Bitcoin operates on a peer-to-peer network, allowing users to transact directly without intermediaries. One crucial aspect of Bitcoin transactions are the transaction fees, which play a pivotal role in the network’s efficiency and security.

In this article, we will explore the nuances of Bitcoin transaction fees, their importance, how they are determined, and their implications for the future of Bitcoin.

The Importance of Transaction Fees

Transaction fees are a fundamental component of the Bitcoin ecosystem. They serve several vital purposes:

- Incentivizing Miners: Bitcoin miners validate and add transactions to the blockchain. The process involves solving cryptographic guesses, which require substantial computational power and energy.

Transaction fees, along with block rewards, incentivize miners to continue validating transactions and secure the network. - Preventing Spam: By imposing a cost on each transaction, fees help prevent the network from being overwhelmed by an excessive number of low-value transactions. This mechanism ensures that only transactions of value and importance are prioritized.

- Ensuring Network Efficiency: Transaction fees help manage the network’s limited block space. Each block has a size limit (1MB), and fees help determine which transactions are included in the next block, ensuring that the most valuable transactions are processed first.

How Bitcoin Transaction Fees are Determined

Bitcoin transaction fees are not fixed and can vary based on several factors:

- Transaction Size: Fees are usually calculated in satoshis per virtual byte (sats/vByte). Larger transactions (in terms of data size) require higher fees.

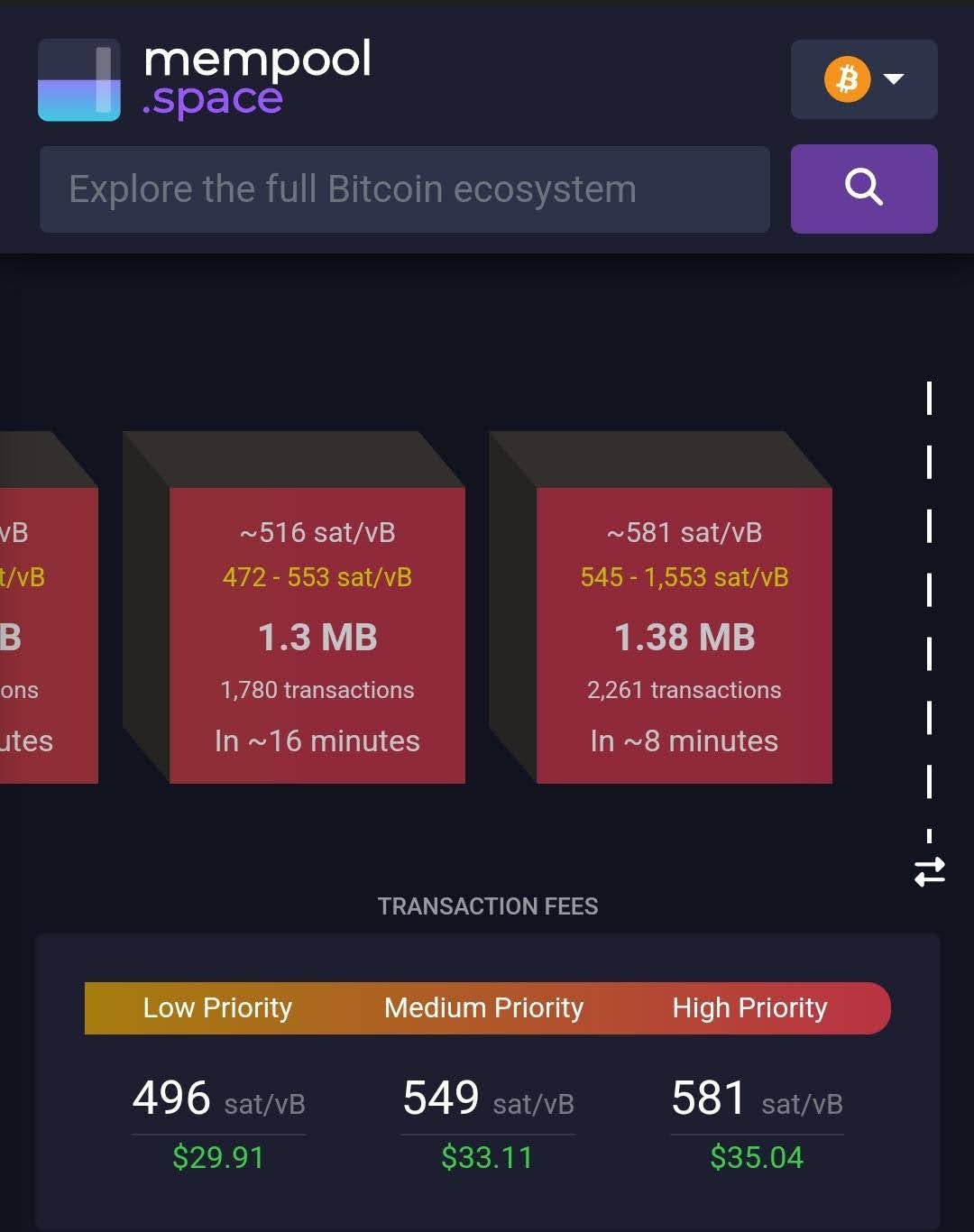

For instance, a transaction with multiple inputs and outputs will be larger and thus more expensive. - Network Congestion: During periods of high network activity, such as bull markets or when there is significant news affecting Bitcoin, the mempool (the pool of unconfirmed transactions) can become crowded.

Users often compete to have their transactions confirmed quickly by offering higher fees, driving up the average fee during such times. - User Preferences: Users can set their transaction fees manually. Wallets often provide recommendations based on current network conditions, but users can choose to pay higher fees for faster confirmation or lower fees if they can wait longer.

Fee Estimation and Tools

Several tools and resources are available to help users estimate appropriate transaction fees:

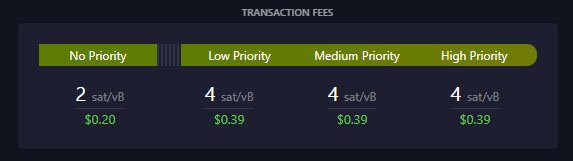

- Fee Estimation Services: Websites like mempool.space and bitcoinfees.net offer real-time fee estimates based on current network conditions.

These platforms analyze the mempool and provide suggested fees for different confirmation times (e.g., next block, 30 minutes, 1 hour). - Wallet Recommendations: Many Bitcoin wallets have built-in fee estimation algorithms that suggest optimal fees based on recent transactions and network congestion. (e.g., sparrow wallet).

- Historical Data: Looking at historical fee data can also help users make informed decisions about setting fees, especially during volatile periods.

Strategies for Managing Transaction Fees

- Timing: Transacting during periods of low network activity can result in lower fees. Late nights or weekends often see reduced activity compared to weekdays or significant news events.

- Batching Transactions: Combining multiple transactions into one can reduce the overall fee per transaction. Businesses and frequent users often utilize this strategy to optimize costs.

- Segregated Witness (SegWit): Using SegWit addresses can reduce the size of transactions, leading to lower fees. SegWit was introduced to help increase the block capacity and reduce transaction costs.

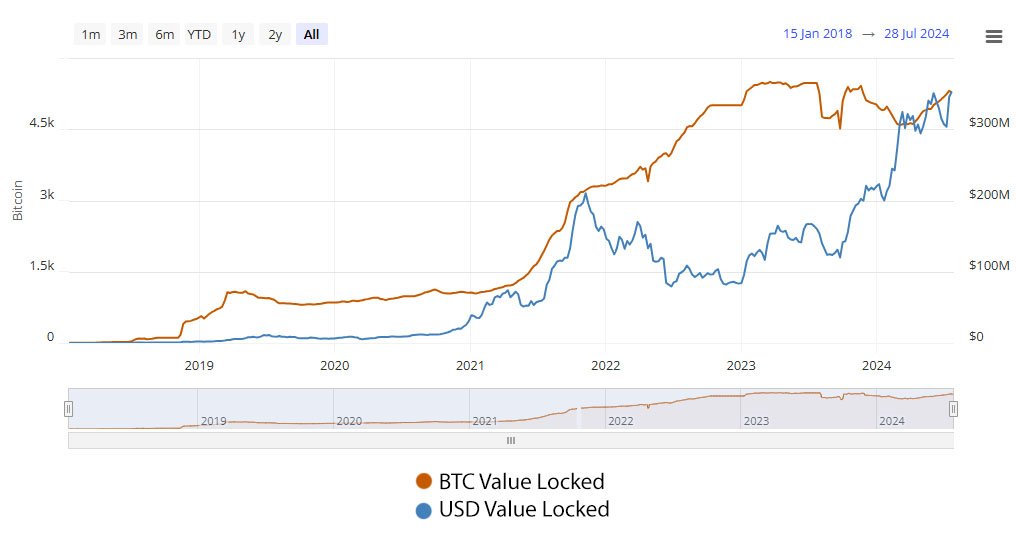

- Layer 2 Solutions: Technologies like the Lightning Network allow for off-chain transactions, which can significantly reduce fees and increase transaction speed.

These solutions are becoming more popular as they offer a way to scale Bitcoin usage without congesting the main blockchain.

Future Implications

As Bitcoin’s block reward halves approximately every four years, transaction fees will play an increasingly critical role in incentivizing miners.

Eventually, the block reward will become negligible, and fees will be the primary incentive for miners. This transition underscores the importance of a well-functioning fee market to ensure the network’s continued security and efficiency.

Furthermore, innovations in transaction processing, such as the aforementioned Lightning Network and other layer 2 solutions, will likely become more prevalent.

These technologies aim to offload smaller transactions from the main chain, reducing congestion and keeping fees manageable for larger transactions that require the security of the main Bitcoin blockchain.

Conclusion

Bitcoin transaction fees are a crucial aspect of the network, balancing incentives for miners, network efficiency, and user costs. Understanding how these fees are determined and managed can help users make more informed decisions and optimize their transaction costs.

As the Bitcoin ecosystem evolves, the role of transaction fees will become even more significant, driving innovations and ensuring the sustainability of the network.

Embracing these dynamics is key to navigating and benefiting from the ever-growing Bitcoin ecosystem.