Many are surprised when they first hear about a “mining” process being associated to a digital asset. Therefore, one of the very first questions newcomers to Bitcoin ask is “What is Bitcoin mining?”

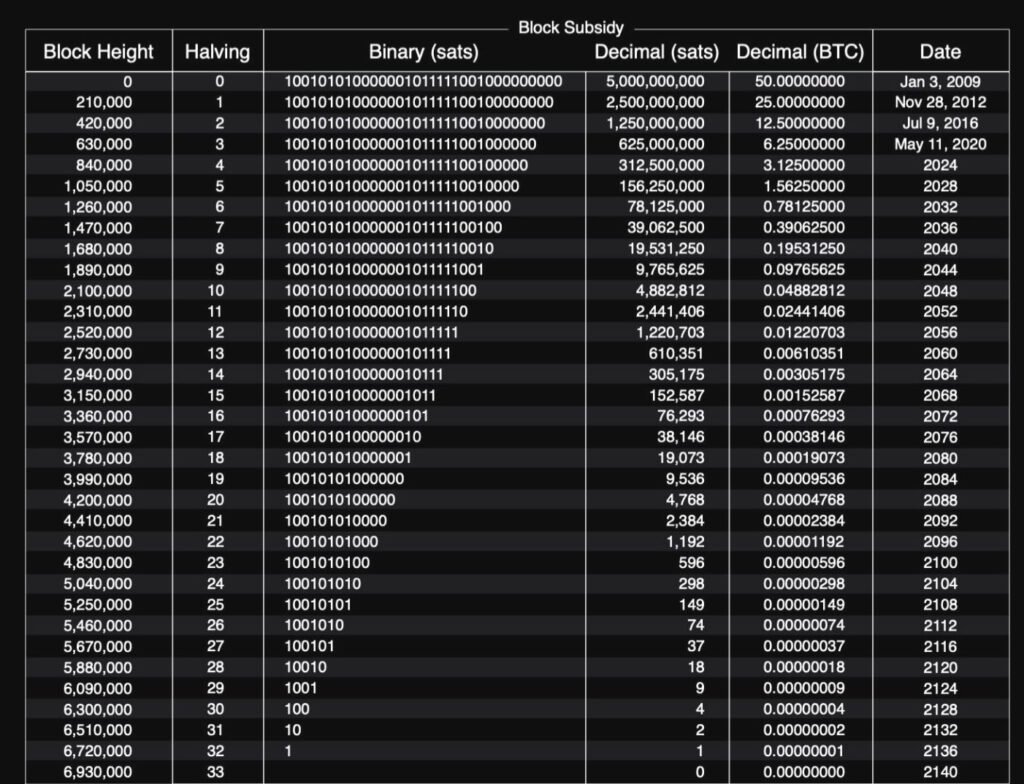

Bitcoin mining is the crucial process through which transactions are verified and new blocks are added to the Bitcoin blockchain, thereby expanding the public ledger. This task is performed by miners who use sophisticated and powerful computing setups to tackle a demanding computational challenge known as the “Proof-of-Work” algorithm. Through this intense competition, miners strive to solve the puzzle first, thereby earning the right to append a new block to the blockchain and claim the block reward. This mechanism not only secures the network but also methodically introduces new bitcoin into circulation, adhering to a predefined issuance schedule.

What is Bitcoin Mining: The Process, Explained

Bitcoin mining is akin to throwing a dart at a massive, constantly shifting dartboard while blindfolded. Each throw represents an attempt to hit a specific, elusive target. In the context of Bitcoin, this target is finding a “nonce” value that, when combined with the block data and passed through a cryptographic function, results in a hash that meets the network’s strict criteria — being below a certain threshold. This task is not only herculean due to the size of the target but also requires immense processing power. Miners essentially perform quintillions of these SHA-256 hashing computations every second in their relentless search for a valid nonce.

Each hashing attempt is independent; a minor change in the input radically transforms the output, ensuring the process remains unpredictably challenging. The difficulty of this cryptographic “dart game” adjusts — akin to the dartboard expanding or shrinking — based on the overall mining power of the network. This ensures that the pace of new block creation remains steady, thus maintaining the blockchain’s security and operational consistency.

The Difficulty Adjustment

To maintain a steady issuance rate of new bitcoin into circulation (on average one block every 10 minutes), the Bitcoin protocol employs a difficulty adjustment algorithm. The difficulty target is recalibrated every 2016 blocks (~2 weeks) based on the total computational power on the network to make the Proof-of-Work puzzle more or less difficult to solve.

As more mining rigs join the network, the difficulty increases exponentially to compensate, ensuring the 10 minute cadence is maintained. This difficulty adjustment mechanic is a key part of Bitcoin’s controlled monetary supply schedule.

Evolution of Bitcoin Mining Hardware

In the nascent stages of Bitcoin, mining was predominantly conducted using basic consumer-grade CPUs and later GPUs, making it accessible to many enthusiasts. However, as Bitcoin garnered attention and the competition among miners intensified, the necessity for more specialized and efficient hardware became apparent.

This led to the adoption of Application-Specific Integrated Circuits (ASICs), which are tailor-made to efficiently solve SHA-256 cryptographic puzzles. Although hashing is a process not unique to Bitcoin, these ASICs are optimized specifically for the high-intensity demands of Bitcoin mining, making them significantly more effective than CPUs and GPUs for this purpose.

Today, while mining has largely become the domain of these powerful ASIC machines, it’s important to note that not all participants in the network are miners. Many operate nodes without engaging in mining, contributing to the network’s integrity and decentralization by verifying transactions and maintaining a full copy of the blockchain.

Conversely, some mining operations also run full nodes, supporting the network while seeking profits from mining activities. This specialization highlights the evolving landscape of Bitcoin’s network infrastructure, balancing efficiency with widespread participation.

Mining Pools

For individual miners, the likelihood of solving a block and earning the full 3.125 BTC reward is extremely low. Consequently, miners often join forces in mining pools.

These pools aggregate computational resources to increase their collective probability of solving a block. When a block is successfully solved, the reward is distributed among pool participants, though the method of distribution varies by pool.

Some may distribute rewards equally based on shares of work contributed, while others might follow a proportional system or even pay per the amount of hash added to a pool regardless of how many blocks were found during that time. This strategy allows miners to receive steadier and more predictable returns, improving their chances of earning from their mining efforts.

Profitability Factors

While Bitcoin mining can be lucrative, there are significant overhead costs to contend with. Access to cheap electricity is crucial as industrial-scale mining rigs consume enormous amounts of energy. Sophisticated cooling infrastructure is also required to prevent rigs from overheating and thermally throttling their performance.

Miners typically operate as part of mining pools which charge fees of 1–3% of rewards. As the mining difficulty continues its upward trajectory, operational expenditures can quickly outpace smaller miners’ ability to participate profitably.

The future of Bitcoin mining lies with large-scale operations that can leverage economies of scale, cutting-edge chip fabrication processes, and strategic geographic positioning near sources of inexpensive or surplus energy.

Importantly, bitcoin’s value is derived from the immense electrical and computational resources required for its mining process. This intrinsically ties Bitcoin’s monetary supply to real-world energy expenditure. Bitcoin mining incentivizes investment into energy production itself — operating as an around-the-clock energy buyer.

This symbiotic relationship means the cheapest, most abundant energy sources become the most economically viable for mining. It provides a mechanism for monetizing surplus or stranded energy that would otherwise be wasted. Ultimately, Bitcoin’s proof-of-work mining helps drive buildout of global energy infrastructure and adoption of efficient, renewable sources to meet its insatiable appetite for low-cost electricity.