Since the departure of Changpeng Zhao (CZ) as CEO, Binance has been facing funds outflows and dealing with significant legal challenges. Zhao’s stepping down following a plea of guilt to charges including money laundering and violations of the Bank Secrecy Act, presumably scared the customers and caused the Binance outflows.

This admission of guilt resulted in a landmark settlement with the DOJ, where Binance agreed to pay over $4 billion. Despite settling with the DOJ, Binance continues to face legal battles with the SEC. The exchange argues that the SEC lacks statutory authority over exchanges’ sales of digital assets, a point of contention in ongoing lawsuits.

Binance Outflows: Impact on Binance’s Operations

The legal issues surrounding Binance have significantly affected the company’s operations. Allegations have been made that Binance, under the leadership of its CEO, Changpeng Zhao (CZ), has been intentionally evading compliance with U.S. laws. This includes inadequate implementation of Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policies, which has allowed sanctioned entities to conduct transactions on the platform.

In an attempt to address these concerns, Binance.US was established as a dedicated platform for the U.S. market. However, the efficacy of this move has been under scrutiny, as it remains unclear whether it has effectively resolved the compliance issues that Binance faces.

Financial Outflows and Market Response

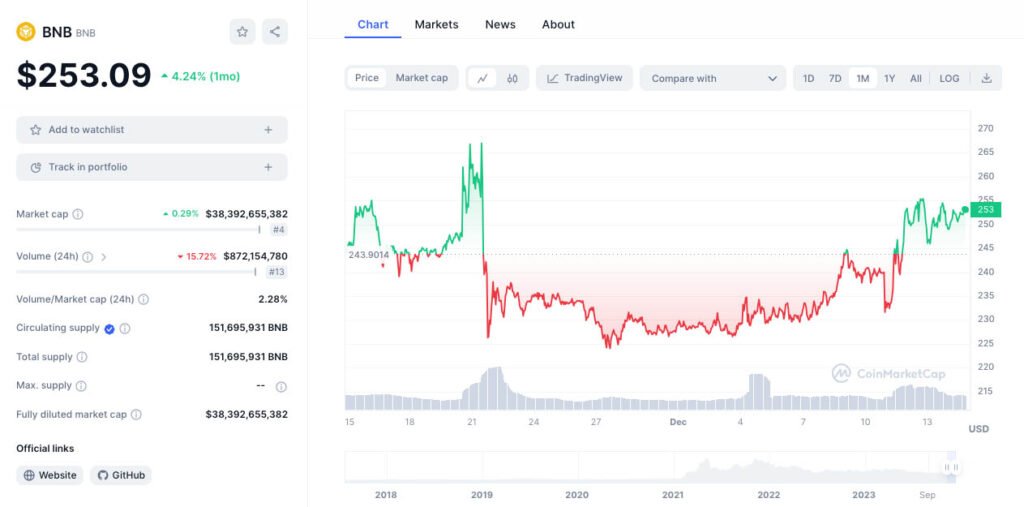

Following all these developments, “Binance saw $800 million in outflows after news broke of Changpeng Zhao’s plea deal.” However, Binance still holds a significant amount of assets, indicating its resilience amid these challenges. The Binance native token, BNB, has also gained back most of the value it lost during these times, reflecting the market might believe that the plea deal could be enough to stop Binance from going under.

Future Prospects

Despite these setbacks, predictions indicate that Binance might soon emerge from its legal woes. The departure of CZ from Binance and the subsequent legal and financial challenges mark a significant period in the digital-asset exchange’s history.

The future of Binance, in the post-CZ era, remains a closely watched topic, with its ability to navigate through these regulatory and challenges being crucial for its long-term success and stability in this dynamic market.

The plea deal CZ stuck has been referred to by some as allowing a financial colonoscopy for Binance. It will be interesting to watch where the chips fail in the coming years.