In a significant development, the United States District Court for the Northern District of Illinois has approved a comprehensive settlement against digital asset exchange Binance and its co-founder and former CEO, Changpeng “CZ” Zhao.

Binance CFTC Complaint

The court ruling, arising from an enforcement action initiated by the Commodity Futures Trading Commission (CFTC) in November, requires Binance to pay a staggering $2.7 billion to settle the Binance CFTC complaint, while CZ personally shoulders a $150 million civil monetary penalty.

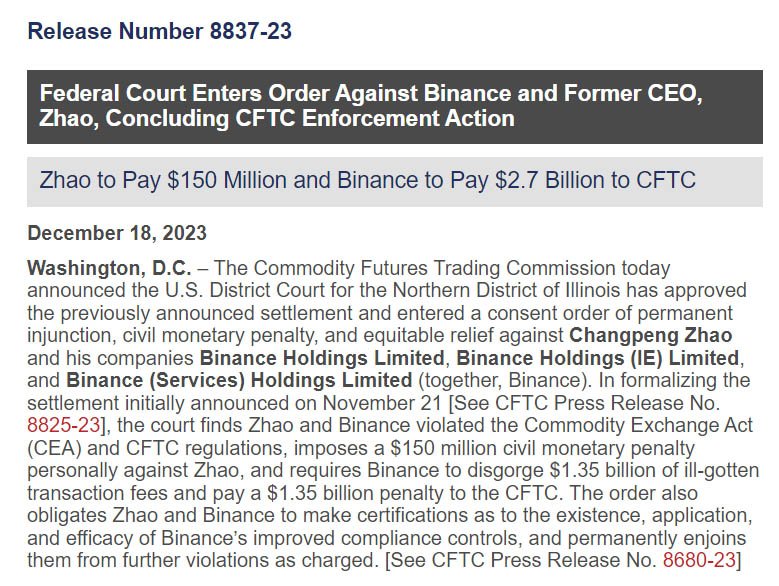

The CFTC officially announced the court’s approval of the settlement on December 18, outlining the terms in a detailed statement. The court has entered a consent order of permanent injunction, civil monetary penalty, and equitable relief against Binance and its co-founder. CFTC writes:

“The court finds Zhao and Binance violated the Commodity Exchange Act (CEA) and CFTC regulations, imposes a $150 million civil monetary penalty personally against Zhao, and requires Binance to disgorge $1.35 billion of ill-gotten transaction fees and pay a $1.35 billion penalty to the CFTC.”

The legal fallout extends to Binance’s former chief compliance officer, Samuel Lim, who faces a separate $1.5 million civil monetary penalty for aiding and abetting the exchange’s violations and engaging in activities outside the U.S. to evade or attempt to evade U.S. law.

Conclusion of a Protracted Legal Battle

This settlement serves as the conclusion of a protracted legal battle initiated by the CFTC against CZ and Binance. The agency initially filed a lawsuit on March 27, accusing the Binance CEO and the exchange of evading federal law and operating an illegal derivatives exchange.

The enforcement action gained momentum when, on November 21, CZ agreed to step down from his position at Binance. This was a part of a broader settlement involving the U.S. Department of Justice, the Treasury Department, and the CFTC.

The charges against CZ included both civil and criminal violations related to anti-money laundering (AML) laws. Simultaneously, Binance faced accusations of breaking U.S. anti-money laundering and sanctions laws, failing to report over 100,000 suspicious transactions potentially linked to terrorist groups.

The exchange was also accused of neglecting to report transactions involving websites distributing child sexual abuse material. Moreover, the exchange was identified as one of the largest recipients of ransomware proceeds.

As part of the settlement, CZ and Binance have committed to implementing enhanced Know-Your-Customer (KYC) measures on the platform. Additionally, Binance is mandated to establish a formalized corporate governance structure, comprising a board of directors with independent members, a compliance committee, and an audit committee.

Under New Management

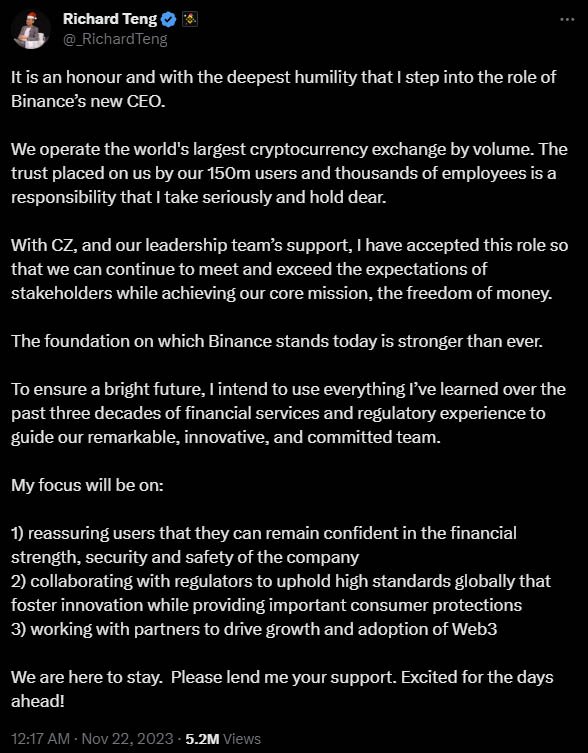

Richard Teng, Binance’s former global head of regional markets, has assumed the role of CEO following CZ’s departure.

He stated at the time:

“My focus will be on reassuring users that they can remain confident in the financial strength, security, and safety of the company, collaborating with regulators to uphold high standards globally that foster innovation while providing important consumer protections, and working with partners to drive growth and adoption of Web3.”

Notably, the recent settlement adds to the challenges Binance has faced over the past 18 months, prompting the termination or significant adjustment of core services in various jurisdictions, including the Netherlands, Cyprus, Australia, and Canada.