In a landmark case, Roman Sterlingov, the founder of Bitcoin Fog, a bitcoin mixing service, has been sentenced to 12 and a half years in prison. The U.S. Department of Justice (DoJ) held that Sterlingov’s platform laundered over $400 million in digital assets tied to illegal activities on the dark web.

Judge Randolph Moss, who presided over the case in Washington D.C., also ordered the forfeiture of hundreds of millions of dollars in Bitcoin-related assets.

Bitcoin Fog operated as a “digital currency mixer,” blending multiple users’ Bitcoin transactions to obscure their origins. Such services can make it difficult for investigators to trace digital assets, particularly those used in illegal transactions.

Related: The Ethics Of Mixing Bitcoin

Bitcoin Fog, which ran for nearly a decade, processed around 1.2 million bitcoin, with much of it allegedly linked to darknet markets involved in selling drugs and other illicit goods.

Sterlingov, a 36-year-old Russian-Swiss national, was convicted in March of multiple charges, including conspiracy to launder money and running an unregistered money-transmitting service.

Although prosecutors had requested a much harsher sentence of 30 years, Judge Moss imposed a lighter sentence.

“A life sentence seems inconsistent with the level of culpability,” Judge Moss noted, but he added that the penalty needed to be harsh enough to deter others, especially in the world of digital assets where authorities have a hard time catching criminals.

United States Department of Justice released a statement on November 8, stating:

“During the decade-long operation, Bitcoin Fog gained notoriety as a go-to money laundering service for criminals seeking to hide their illicit proceeds from law enforcement and processed transactions involving over 1.2 million bitcoin, valued at approximately $400 million at the time the transactions occurred.”

The statement claims that the bulk of the laundered bitcoin came from darknet marketplaces and was tied to illegal narcotics, computer crimes, identity theft, and child sexual abuse material.

It adds that the website operators were “involved in a sophisticated business email compromise scheme targeting real estate transactions in the United States.”

Deputy Attorney General Lisa Monaco stated that the sentencing underscores the agency’s commitment to targeting criminal networks that enable malicious individuals to thrive. She stated:

“Roman Sterlingov ran the longest-running bitcoin money laundering service on the darknet, and today he paid the price. In the deepest corners of the internet, he provided a home for criminals of all stripes, from drug traffickers to identity thieves, to store hundreds of millions of dollars in illicit proceeds.”

Bitcoin Fog’s case has become a symbol of law enforcement’s crackdown on digital tools used for privacy.

According to the U.S. Department of Justice, Sterlingov’s platform allowed criminals to disguise the sources of their funds by blending them with other transactions. This service, the DOJ argued, was “open for business to criminals looking to hide dirty money.”

The prosecution argued that Bitcoin Fog was a key player in enabling the movement of funds tied to illegal transactions across the internet, and they insisted that Sterlingov knew his service was primarily used by those “with real problems with the law.”

Prosecutors pushed for a significant sentence, stressing that Sterlingov’s actions were part of a “criminal activity of a staggering scale over a prolonged period of time,” in the words of Christopher Brown, a federal prosecutor on the case.

The FBI, which worked on the investigation, echoed the DOJ’s stance.

Assistant Director David Sundberg said, “The FBI will not hesitate to use all tools at its disposal and will leverage our extensive partnerships to disrupt the cybercriminal ecosystem and the individuals who provide the key services that facilitate criminal activity.”

In court, Sterlingov denied operating Bitcoin Fog, claiming he was merely a user of the service rather than its mastermind. His defense attorney, Tor Ekeland, argued that the prosecution had no eyewitnesses or solid evidence directly linking his client to the platform’s operations.

Ekeland emphasized that there were no records that could place him at the helm of Bitcoin Fog, pointing out what he argued were gaps in the prosecution’s case.

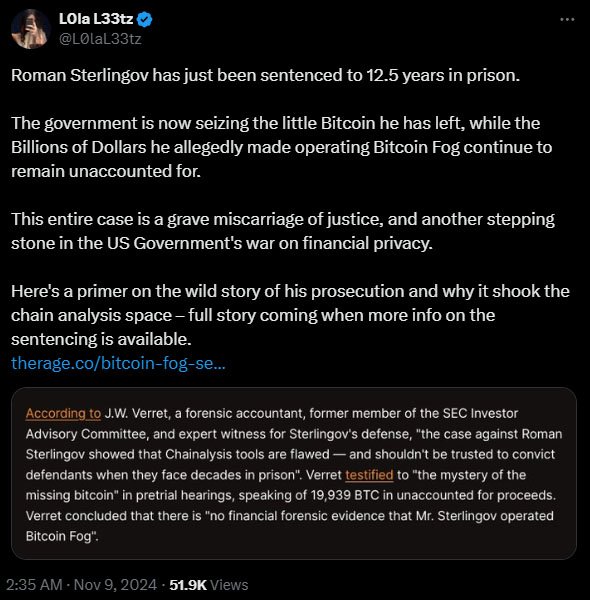

Critics of the government’s case included some privacy advocates, who raised concerns about the methods used to link Sterlingov to Bitcoin Fog.

Freelance journalist Lola L33tz criticized the use of blockchain analysis tools such as those provided by Chainalysis, calling them potentially unreliable in cases with such high stakes.

Related: Chainalysis Says No Scientific Evidence The Surveillance Software Works

In her view, the government’s crackdown on Bitcoin Fog reflected a broader “war on financial privacy.”

Despite these arguments, the jury ultimately convicted Sterlingov, and Judge Moss ruled that the case had shown sufficient evidence of his involvement in the platform’s operations.

The sentencing in the Bitcoin Fog case has sent a powerful signal to the Bitcoin industry.

Privacy-enhancing technologies such as mixers, often touted for their ability to protect user anonymity, are now under increasing scrutiny from regulators. Some see this case as an example of necessary enforcement action in an area where criminal activity can go undetected.

Bitcoin podcaster Mario Nawfal commented on the sentence, saying, “This ain’t just a slap on the wrist – it’s a straight-up message to mixers: play shady, pay heavy.”

For many in the Bitcoin industry, the Sterlingov case marks a shift, with law enforcement agencies ramping up their ability to track illicit activity despite the anonymity provided by certain privacy tools.

Still, some argue that mixers have legitimate uses. Privacy advocates note that they can protect individuals from tracking and surveillance, enabling financial privacy even in lawful transactions.

Related: Blockchain Forensics | Balancing Crime and Privacy Rights

For now, however, the Bitcoin Fog ruling suggests that regulatory bodies are focused on holding creators of such tools accountable if their services are used for illegal activities.

Sterlingov’s sentencing also draws attention to other platforms that offer similar services. Authorities are now investigating other digital asset mixers, such as Tornado Cash, and examining the operations of privacy-focused wallets like Samourai Wallet.

Roman Storm and Roman Semenov, the founders of Tornado Cash, and William Hill, the chief technology officer of Samourai Wallet, face increasing scrutiny.

The DOJ has made clear that the Bitcoin Fog case is only the beginning of its effort to root out platforms facilitating illegal activity.

“The prosecution of Roman Sterlingov and the sentence imposed today should serve as a warning to cybercriminals,” said the FBI’s Sundberg, emphasizing that their efforts to track down cybercriminal networks will only grow.

At the end of his trial, Sterlingov expressed remorse. “I am sorry for any harm that may have come from my actions,” he told Judge Moss, who acknowledged Sterlingov’s statement but stood by the need for a deterrent sentence.

The Bitcoin Fog case leaves the Bitcoin community at a crossroads, as privacy advocates, platform developers, and regulators continue to navigate the fine line between protecting privacy and preventing crime.

For Sterlingov, the implications of his case are already real, but for the industry at large, his sentencing is both a lesson and a warning that as Bitcoin grows, so does the need for accountability.