Table of Contents

Introduction

One of the very first hurdles a user new to Bitcoin will encounter is what to do with their coins once purchased. At the heart of engaging with this revolutionary technology is the Bitcoin wallet, a tool that not only stores your digital wealth but also empowers users to manage their bitcoin with autonomy and security when done properly. This guide delves into the intricacies of Bitcoin wallets, ensuring novices and seasoned users alike can navigate this landscape with confidence.

Understanding Bitcoin Wallets

A Bitcoin wallet is akin to a digital keychain, holding the keys to unlock your bitcoin stored on the blockchain. Each wallet contains a set of private keys, a secret code that allows you to spend your bitcoin, paired with public addresses, identifiers that enable you to receive bitcoin. This fundamental tool interfaces with the Bitcoin network, providing a balance of security and accessibility.

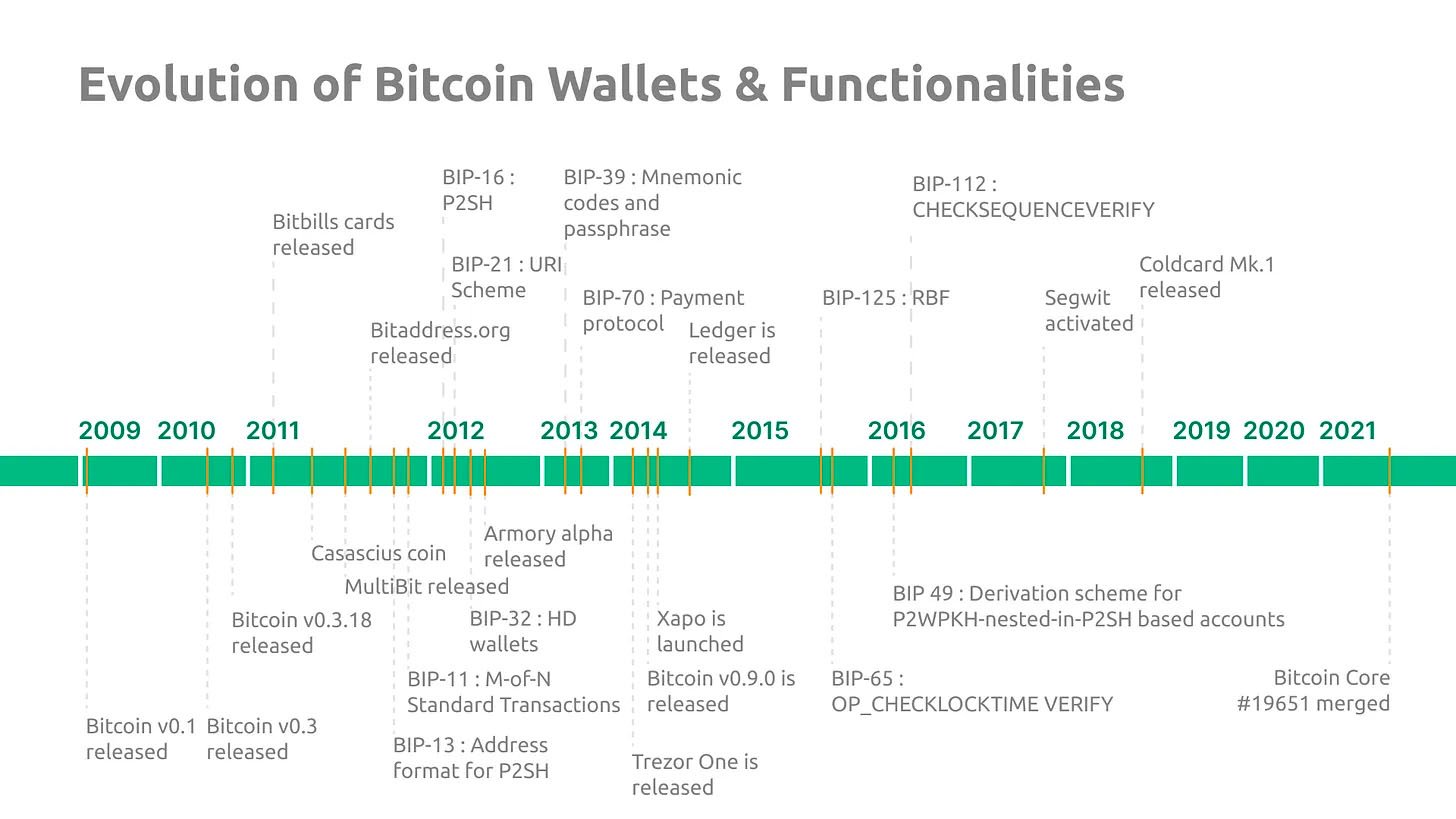

Wallets have come a long way since the inception of Bitcoin, becoming more and more convenient and easy to use, especially for less technically savvy users. Nowadays, most wallets implement the Hierarchical Deterministic (HD) standard. Before we get into some of the more technical aspects, it’s important to understand some of the more basic concepts.

Terminology Brief

Before exploring the intricacies of Bitcoin wallets and their operational flow, it’s essential to familiarize yourself with the following basic concepts:

- Mnemonic Phrase (Seed Phrase): A series of words generated by your wallet that provides access to the bitcoin you hold. It can restore your wallet if lost or damaged.

- Private Key: A secret alphanumeric code that proves the ownership of bitcoin in a wallet, allowing the user to spend them.

- Public Address: An alphanumeric string derived from the public key, used to receive bitcoin. It can be shared publicly.

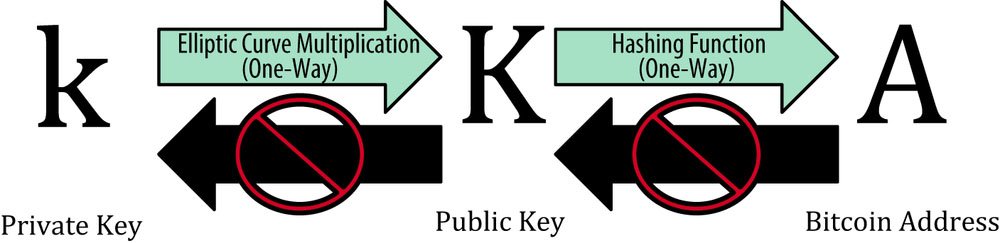

- Public Key: Generated from the private key, this cryptographic code is used to create a wallet’s public addresses.

- Seed: A digital representation of the mnemonic phrase, used to generate all the private and public keys in a wallet.

- Master Private Key: The root key generated from the seed, from which all other keys are derived in a hierarchical deterministic wallet.

- Master Public Key: Derived from the master private key, it allows for the generation of public keys (and therefore public addresses) without exposing the master private key.

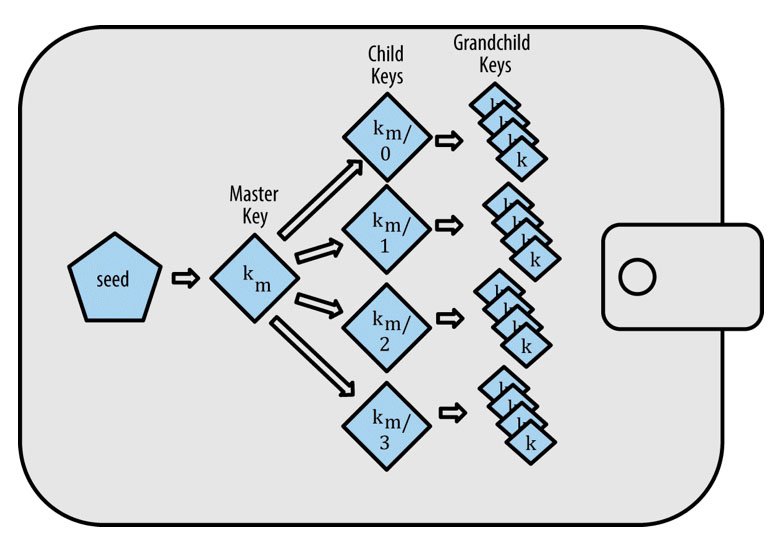

- Hierarchical Deterministic (HD) Wallet: A wallet that generates a hierarchical tree-like structure of keys from a single seed, allowing for organized and efficient management of multiple accounts and addresses.

- Chain Code: Part of an extended key, it helps in generating child keys in an HD wallet, contributing to the wallet’s hierarchical structure.

- Extended Keys: Keys that include additional data such as the chain code and identifiers, allowing for the derivation of child keys and the reconstruction of the wallet’s key structure.

- BIP32/BIP39/BIP44: Bitcoin Improvement Proposals that standardize the structure for HD wallets, mnemonic phrase generation, and wallet architecture, respectively.

Understanding these concepts provides a solid foundation for grasping the more complex mechanisms of Bitcoin wallets that we will discuss below.

How do Wallets Work?

The functionality of Bitcoin wallets is rooted in cryptographic principles, enabling secure management of bitcoin. Here’s an overview of the process from generating a mnemonic phrase to the creation of a public address, as used in the HD wallet standard:

Mnemonic Phrase Generation

The journey begins with the generation of a mnemonic phrase, typically 12 to 24 words long, derived from a predefined list of 2048 words. This phrase, based on random selection, serves as a human-readable form of your wallet’s seed.

Seed Generation

The mnemonic phrase is processed through a hashing algorithm to produce a 512-bit seed, incorporating optional passphrase protection for added security. This seed is the foundation from which all cryptographic keys are derived.

Master Private Key and Master Chain Code Generation

From the seed, a master private key, and a master chain code are created. The master private key is essential for generating all subsequent private keys, while the master chain code helps in deriving the corresponding public keys.

Master Public Key Generation

The master public key is calculated from the master private key. It allows the derivation of all subsequent public keys—and therefore public addresses—without exposing the master private key.

Hierarchical Deterministic (HD) Wallet Structure

The master keys facilitate the creation of a hierarchical tree of keys, enabling the organized generation of multiple wallets, accounts, and addresses from the same seed, simplifying fund and address management.

Derivation of Child Keys

Child keys, both private and public, are derived from their parent keys, maintaining a deterministic structure that ensures the same parent always produces the same child keys. This structure includes hardened and non-hardened derivations to enhance security.

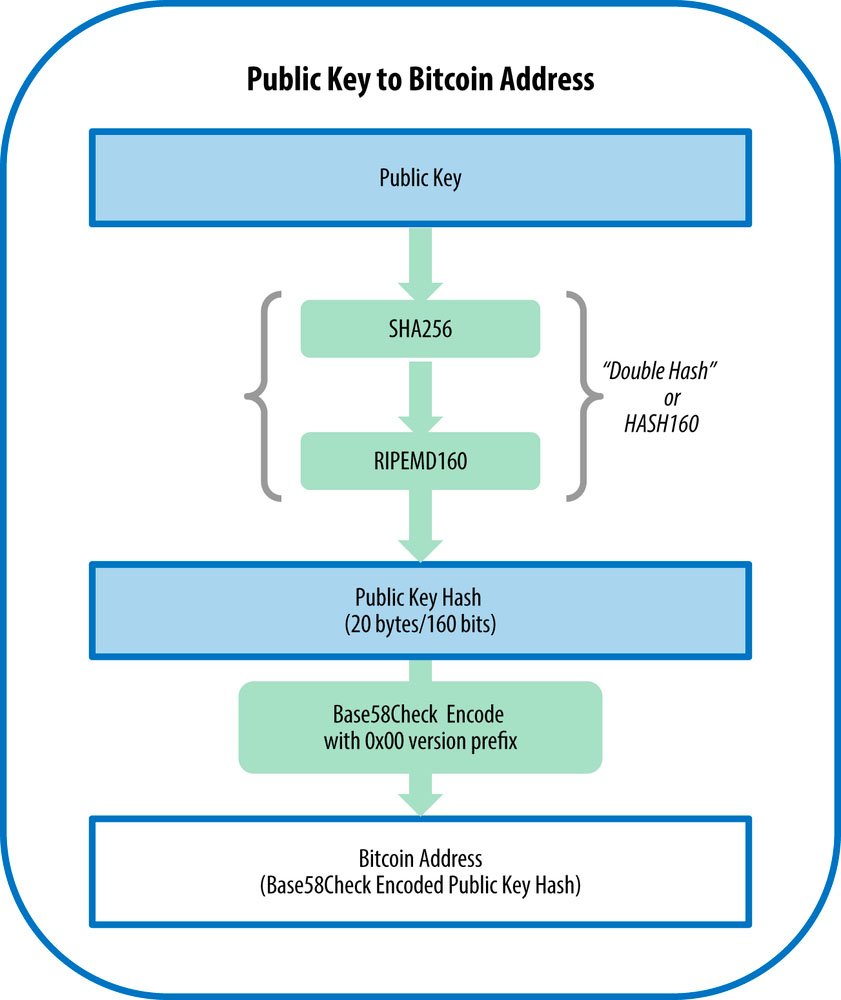

Public Address Generation

Public keys are transformed through cryptographic functions to generate a public address. This address, encoded for user-friendliness, is what others use to send you bitcoin.

Extended Keys

Extended keys carry additional data, like the chain code and parent key identifier, allowing for the reconstruction of the wallet’s key structure if needed.

This intricate process showcases the cryptographic foundation of Bitcoin wallets, ensuring secure and efficient management of bitcoin. Hopefully, you can better appreciate the balance between security, convenience, and control that wallets provide in the Bitcoin ecosystem.

Now, let’s dive into the concept of addresses. It’s important to understand some of the subtleties involved so that you reduce the chances of making mistakes.

Understanding Bitcoin Addresses

Addresses play a critical role in facilitating the secure transfer of bitcoin. Here’s what you need to know about Bitcoin addresses:

- Definition and Function: A Bitcoin address is a string of alphanumeric characters that represents a destination for a Bitcoin payment. Similar to how an email address works for sending messages, a Bitcoin address allows users to send and receive Bitcoin securely on the blockchain.

- Generation: Bitcoin addresses are derived from public keys using cryptographic algorithms. Specifically, a public key, generated from a private key, undergoes a series of cryptographic transformations including SHA-256 hashing and RIPEMD-160 hashing. The result is then encoded, typically in Base58Check or Bech32 formats, to create the Bitcoin address. This process ensures that each address is unique and securely tied to its corresponding public key.

Types of Addresses

- P2PKH (Pay-to-PubKey Hash): Starting with ‘1’, these addresses are the original Bitcoin address format. They directly hash the public key, providing a layer of obfuscation.

- P2SH (Pay-to-Script Hash): Beginning with ‘3’, P2SH addresses allow for transactions that require a specific set of conditions to be met for the bitcoin to be spent, including multisig configurations.

- Bech32 (SegWit): Starting with ‘bc1’, these addresses support Segregated Witness (SegWit) technology, which helps in scaling Bitcoin by reducing the size of transactions, thus allowing for more transactions to fit in a block.

Some wallets will offer you the option to select which kind of address format you want to use. If it’s your first wallet and you do not intend on doing complex transactions (which will end up costing you more in fees) and want to save on transaction fees, then select the Bech32 (SegWit) format.

Security and Privacy

To enhance security and privacy, it is recommended to use a new address for each transaction. HD wallets facilitate this practice by generating a hierarchical tree of addresses from a single seed, allowing users to maintain privacy and reduce the risk of revealing their total bitcoin balance.

Address Verification

Before sending bitcoin, verifying the accuracy of the recipient’s address is essential to prevent loss of funds. Double-checking the address and using QR codes can mitigate errors in address entry.

Recovery and Backup

Since addresses in an HD wallet are derived from the wallet’s seed phrase, backing up the mnemonic seed phrase ensures that all associated addresses and their funds can be recovered in case of device loss or failure.

Types of Bitcoin Wallets

- Software Wallets: Applications running on your computer or smartphone, balancing convenience and security. Mobile wallets like BlueWallet and desktop wallets like Electrum are tailored to different user needs, each offering unique features.

- Hardware Wallets: Devices such as the COLDCARD and Trezor enhance security by storing private keys on a dedicated device, isolating them from external risks. Ideal for securing large amounts of bitcoin.

- Paper Wallets: Physical documents containing your private key and public address. Secure from digital threats but require careful safeguarding against physical damage or loss.

- Web Wallets: Accessible via web browsers, these third-party hosted wallets offer convenience at the expense of increased risk, varying greatly in security measures.

- Lightning Network Wallets: Specialized wallets like Phoenix facilitate transactions on the Lightning Network, enabling faster and cheaper transfers with unique technological requirements.

Custodial vs Non-Custodial Wallets

The wallet types mentioned above can come in two types: custodial and non-custodial. More on this below:

- Custodial Wallets: These wallets manage all operations on behalf of the user, offering greater convenience by handling the security, backup, and technical complexity. However, this convenience comes at the expense of autonomy, as you are not in direct control of your funds.

Using a custodial wallet means that each time you wish to withdraw or transfer funds, you are effectively asking permission from the custodian. While custodial wallets can be integrated into software, web, or even hardware forms, they often reside on exchanges, making them convenient for traders but susceptible to hacking if the custodian’s security is compromised. The trade-off here is between ease of use and the potential risks of third-party control over your bitcoin.

- Non-custodial Wallets: The antithesis of custodial wallets, non-custodial options put you in full control of your bitcoin and the associated private keys. This model aligns with the core philosophy of Bitcoin by supporting censorship-resistant transactions. With this autonomy comes the responsibility of safeguarding your private key.

Non-custodial wallets demand a proactive approach to security, such as employing hardware wallets for key storage, creating secure backups of recovery phrases, and understanding the wallet’s operational security. These wallets empower users to directly engage in transactions, maintaining privacy and eliminating reliance on third parties. Available in various formats, including software, hardware, and paper, non-custodial wallets offer a range of security levels and user experiences, emphasizing the user’s ultimate control over their bitcoin.

Hot vs Cold Wallets

These terms refer to the wallets’ connectivity to the internet and, by extension, their vulnerability to online threats.

Hot Wallets

- Definition: Hot wallets are Bitcoin wallets that are connected to the internet. This includes most software wallets, web wallets, and mobile wallets.

- Convenience: They offer unmatched convenience for daily transactions, allowing users to send and receive bitcoin with ease. This makes them ideal for spending and receiving on the go.

- Security Risks: The main drawback is their susceptibility to online threats such as hacking and phishing attacks. The Internet connectivity, while convenient, exposes users to potential vulnerabilities.

- Use Case: Best suited for smaller amounts of bitcoin that you might use regularly for transactions, similar to a physical wallet used for day-to-day spending.

Cold Wallets

- Definition: Cold wallets refer to Bitcoin wallets that are not connected to the internet. This category includes hardware wallets and paper wallets.

- Security: By being offline, cold wallets are far less susceptible to hacking and represent a secure way to store large amounts of Bitcoin. They act as a form of “cold storage,” akin to a safe deposit box for your bitcoin.

- Accessibility: While highly secure, the trade-off is less convenience. Accessing your funds typically involves extra steps compared to hot wallets, which may not be ideal for frequent transactions.

- Use Case: Ideal for long-term storage of large amounts of Bitcoin, providing peace of mind through enhanced security measures.

Choosing Your First Bitcoin Wallet

Selecting a wallet is a balance of security, ease of use, and specific features needed. Open-source wallets are preferred for their transparency, allowing the community to audit them for security vulnerabilities. To better benefit from what Bitcoin has to offer, a non-custodial wallet is the way to go.

Setting Up Your Bitcoin Wallet

The setup process involves downloading software or purchasing a device, generating a new wallet, and securely storing the recovery phrase—a critical step for accessing your bitcoin if the wallet is lost.

Using Your Bitcoin Wallet

To receive bitcoin, share your public address. This is typically obtained by selecting the “Receive” option in your wallet. To send bitcoin, use your wallet to input the recipient’s address and the amount, by selecting the “Send” option in your wallet. Regularly monitor your transactions and balance for unauthorized activity. Check out this article to learn more about setting up and using your first wallet.

Security Measures

Prioritize securing your wallet with a passphrase, and two-factor or biometric authentication if available, and consider a hardware wallet for substantial holdings. Regular backups and meticulous private key management are essential to mitigate loss or theft risks. Remember, anyone with access to your mnemonic phrase, private key, or seed can steal your funds. Here are some important security do’s and don’ts:

- Never make a digital copy of the seed, private key, or mnemonic.

- Write down the mnemonic phrase on paper or a metal backup. Make sure that it is legible and in the correct order.

- Don’t keep your backup out in the open, keep it somewhere safe.

Advanced Features and Considerations

Multi-signature Wallets

Enhance security by requiring multiple-party authorizations for transactions, adding an extra security layer. This is a more complex setup, so it’s not recommend for most users. If you want additional security without risking getting lost in the setup or losing some key materials for recovering your funds, you can opt for the a passphrase.

Passphrase

A passphrase in the context of Bitcoin wallets is an optional, additional layer of security used alongside the mnemonic seed phrase. It acts as a custom, user-defined extension to the mnemonic phrase, effectively creating a new and unique set of private keys and addresses when applied. This means that even if someone discovers your mnemonic phrase, they would still need the passphrase to access your funds. The passphrase must be remembered precisely, as its loss can make it impossible to recover the wallet’s contents, just as losing the seed phrase would. Also, keep it stored separately from your backup.

The Evolution of Bitcoin Wallets

From simple software programs to the development of hierarchical deterministic (HD) wallets, the journey of Bitcoin wallet technology mirrors the community’s growing focus on security and usability. The advent of hardware wallets introduced a robust solution for offline key storage, while the Lightning Network’s emergence prompted innovations in wallet functionalities to accommodate its operations.

Conclusion

Embarking on the Bitcoin journey begins with selecting the right wallet—one that harmonizes security, convenience, and control, tailored to your specific needs. As the Bitcoin ecosystem evolves, so too does the landscape of Bitcoin wallets, with each innovation bringing us closer to a future where managing bitcoin is intuitive and secure.

FAQ

u003cstrongu003eWhat is a Bitcoin wallet?u003c/strongu003e

A Bitcoin wallet is a digital tool that stores private keys, allowing users to manage and transact their bitcoin securely. It acts as a keychain for accessing and controlling one’s digital wealth.

u003cstrongu003eHow does a Bitcoin wallet work?u003c/strongu003e

Bitcoin wallets operate based on cryptographic principles, generating a mnemonic phrase, seed, private and public keys, and hierarchical deterministic structures to manage and secure Bitcoin transactions.

u003cstrongu003eWhat is a mnemonic phrase (seed phrase)?u003c/strongu003e

A mnemonic phrase is a series of words generated by a wallet, serving as a human-readable form of the wallet’s seed. It is crucial for wallet recovery and backup.

u003cstrongu003eWhat are public and private keys in Bitcoin wallets?u003c/strongu003e

Private keys are secret alphanumeric codes proving ownership of bitcoin, while public keys and addresses are derived from them, allowing users to receive bitcoin securely.

u003cstrongu003eWhat is the role of addresses in Bitcoin transactions?u003c/strongu003e

Bitcoin addresses are alphanumeric strings representing destinations for bitcoin payments. They are generated from public keys and play a critical role in secure transactions.

u003cstrongu003eWhat are the different types of Bitcoin addresses?u003c/strongu003e

Bitcoin addresses include P2PKH, P2SH, and Bech32 formats, each with its characteristics. The choice of address type may impact transaction fees and security.

u003cstrongu003eWhat are the types of Bitcoin wallets?u003c/strongu003e

Bitcoin wallets come in various types, including software, hardware, paper, web, and Lightning Network wallets. Each type offers different levels of security, convenience, and functionality.

u003cstrongu003eWhat is the difference between custodial and non-custodial wallets?u003c/strongu003e

Custodial wallets manage operations on behalf of the user, providing convenience but sacrificing autonomy. Non-custodial wallets give users full control over their bitcoin and private keys, aligning with the core philosophy of Bitcoin.

u003cstrongu003eWhat are hot and cold wallets?u003c/strongu003e

Hot wallets are connected to the internet, offering convenience for daily transactions but with security risks. Cold wallets, not connected to the internet, provide enhanced security for long-term storage but with less convenience.

u003cstrongu003eHow do I choose and set up my first Bitcoin wallet?u003c/strongu003e

Choosing a Bitcoin wallet involves balancing security, ease of use, and specific features. Setting up a wallet includes downloading software or purchasing a device, generating a new wallet, and securely storing the recovery phrase for future access.