In a recent development in Binance US news, the U.S. Securities and Exchange Commission (SEC) has raised concerns over the compliance of Binance.US, the American arm of the global exchange Binance, with ongoing investigations. The SEC alleges that Binance.US has been uncooperative in providing crucial information regarding customer assets and other vital aspects of the investigation.

SEC Allegations and Binance.US Response

The SEC has accused Binance.US of deliberately frustrating the ongoing discovery process by failing to adequately prove that its global parent company, Binance Holdings, does not have access to funds owned by Binance.US customers.

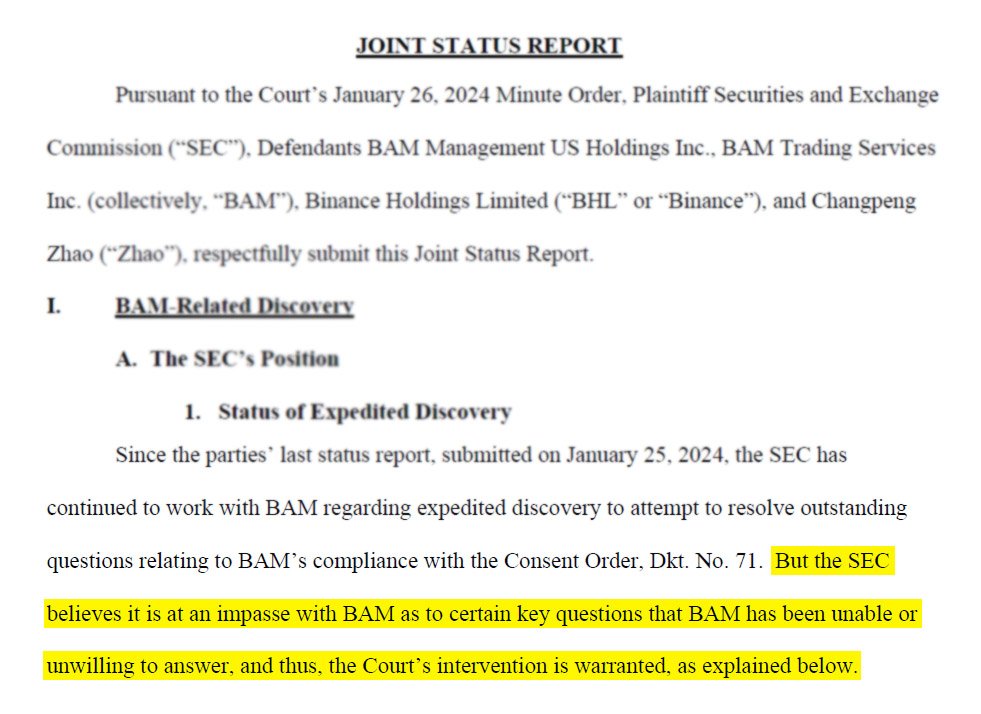

In a joint status report filed to a Washington, D.C. District Court, the SEC claimed that Binance.US has been unwilling or unable to respond to requests for information regarding the custody of customer assets. The regulatory body has requested the court’s intervention to expedite the discovery process.

The regulator added:

“expedited discovery has cast doubt upon BAM’s claims that it exclusively controls the private keys.”

The SEC’s lawyers assert that they have reached an impasse with BAM on crucial matters, contending that BAM has been uncooperative or unable to provide answers to key questions. The SEC believes that court intervention is necessary in light of BAM’s refusal to fulfill basic discovery obligations, such as producing attachments and metadata associated with relevant documents and providing written responses.

According to the SEC’s filing, BAM has consistently claimed exclusive custody and control over its customer assets, including private and administrative keys, as well as related transfers and withdrawals. This purported control extends to the exclusion of the Binance Entities.

However, the SEC’s discovery process has uncovered information suggesting that BHL can influence transfers of BAM’s digital assets from customer deposit wallets to hot wallets, particularly when encountering issues with the PNK system. The Head of Clearing at BAM, Tao Zhang, allegedly communicates with a chat group referred to as the ‘BHL wallet team’ when facing technical challenges related to asset movement.

Despite these revelations, the SEC argues that, after eight months of discovery, they have not found any evidence indicating insecurity, misuse, or dissipation of BAM’s customer assets. The filing contends that additional depositions are unwarranted, and the SEC seeks court intervention to address the impasse and obtain the necessary information from BAM.

In response to these allegations, Binance.US has vehemently denied the SEC’s claims, asserting that it has complied with all of the regulator’s requests for information. The exchange argues that the SEC’s claims regarding customer assets are unfounded and that it has gone above and beyond its obligations to cooperate with the securities watchdog.

Central Issues in the Investigation

At the heart of the SEC’s investigation is the question of whether employees of Binance’s non-U.S. arm had access to customer assets held by Binance.US. The SEC contends that Binance.US has failed to prove that it did not grant access to private keys or other forms of access to customer assets to employees outside the U.S.

This dispute between Binance.US and the SEC is part of a broader legal challenge initiated by the SEC in June last year against Binance, Binance.US, and their founder and former CEO, Changpeng Zhao. The lawsuit alleges violations of U.S. securities laws, including the sale of unregistered securities and the commingling of customer assets with those of a separate entity controlled by Zhao.

Related reading: SEC’s Battle on “Unregistered Securities”: What is the Regulator Up To?

In June, the SEC sued Binance Holdings Ltd., Binance.US, BAM Trading Services, BAM Management US, and Changpeng Zhao, alleging US securities law violations. It claimed Binance staff abroad accessed Binance.US customer assets. SEC’s Division of Enforcement Director, Gurbir S. Grewal, stated Zhao and Binance entities “not only knew the rules of the road, but they also consciously chose to evade them and put their customers and investors at risk – all in an effort to maximize their own profits.”

Additionally, Binance reached a settlement with the U.S. Department of Justice on November 21, agreeing to pay $4.3 billion over violations of U.S. anti-money laundering and terrorism financing laws. As part of the settlement, Zhao pleaded guilty to money laundering charges and is awaiting his criminal sentencing hearing scheduled for April 3, where he could face up to 10 years in prison.

Impact on Binance.US Operations

The ongoing SEC investigation has had tangible effects on Binance.US’s operations. The exchange has expressed concerns over the loss of banking partners and a decrease in active users. These challenges have led to significant operational changes within the company, including the termination of more than 200 employees, equating to two-thirds of its workforce since June 2023.

Binance.US COO Christopher Blodgett linked staff reductions to decreased earnings and rising expenses after SEC intervention.

Binance US News: Conclusion

As the SEC’s investigation into Binance.US continues, the digital asset exchange faces mounting scrutiny over its compliance with regulatory requirements. The outcome of this investigation will not only impact Binance.US but could also have broader implications for the digital asset industry as a whole.

In light of these developments, stakeholders closely monitor the proceedings, awaiting further clarity on the allegations and their potential repercussions.