Renowned blockchain investigator ZachXBT has made headlines recently, alleging harassment by the Internal Revenue Service’s Criminal Investigation Unit (IRS-CI) in their pursuit of assistance with blockchain-related crimes.

Harassment Allegations

ZachXBT, known for his expertise in tracking down fraudsters within the digital assets space, has raised concerns about what he describes as harassment by IRS-CI agents.

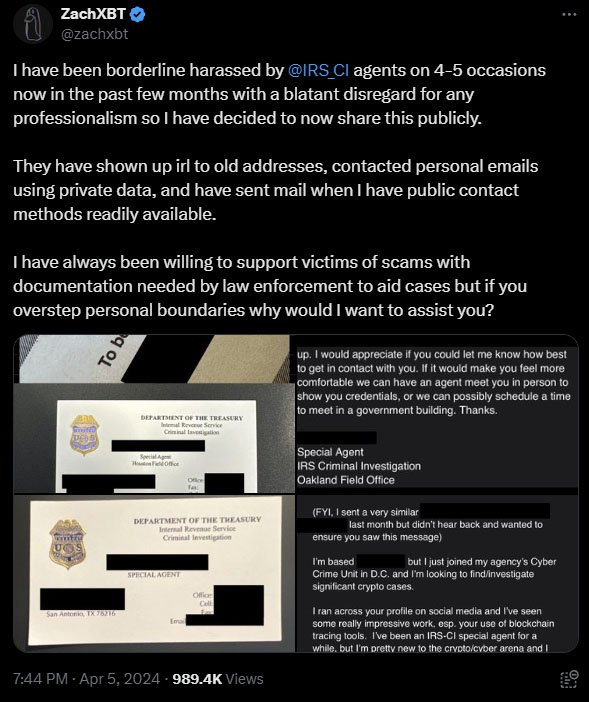

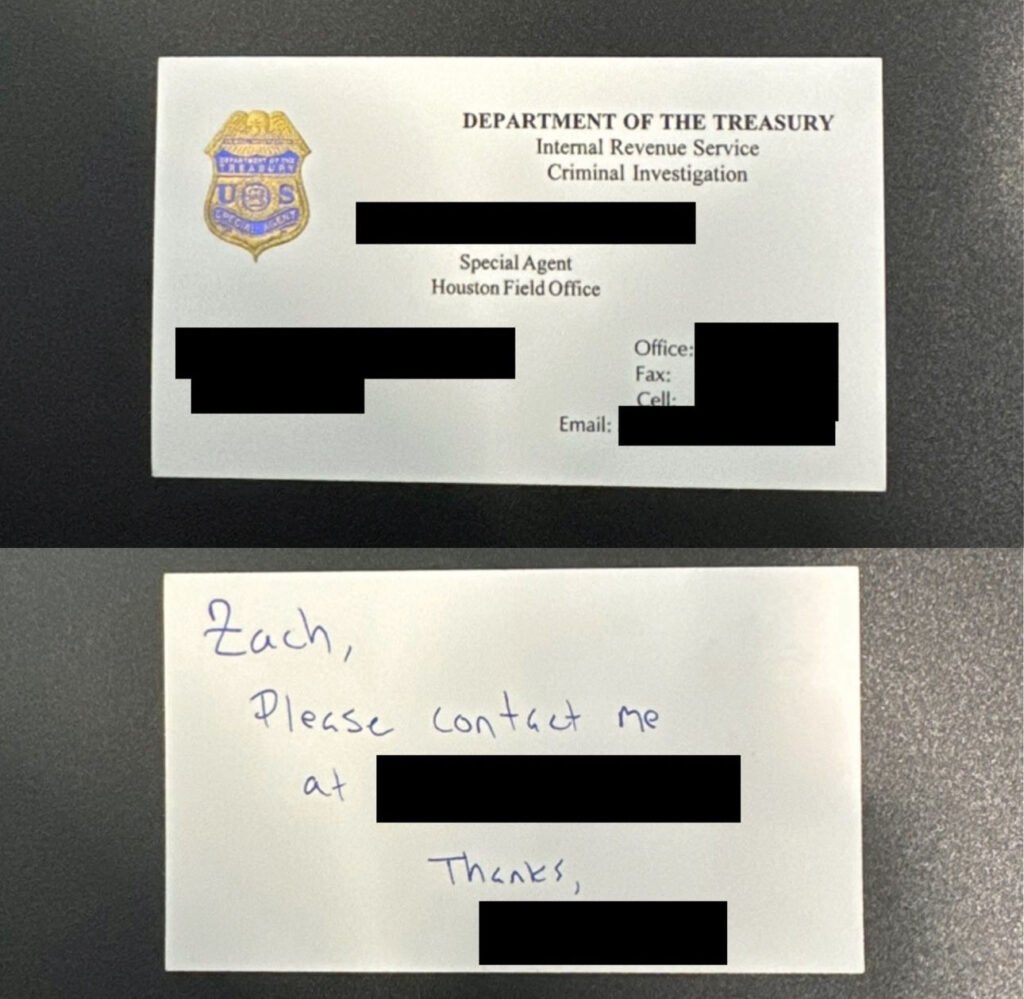

In multiple instances detailed by ZachXBT, IRS agents have allegedly gone to great lengths, including tracking old addresses and contacting personal emails using private data, to solicit his help in ongoing blockchain investigations. He expressed his discomfort, stating:

“I have been borderline harassed by @IRS_CI agents on 4-5 occasions now in the past few months with a blatant disregard for any professionalism so I have decided to now share this publicly.”

Related reading: Blockchain Forensics: Balancing Crime and Privacy Rights

Request for Assistance

The alleged harassment came in the form of persistent requests for ZachXBT’s assistance in solving blockchain crimes. Emails shared by the analyst depict an IRS special agent praising his work and seeking guidance in navigating the complex world of blockchain investigations. The agent admits their limited knowledge in the digital-assets/cyber arena and expresses a desire to make a significant impact with ZachXBT’s assistance.

In one instance, an agent wrote to him:

“I ran across your profile on social media and I’ve seen some really impressive work, esp. Your use of blockchain tracing tools. I’ve been an IRS-CI special agent for a while, but I’m pretty new to the crypto/cyber arena and I was hoping you could give me a sense of what I should be looking at if I wanted to make the biggest impact.”

ZachXBT perceives the IRS-CI’s actions as a violation of his privacy. By reaching out through personal channels and old addresses, he feels his boundaries have been crossed. This sentiment is echoed in ZachXBT’s statement: “They have shown up irl to old addresses, contacted personal emails using private data, and have sent mail when I have public contact methods readily available” highlighting the invasive nature of the IRS-CI’s approach.

Related reading: “Lack in Privacy”: What it Means and How NOSTR Can Help

ZachXBT’s Refusal to Assist Memecoin Holders

ZachXBT’s decision to publicly disclose the alleged harassment coincides with his refusal to assist holders of the Complex (SIMPLE) memecoin, which faced threats of shutdown. While expressing a willingness to aid victims of real investing, ZachXBT expressed reluctance to dedicate time to those involved in speculative meme coins. This stance underscores his commitment to prioritizing legitimate cases over volatile investments.

He noted that he doesn’t like “spending long periods helping people who willingly choose to gamble on vaporware meme coins vs actual victims.”

IRS-CI’s Collaborative Efforts and Broader Implications

Despite ZachXBT’s allegations, the IRS-CI has been actively seeking collaborations to enhance its capabilities in investigating digital-asset-related crimes. Partnerships with blockchain analytics firms like Chainalysis have provided invaluable tools and infrastructure. IRS-CI Chief Jim Lee noted the significant impact of these collaborations, citing the seizure of approximately $10 billion worth of digital assets since the unit’s focus shifted to the field.

ZachXBT’s experience sheds light on the evolving dynamics between independent investigators and government agencies in the digital assets sphere. While collaboration can enhance law enforcement efforts, concerns about privacy invasion and professionalism remain pertinent. The incident sparks a broader conversation within the community about the balance between cooperation with law enforcement and the protection of individual rights.

Conclusion

The allegations raised by ZachXBT against the IRS-CI underscore the challenges faced by independent investigators in navigating their roles within the evolving landscape of digital assets investigations. As the industry continues to mature, finding a balance between collaboration and autonomy remains crucial for maintaining trust and integrity within the community.