Bitcoin ATMs, once hailed as a convenient way to buy and sell the digital asset, are now facing serious scrutiny due to an alarming rise in fraud cases, particularly those targeting elderly Americans.

According to reports, losses from scams involving Bitcoin ATMs have skyrocketed, leading U.S. lawmakers and experts to call for immediate action to address the growing problem.

In 2023 alone, Bitcoin ATM-related scams have resulted in over $120 million in losses, with a significant portion of that figure affecting older individuals.

The Federal Trade Commission (FTC) noted a sharp increase in scam incidents involving these machines, which have surged by 1,000% since 2020. According to data from the FTC, elderly Americans are three times more likely to fall victim to these scams than younger adults.

Related: Bitcoin ATM Scams Have Risen 10-Fold Since 2020 | FTC Report

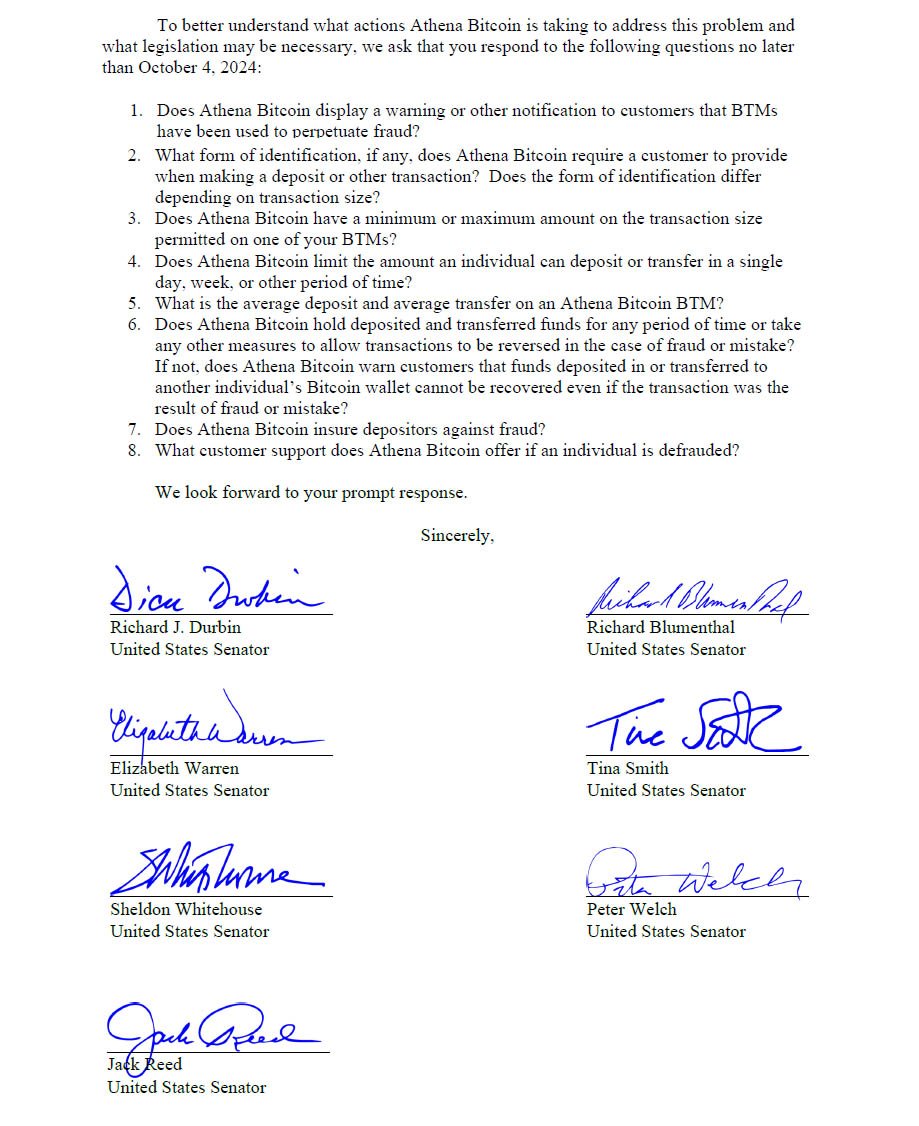

Senators, including Senate Majority Whip Dick Durbin and Senator Elizabeth Warren, have taken notice. In a letter dated September 11, 2023, a group of U.S. Senate Democrats demanded that Bitcoin ATM operators take stronger measures to protect the elderly from falling prey to these fraudulent schemes.

The senators have given these companies a deadline of October 4 to provide details on what steps they are taking to prevent further fraud. The Senators wrote:

“As companies like yours have staged BTMs in a variety of businesses — sometimes even paying businesses to host your BTMs — there has been a marked increase in Bitcoin scams impacting elderly Americans.”

They added: “We write to call on you to take immediate action to address troubling reports that your bitcoin ATMs (BTMs) are contributing to widespread financial fraud against elderly Americans.”

Bitcoin ATMs work much like traditional ATMs but allow users to buy or sell bitcoin instead of withdrawing cash. However, because Bitcoin transactions are decentralized and irreversible, they have become a prime target for hackers and scammers.

In some cases, criminals may trick victims—often seniors—into believing they need to send money through a Bitcoin ATM to fix a problem or claim a reward.

For example, elderly victims have been coerced into depositing large amounts of money into Bitcoin ATMs to pay off fake fines, bail out a family member, or even invest in a scam endorsed by a celebrity, like Elon Musk.

Related: Evolution Of Elon Musk “Bitcoin Giveaway” Scams

One store owner, Sai Patel, recounted a troubling encounter at his Middletown, Ohio shop. An elderly woman came in, ready to send a lot of money through the Bitcoin ATM. She said Elon Musk told her to do it. Patel quickly realized she had fallen for a scam and stopped her.

Experts are raising alarms over the growing risks tied to Bitcoin ATMs. Timothy Bates, a cybersecurity professor at the University of Michigan, noted that these machines are vulnerable to both physical and cyber threats. Bates stated:

“It’s clear that these machines are particularly vulnerable to both physical and cyber threats, making them a prime target for hackers and thieves.”

Moreover, many Bitcoin ATMs require users to provide personal information like Social Security numbers and IDs to comply with financial regulations, making them a potential goldmine for identity theft if the machines are compromised.

Joe Dobson, a cybersecurity expert at Google Cloud-owned Mandiant, explained the added risks: “If an attacker compromises a Bitcoin ATM, they may change the receiving wallet address, effectively stealing user funds.”

The concerns of experts are echoed by lawmakers, who are urging Bitcoin ATM operators to act responsibly.

The group of Senate Democrats who penned the letter are asking companies like Bitcoin Depot, CoinFlip, and RockItCoin to take a range of actions to prevent fraud. These include setting transaction limits, posting scam warnings on machines, and offering fraud insurance.

The senators pointed to a case in Illinois where a business owner removed a Bitcoin ATM after realizing it was primarily used by scam victims.

The group is calling for more transparency from operators, with the hope that these measures will curb the growing problem of elder financial abuse through Bitcoin ATMs.

Some operators have acknowledged the concerns and claim they are already taking steps to protect users.

Bitcoin Depot, the largest operator of Bitcoin ATMs, managing over 8,000 machines globally, has said their machines include layers of security to prevent fraud.

“Bitcoin ATMs aren’t typically high-priority targets for cybercriminals due to the separation of the hardware and the Bitcoin wallet environments,” said Brandon Mintz, CEO of Bitcoin Depot.

He also noted that their ATMs only accept cash, which eliminates the risk of card skimming, a common fraud tactic used with traditional ATMs.

However, despite these claims, some experts and lawmakers remain unconvinced.

Fraud losses from Bitcoin ATMs in the U.S. surpassed $65 million in the first half of 2023 alone, up from just $12 million in 2020. Critics argue that the industry still has a long way to go in ensuring consumer protection, especially for the elderly.

Experts advise consumers to remain cautious when using Bitcoin ATMs, especially if they are asked to send digital assets to someone they do not know.

“Customers of Bitcoin ATMs should never send Bitcoin or other cryptocurrencies to unknown digital wallets or individuals they don’t know and trust,” Mintz said.

Additionally, users are encouraged to verify the legitimacy of transactions and be skeptical of any urgent requests for bitcoin payments.

The rising tide of Bitcoin ATM fraud shows no signs of slowing down.

Lawmakers and experts agree that stronger regulations, better security measures, and increased consumer awareness are needed to tackle the issue. With the October 4 deadline approaching, all eyes are on Bitcoin ATM operators to see how they will respond to the demands for accountability.

As Bitcoin continues to grow in popularity, ensuring the safety of users—particularly vulnerable groups like the elderly—has become more critical than ever.