Binance, the world’s largest digital asset trading platform, witnessed a management upheaval with its co-founder and CEO, Changpeng ‘CZ’ Zhao, stepping down. As current Binance CEO CZ steps down, Richard Teng, the firm’s head of regional markets outside of the United States, has been named as the new chief executive. On the other hand, the exchange also settled its dispute with the Department of Justice (DoJ).

Related reading: Bitcoin Plunges Below $26,000 As SEC Sues Binance

In a post on social media platform X, Zhao confirmed his departure, stating that Binance is no longer a “baby” and that it was time for him to “let it walk and run.” CZ also confirmed that he will remain available to the exchange as its largest shareholder and will share his past experience and expertise whenever needed.

Former Binance CEO CZ to ‘Take a Break’

Zhao added that he will “take a break first,” stating that he did not have “a single day of real (phone off) break for the last 6 and a half years.” He added:

“After that, my current thinking is that I will probably do some passive investing, being a minority token/shareholder in startups in areas of blockchain/Web3/DeFi, AI, and biotech. I am happy that I will finally have more time to spend looking at DeFi.”

CZ cleared that he will no longer serve as CEO of any other company but will mentor other startups if they need his expertise. “If for nothing else, I can at least tell them what not to do,” said the former Binance executive.

It is also crucial to note that Binance and Zhao were both charged by the DoJ for violating the Bank Secrecy Act and not integrating strict anti-money laundering and KYC policies. The exchange was also accused of bypassing US sanctions on Russia and other countries.

Settlement with the U.S. Authorities

As broken down in a report and announced by Attorney General Merrick Garland, CZ and his exchange settled with the US authorities, paying $4.3 billion in total. DoJ got $2.018 billion from Binance and $50 million from Zhao, while the Treasury’s Financial Crimes Enforcement Network (FinCEN) received $780 million from the exchange.

Binance also paid $70 million to the Office of Foreign Assets Control (OFAC). On a similar note, Commodity Futures Trading Commission (CFTC) received $1.35 billion from the firm, $150 million from CZ, and $1.5 million from Binance’s Chief Compliance Officer Samuel Lim, who was also included in the indictment.

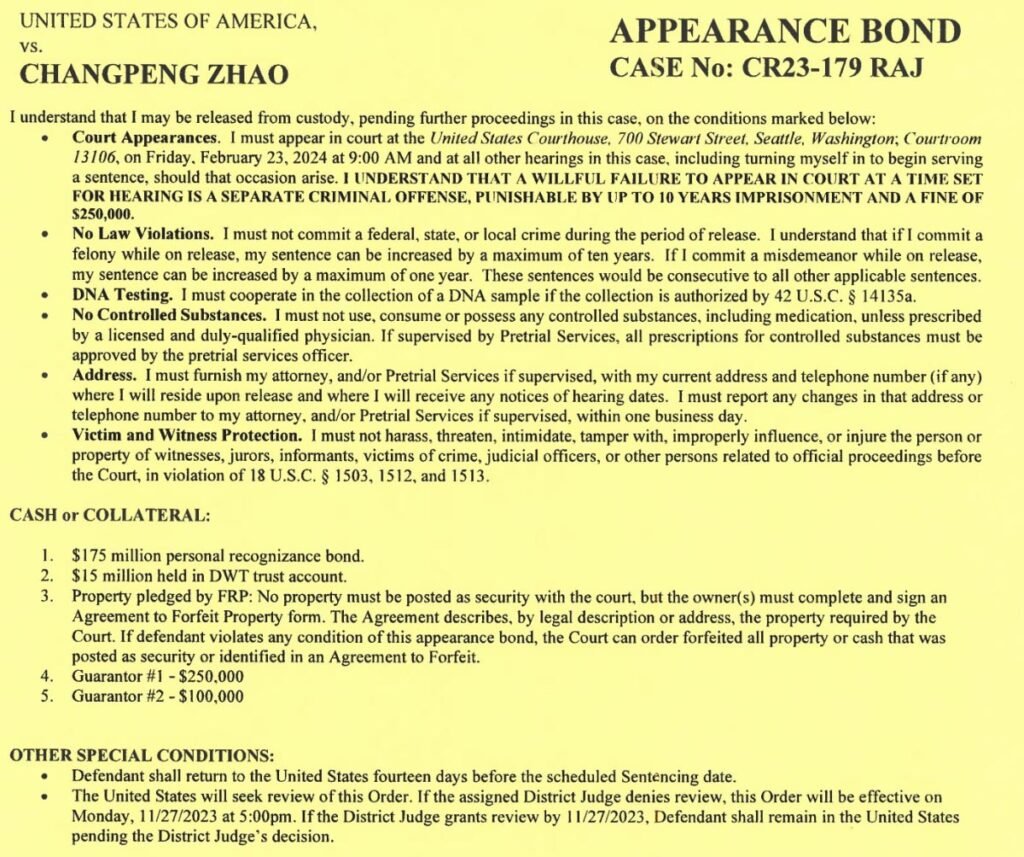

Zhao, the former Binance executive, could potentially face imprisonment following this historic $4.3 billion settlement. His court sentencing is scheduled for February 24, 2024. To secure his release, CZ posted a substantial $175 million bail bond. A crucial condition of this bond requires him to be in the US 14 days before the sentencing.

Zhao has also deposited $15 million into a trust account. Should he fail to meet the specified bond conditions, CZ has agreed to forfeit this amount.

As seen above, the bail bond also lists two guarantors who posted $250,000 and $100,000. If CZ fails to appear in court, he will have to pay a staggering fine of $250 million and might face a jail time of 10 years. The New York Times reported that pleading guilty to a violation of the Bank Secrecy Act carries a maximum sentence of 18 months, but prosecutors might push for a longer time period.

It is also important to note that the US will seek a review of Zhao’s bail order. If a judge denies review of the order, it will become effective on November 27 at 5 p.m. Washington time. Conversely, if the review is granted, CZ is obligated to remain in the US until the judge reaches a final decision.