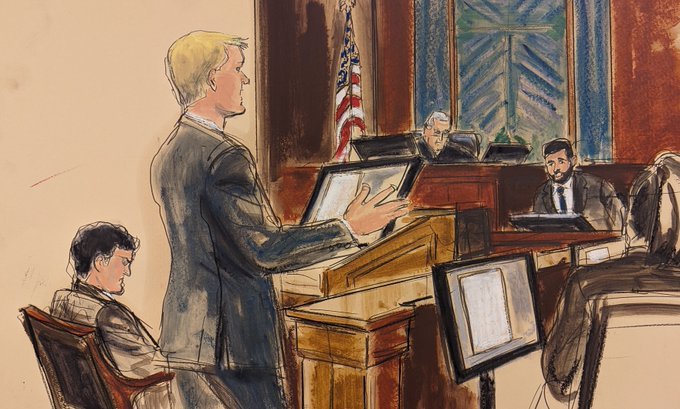

SBF’s intense criminal fraud trial has recently faced a major twist as Can Sun, the former general counsel of the exchange, strongly denied approving the controversial transfer of customer funds to Alameda Research.

Sun’s tenure, who worked for the exchange from August 2021 to its meltdown in November 2022, was characterized by his staunch belief in segregating client assets, a common practice in financial custodianship. His recent revelations during the trial shed light on internal operational conflicts within the exchange.

SBF Wanted “Jurisdictions” for Missing Funds: Can Sun

During the trial, Sun revealed that he became aware of Alameda’s alleged exemption from auto-liquidation in August or September of 2022. However, when he asked to remove it, Bankman-Fried and FTX’s former Chief Technology Officer Gary Wang refuse to do so, as the “carveout” for Alameda “had never been triggered.”

Interestingly, Sun further revealed that SBF asked him to come up with “legal justifications” for the $7 billion in missing customer funds just days before FTX’s bankruptcy. FTX was in discussions with Apollo on November 7, 2022, to secure emergency capital due to a surge in customer withdrawals.

When Apollo asked for financial statements, Sun received a spreadsheet from SBF with a multi-billion-dollar shortfall in covering FTX customer withdrawals. Additionally, it showed substantial debts owed by Alameda Research to FTX. He stated:

“He asked me to come up with legal justifications. It basically confirmed my suspicion that had been rising all day that FTX did not have the funds to satisfy customer withdrawals, and that they had been misappropriated by Alameda.”

FTX’s Terms of Service

During the cross-examination, the focus was on FTX Digital Markets’ terms of service, which the defense considers a crucial element in the case.

These terms explicitly stated FTX’s commitment to keep customer funds “ring-fenced,” untouchable, and separate from its operational assets. It clearly emphasized that the assets deposited belonged solely to the customers. However, the prosecutor asserts that Alameda, the exchange’s sister company, accessed and used FTX customers’ deposits.

Interestingly, SBF’s lawyer Mark Cohen attempted to challenge this theory during the trial by questioning the margin trading section of the terms. He asked Sun how many customers engaged in such trading strategies. However, Cohen had to move on as Sun couldn’t recall specific data on the matter.

Cohen also highlighted a section in the terms related to account liquidation on FTX. It mentioned that customers might lose all their assets if backstop liquidity providers couldn’t step in effectively. Sun had no response to these questions.

Related reading: