California is taking decisive measures to tackle fraudulent activities targeting Bitcoin ATMs, which have scammed many individuals out of thousands of dollars. Starting in January, Governor Gavin Newsom will impose strict limitations on Bitcoin ATM transactions, capping them at $1,000 per person per day.

New Law Limits Bitcoin ATM Withdrawals

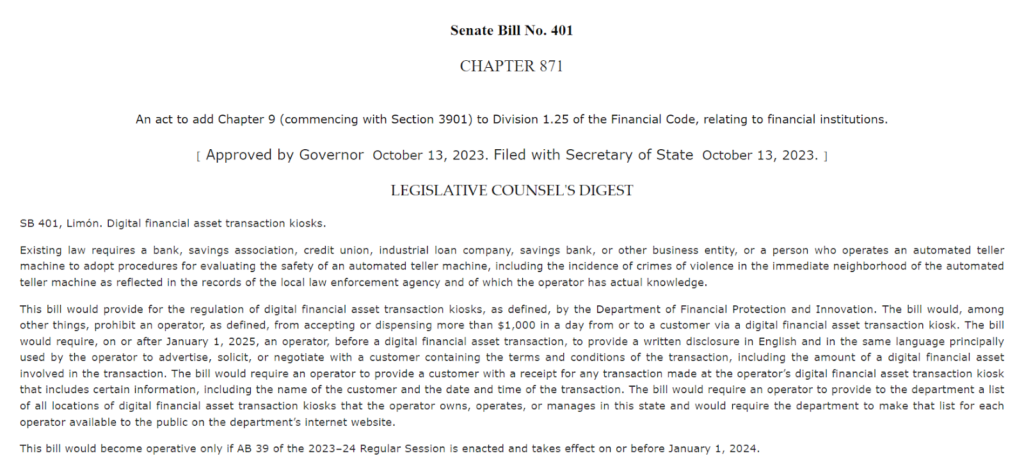

The new law, signed by Governor Gavin Newsom, explicitly states:

“An operator shall not accept or dispense more than one thousand dollars ($1,000) in a day from or to a customer via a digital financial asset transaction kiosk.”

Digital assets are often challenging to trace, making it easier for scammers to operate. According to the bill information for the new law, Assembly Bill 39, the primary objective behind Bitcoin ATM limits is to provide potential fraud victims with more time to recognize fraudulent activities before they transfer substantial amounts of money into digital assets.

Despite concerns raised by crypto industry advocates that this law may negatively impact consumers, consumer groups argue that it is a necessary step to combat the rising instances of fraud associated with Bitcoin ATMs. According to the Federal Trade Commission, over 46,000 individuals reported losses exceeding $1 billion due to crypto-related scams last year.

According to Coin ATM Radar, California currently hosts more than 3,200 Bitcoin ATMs, illustrating the significance of this regulation in the state’s digital asset ecosystem.

Assembly Bill 39: Specifics

Assembly Bill 39 defines a “digital financial asset transaction kiosk” as a device that facilitates cash-to-crypto transactions. Commencing on January 1, 2025, operators of these kiosks will be prohibited from charging fees exceeding $5 or 15% of the transaction, whichever is higher.

The operators will also be required to provide customers with detailed transaction disclosures, including the crypto amount, dollar amount, and fees charged. Customers must receive receipts containing vital transaction details, including the information of the licensed exchange used to calculate the price spread.

Under the new law, operators must maintain an up-to-date list of kiosk locations. Moreover, after July 1, 2025, they must ensure compliance with California’s digital asset business licensing requirements or verify that third parties utilizing their kiosks possess state crypto licenses.

Meanwhile, California is gearing up to establish a comprehensive regulatory framework for digital asset companies by 2025, known as the Digital Financial Assets Law, which Newsom recently approved. This law will mandate digital asset firms to obtain state licenses and adhere to stringent auditing and record-keeping requirements, signifying a shift in Newsom’s approach to cryptocurrency regulation.

Under the new law, operators must maintain an up-to-date list of kiosk locations. Moreover, after July 1, 2025, they must ensure compliance with California’s digital asset business licensing requirements or verify that third parties utilizing their kiosks possess state crypto licenses.

Meanwhile, California is gearing up to establish a comprehensive regulatory framework for digital asset companies by 2025, known as the Digital Financial Assets Law, which Newsom recently approved. This law will mandate digital asset firms to obtain state licenses and adhere to stringent auditing and record-keeping requirements, signifying a shift in Newsom’s approach to cryptocurrency regulation.