European digital asset trading platform Bittrex Global has announced that it will end operations, starting with the closure of trading services on December 4, 18:00 UTC. The message was displayed on the firm’s official website, and the exchange noted that the decision “was not made lightly.”

In the message, Bittrex Global said that after the December 4 deadlines, “customers will only be able to withdraw assets as part of the winding down process.” The firm requested that existing users transfer their digital assets as soon as possible and not deposit bitcoin and other assets on the platform. It stated:

“We understand that this news may raise concerns and questions, and we want to assure you that we are committed to facilitating a smooth and transparent wind-down process during this period.”

Bittrex Global Terminates Referral Program

Bittrex Global asked customers to ensure that they have completed all the required transactions prior to December 4, following which their client relationship will be terminated and all the services will cease to operate. Further, for those clients who have a USD balance in their accounts, Bittrex Global asked them to convert their holdings into either EUR or a digital asset and transfer them to another wallet.

Moreover, the Bittrex referral program has also been terminated, and customers will no longer receive rewards from the program. “All rewards earned on trades executed up to and including November 19, 2023, will be paid out in the coming days,” the exchange added.

The European exchange took to social media platform X to confirm the news. Bittrex Global also informed customers that “all funds and tokens remain safe and secure” and are available for withdrawal.

“Do not make any deposits to our platform. We cannot guarantee that they will be received safely. If you do send a deposit, your funds may be permanently lost as a result of the attempted transfer,” warned Bittrex in the message.

The Collapse of Bittrex

Bittrex also asked customers to approach the team’s support team in case they had questions or concerns during the transition process. It is important to mention here that the exchange also ended operations in the United States, citing an unclear and unfair regulatory framework. The firm made the announcement on its ninth anniversary in April.

Related reading: “Bitcoin Is In Danger In U.S.” — Warns Hedge Fund Manager Paul Tudor

Richard Lei, the exchange’s co-founder and CEO, commented that with the development of the digital asset sector in the US, unfair laws were “enforced without appropriate discussion or input,” resulting in an “uneven competitive landscape.”

The Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network (FinCEN) fined Bittrex around $53 million for violating the Bank Secrecy Act’s (BSA’s) anti-money laundering (AML) and suspicious activity report (SAR) reporting requirements.

Related reading: KYC Is The Illicit Activity

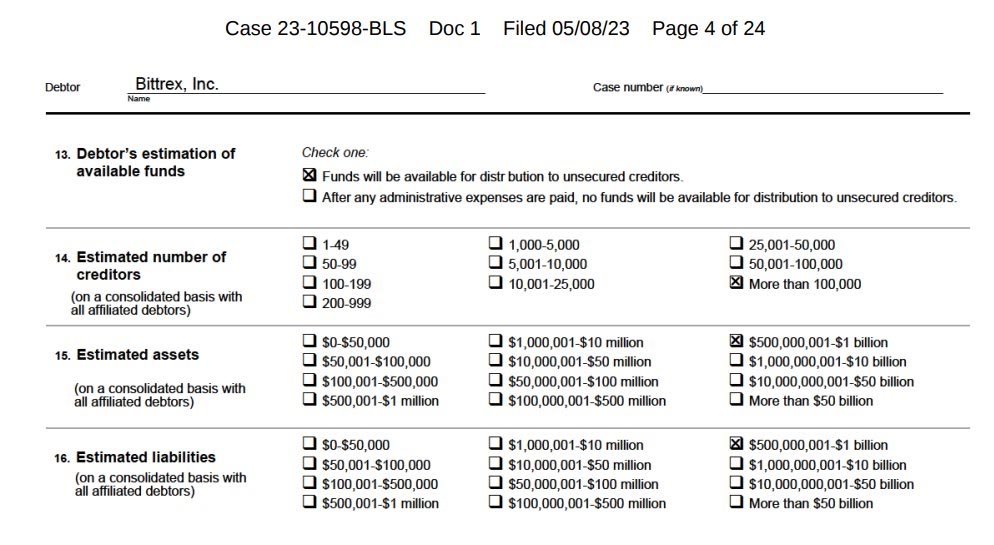

In May, the exchange also filed for Chapter 11 bankruptcy in the United States Bankruptcy Court for the District of Delaware. As per the filing, Bittrex had 100,000 creditors, between $500 million and $1 billion in assets, and between $500 million and $1 billion in liabilities.