In a shocking incident, a Bitcoin user set a record by paying a staggering $3 million transaction fee. The wallet’s owner came forward in latest development, alleging that the transaction was the result of a hacking incident.

A bitcoin holder recently intended to transfer 139 BTC to a newly created wallet. Unfortunately, they ended up paying around 83.65 BTC, equivalent to $3.1 million, in transaction fees, marking the largest transaction fee ever paid in US dollars value. This historic transaction, resulting in the remaining 55.77 BTC ( $2.1 million) UTXO, occurred on November 23 at around 9:59 a.m. UTC.

$3 Million Transaction Fee: Victim Came Forward

In recent developments regarding the record breaking $3 million transaction fee, on November 24, the self-proclaimed victim created an account on social media platform X with the username @83_5BTC.

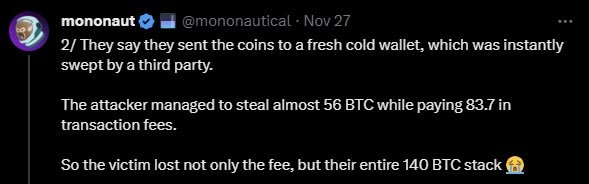

They claimed that they sought to transfer 139.42 BTC after creating a new cold wallet. However, when they initiated the transaction, the destination address was quickly swept, paying 83.6 BTC in transaction fees, while the other 55.77 BTC “got transferred out to another wallet immediately.”

“I can only imagine that someone was running a script on that wallet and that the script had a weird fee calculation,” said @83_5BTC while noting, “55 BTC gone forever. 83.5 BTC to be decided.”

The victim also signed a message to prove his ownership of the wallet. The signature was verified by Mononaut, the pseudonymous developer of the Bitcoin explorer Mempool. The post reads:

“The signature checks out; @83_5BTC apparently controls the key that paid that 83.7 BTC fee.”

Additionally, Mononaut cautioned that if the wallet is compromised, it is very much possible that @83_5BTC could also be the hacker. According to data from Blockchair, a blockchain analysis platform, the transaction was mined by AntPool in block 818,087.

Interestingly, bitcoin community member “niftydev” came out in support of the victim, confirming that he knew @83_5BTC. He added that the latter was the victim who created the X account and is trying to get the allegedly stolen funds back.

Meanwhile, AntPool has yet to publicly address the issue. The previous record holder for the largest bitcoin fee paid, was payments firm Paxos. In September, the US-based firm paid $500,000 to move just 0.008 BTC ($200). F2Pool, the miner that mined the block containing the transaction, announced that it had fully refunded the fee to Paxos.

This recent incident does indeed set a new record for fees paid for a single bitcoin transaction.

Possible Explanation For High Transaction Fees

Mononaut later also explained that the cause of the exploit could possibly be a low-entropy wallet. This means that the cold wallet created by the victim rose from insufficient randomness, which made it vulnerable to exploiters.

Additionally, Mononaut stated that the replace-by-fee (RBF) mechanism is usually used on an unconfirmed transaction with insufficient fee for swift processing, so that it could be processed faster.

The developer said that in this case, multiple hackers could have been fighting over taking control of the funds, resulting in the sudden fee spike. That could have happened if the cold wallet was created using low entropy.

Mononaut noted that the fees were exactly 60% of the total 139.42 BTC stolen. Moreover, the exploiter took 0.001 BTC from the same address, paying 0.0006 BTC in fees, which is again, 60% of total. It stated:

“This, combined with the speed of the theft, seems like reasonable evidence for an automated script set to pay a fixed 60% of the value in fees to steal coins sent to vulnerable addresses.”

He added:

“Let this be a reminder not to take shortcuts with your entropy, and ideally to use multisig for very large sums.”

Previous Assumptions and Analysis

When the news of this transaction was initially announced, it made shockwaves through the community. Many started analyzing the transaction and presented their findings.

Previously a Reddit user, suggested the mining pool responsible for the transaction might consider returning the excessive fee if asked politely, while others expressed concerns about potential money or Bitcoin laundering.

Another user had provided a timeline of the incident on Reddit, dispelling conspiracy theories about Antpool mining the transaction privately. They noted that the transaction sat in the mempool for a few minutes before being mined, indicating that any mining pool could have potentially mined the block. This observation contradicted theories labeling the transaction as “private” and linked to potential money laundering.

Someone else analyzed the transaction history, highlighting that the fee was increased after the initial submission. The user found humor in the situation, noting the sender initially used a fee of 65,086,251 sat/vB and then increased it to 76,397,238 to ensure quick mining on the next block.

Addressing the exorbitant fee, some users speculated about a software bug, suggesting that the transaction might be a “Child Pays For Parent” (CPFP) transaction.

They pointed out the absence of a change address, hinting at a potential software bug in the wallet that treated the change as an additional fee. Overall, the incident prompted a detailed analysis and diverse opinions within the Bitcoin community, ranging from fee return suggestions to theories about software bugs and money laundering concerns.