UTXO) represents the remaining bitcoin after executing a transaction. Managing UTXOs efficiently is vital for optimizing transaction fees.

u003cstrongu003eHow can I reduce Bitcoin transaction fees?u003c/strongu003e

Strategies include timing transactions during off-peak hours, efficient UTXO management, using fee estimation tools, employing SegWit wallets, and batching transactions.

u003cstrongu003eHow does transaction timing affect fees?u003c/strongu003e

Fees tend to be lower during times of decreased network activity. Users can plan transactions for off-peak times or set lower transaction fees that are likely to be confirmed during these periods.

u003cstrongu003eWhat is UTXO management, and how can it reduce fees?u003c/strongu003e

Efficient UTXO management involves consolidating inputs and planning transactions to minimize size. Users can use wallets with UTXO management features and consolidate UTXOs during low network activity to reduce future transaction costs.

u003cstrongu003eHow can fee estimation tools help in reducing fees?u003c/strongu003e

Fee estimation tools analyze the Bitcoin network to recommend optimal fees for timely transaction confirmation. Users can utilize wallets or online services like mempool.space for fee estimation.

u003cstrongu003eHow does using SegWit wallets reduce fees?u003c/strongu003e

Segregated Witness (SegWit) reduces transaction size, leading to lower fees. Users should ensure their wallet supports SegWit (addresses starting with bc1) for transactions to benefit from smaller sizes.

u003cstrongu003eWhat is transaction batching, and how does it save on fees?u003c/strongu003e

Batching involves combining multiple outputs into a single transaction, reducing the fee per payment. Businesses or frequent users can use wallets that support batching to save up to 75% in fees.

u003cstrongu003eWhat are advanced u003c/strongu003eBitcoin layer-2 solutions, and do they have lower fees?

The Lightning Network is a layer-2 solution for low-fee, instant transactions off the main blockchain. The Liquid Network is a sidechain with faster processing and private transactions. Both cater to specific user needs for cost-effective and discreet transactions but require understanding and setup.