Bitcoin can be daunting, especially given its notorious price volatility in dollar terms.

However, one strategy that has gained popularity among Bitcoin hodlers and investors alike seeking to mitigate risk and benefit from long-term price trends is Dollar Cost Averaging (DCA).

A Bitcoin dollar cost average calculator is a valuable tool for those looking to implement this investment approach effectively. This article explores what DCA is, how it applies to Bitcoin, and how a DCA calculator can help investors make informed decisions.

Understanding Dollar Cost Averaging

Dollar Cost Averaging is an investment strategy where an investor divides the total amount to be invested across periodic purchases of an asset, regardless of its price.

The goal is to reduce the impact of volatility by spreading it over time, rather than making a single lump-sum purchase. This method allows investors to buy more bitcoin when prices are low and less when prices are high, averaging out the purchase cost over time.

The Benefits of Dollar Cost Averaging in Bitcoin

- Mitigating Volatility: Bitcoin is known for its price swings. By spreading investments over time, investors can reduce the risk of buying at peak prices and potentially suffering significant losses.

- Reducing Emotional Decision-Making: Regular, pre-scheduled investments can help investors avoid the emotional pitfalls of trying to time the market, such as panic selling during a dip or buying impulsively during a surge.

- Encouraging Discipline: DCA promotes a disciplined investment approach, helping investors to stay committed to their long-term financial goals without being swayed by short-term market movements.

How a Bitcoin Dollar Cost Average Calculator Works

A Bitcoin DCA Calculator helps investors plan and track their DCA strategy. Here’s how it typically works:

- Input Parameters: Users would enter their total investment amount, the frequency of investment (e.g., weekly, monthly), and the duration over which they plan to invest.

- Historical Data: The calculator uses historical bitcoin price data to simulate the investment over the specified period.

- Calculation and Analysis: It calculates the average purchase price, the total amount of bitcoin accumulated, and the overall value of the investment based on current or historical prices.

- Comparison: Some calculators also allow investors to compare the DCA strategy with a lump-sum investment made at the start of the period.

Using a Bitcoin Dollar Cost Average Calculator

- Determine Investment Amount and Period: Decide how much bitcoin you want to buy and over what period. For example, you might choose to buy $5,000 worth of bitcoin over one year.

- Set Investment Frequency: Decide how often you will invest. Common frequencies are weekly or monthly. For instance, you might opt to buy $100 worth of bitcoin every week.

- Input Parameters into the Calculator: Enter the total investment amount, the investment frequency, and the duration into the DCA calculator.

- Review Results: The calculator will provide a breakdown of each purchase, the average purchase price, the total amount of bitcoin accumulated, and the overall value of the investment.

- Analyze and Adjust: Use the results to analyze the effectiveness of the DCA strategy. You can adjust the investment amount or frequency to see how different approaches would impact your investment.

Examples of Bitcoin DCA Calculators

dcaBTC

This calculator allows you to input the amount you want to invest regularly, the frequency of the investments, and the time period. It then calculates the amount of bitcoin you would have accumulated and the value of your investment based on historical data.

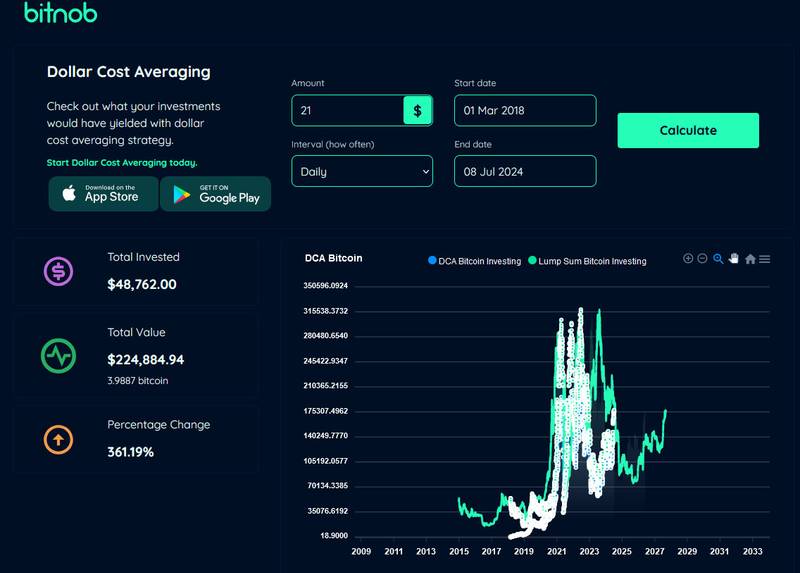

Bitnob DCA Calculator

Bitnob offers a range of services for bitcoin accumulation, including a DCA feature.

Users can set up regular purchases of bitcoin, choosing the amount and frequency that suits their investment strategy. Bitnob also provides a simple and user-friendly interface, making it accessible for beginners and experienced Bitcoiners alike.

Bitcoin Dollar Cost Average

A simple yet effective calculator that allows users to see the potential benefits of DCA. Users can input the start date, investment frequency, and amount to simulate their DCA strategy.

Advantages of Using a Bitcoin DCA Calculator

- Simplicity and Efficiency: The calculator simplifies complex calculations, allowing investors to focus on strategy rather than number-crunching.

- Informed Decision-Making: By simulating different scenarios, investors can see how changes in investment amount or frequency affect their overall strategy.

- Historical Perspective: Using historical data, the calculator provides insights into how the DCA strategy would have performed in different market conditions.

Conclusion

A Bitcoin Dollar Cost Average Calculator is an invaluable tool for investors and Bitcoiners alike. By promoting a disciplined and systematic approach, DCA helps mitigate risks associated with market timing and emotional decision-making.

Whether you are a seasoned investor or new to the Bitcoin hodling culture, understanding and utilizing a DCA calculator can enhance your investment strategy, helping you achieve your financial goals with greater confidence and peace of mind.