Ever swiped your credit card and then paused, wondering, “What in the world does APY mean?” You’re not alone. This question often remains tucked away in the fine print, unseen by those who diligently clear their balances each month. However, miss a payment, and APY swiftly moves from obscurity to stark reality, revealing itself as a formidable force.

What Does APY Mean?

Envision APY as the financial world’s shape-shifter — equally capable of being your guardian or your challenger. It acts as a silent partner, nurturing your savings in the backdrop, or an unforeseen opponent, leveraging every slip-up to tip the scales against you. Grasping APY’s essence is akin to uncovering the secret behind a masterful magic trick: once revealed, you’re equipped to either command the stage or sidestep the pitfalls, ensuring your finances flourish rather than fade.

At its heart, APY is the finance world’s attempt to make things fair and square, measuring the real rate of return on your investments or savings, considering the magical effects of compounding interest. Unlike its less sophisticated cousin, simple interest, which only plays with the principal amount like a kid in a sandbox, compounding interest builds castles by adding layers upon layers over time. This means your money doesn’t just sit there; it grows an interest beard, and then that beard grows another beard, and so on, leading to a much more impressive sum over time.

But why should you care? Because knowing the APY on your investments or savings account is like having a crystal ball that shows you how much your money will grow in a year, and who doesn’t like seeing their money multiply without having to wave a wand?

How APY Works

To demystify APY, let’s say you invest $1,000 in a savings account with a 5% APY. Unlike your gym membership, this is a commitment that actually pays off. With monthly compounding at 5% APY, your $1,000 would grow to about $1,051 after one year. This is slightly more growth than you would see with an account earning 5% APR without compounding. That’s because with APY, the interest accumulates each month, earning a return on both your original principal and the previously accumulated interest. This compounding effect allows your money to grow faster over time compared to simple interest from APR alone.

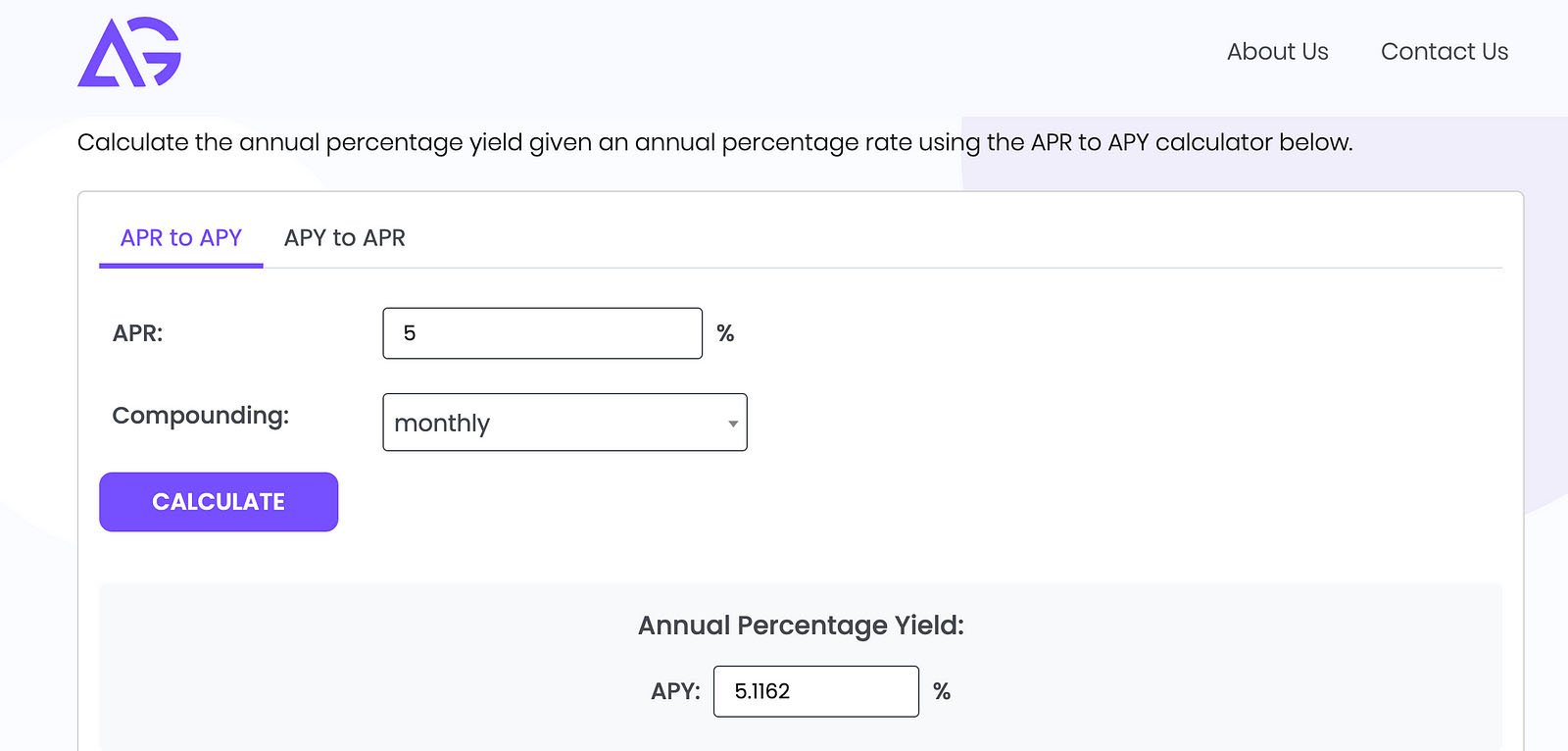

The key difference is that APY reflects compound interest and shows the true annual return on an account, while APR does not account for compounding. Even a small rate difference compounds into bigger earnings thanks to the magic of compound interest! Understanding the power of APY versus APR can help guide your financial decisions. The tool linked below is quite helpful in this regard.

At first, a .1162% increase might seem minor, but over 30 to 40 years, the significance magnifies. The Annual Percentage Yield (APY) turns this modest uptick into a financial celebration, compounding your money to increasingly grand sums.

Importance of APY in Financial Decisions

When it comes to choosing where to park your savings or invest, APY is your compass in the vast ocean of financial options. It’s like choosing between a superhero and a sidekick; both are great, but one clearly packs a bigger punch. APY helps you see beyond flashy introductory offers or the charm of a well-decorated bank lobby, focusing on what truly matters — how much your money will grow.

But beware, not all high APYs come without strings attached. It’s essential to read the fine print, as some accounts with stellar APYs might require a minimum balance that’s higher than the empire state or fees that could eat into your interest earnings like the cookie monster.

It is also important to be wary of offers with exceptionally high APYs, as they might not always be as promising as they appear. The financial world is replete with examples where companies, funds, and “crypto projects” have enticed investors with remarkable yields, only to later fold, be exposed as fraudulent, or face similar troubles. This pattern suggests that while high APYs can be appealing, they often require a careful assessment of the risks and underlying conditions.

The Role of APY in Credit Card Debt

Now, onto the darker side of APY: credit card debt. Here, APY turns into a villain, sneakily emptying your pockets if you’re not vigilant. Credit cards with high APYs are like those friends who encourage you to order another round of drinks, knowing very well you’ll regret it in the morning. Except, with credit card debt, the regret is measured in compounded interest, making even a small debt grow like a snowball rolling down a hill.

The strategy here is to select credit cards that offer the best rewards while ensuring you pay off your balances punctually.