The journey of Celsius, the renowned digital asset lending platform, has been riddled with turbulence, following its bankruptcy declaration in July 2022. In recent Celsius bankruptcy news, the company unveiled plans to seek recovery of funds from significant withdrawals made before its bankruptcy, delving into legal actions and settlement requests.

Celsius Bankruptcy News: Recovering Pre-Bankruptcy Withdrawals

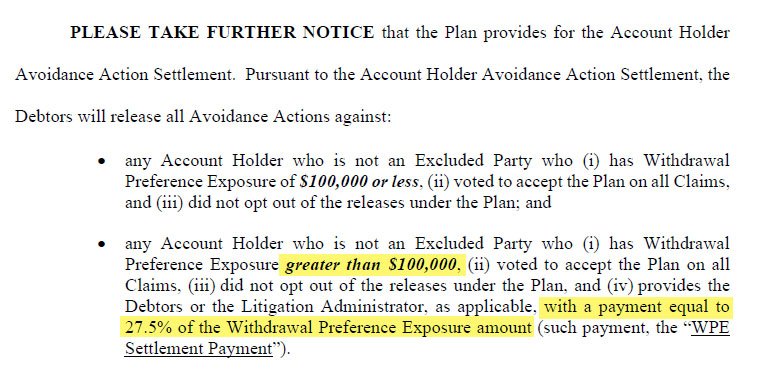

Celsius has initiated a bold move, demanding a 27.5% return on substantial withdrawals made just before its bankruptcy filing. Account holders who withdrew over $100,000 within 90 days before the company’s bankruptcy declaration are now under scrutiny. Failure to comply with this directive might result in legal action. However, compliance renders these creditors eligible for future distributions per Celsius’ reorganization plan.

Legal Proceedings and Intent to Recover

Administrators overseeing Celsius’s bankruptcy have filed an intent to recover funds from account holders who withdrew more than $100,000 before the bankruptcy declaration. Eligible individuals can settle their liabilities by remitting 27.5% of the withdrawn funds. Non-compliance may lead to lawsuits to recover these preferences, adding weight to the impending settlement deadline of January 31, 2024.

Celsius Network’s settlement terms vary based on withdrawal amounts. Those who withdrew $100,000 or less are exempt from making a settlement payment and won’t receive instructions for settlement procedures. However, larger withdrawals prompt strict conditions: account holders must settle by January 31 to receive releases under the reorganization plan. Settlements can be made using cash, Bitcoin, or Ethereum.

Complex Bankruptcy Journey and Regulatory Challenges

Celsius’s bankruptcy, unveiling a staggering $1.2 billion deficit, led to a reorganization plan approval in September 2023, providing varying distributions to account holders based on their holdings. Additionally, legal challenges involving CEO Alex Mashinsky, charged with fraud, added complexity to the scenario. A $4.7 billion settlement with the FTC hinges on completing bankruptcy proceedings.

Post-bankruptcy, Celsius redirected focus towards Bitcoin mining, steering away from initial plans involving staking fees and managing digital asset loans. The company’s equity transfer to NewCo, managed by the Fahrenheit consortium, aimed to navigate regulatory dynamics and address creditor claims. Recent actions involve unstaking Ethereum to meet creditor obligations.

Celsius Still Navigating Turbulent Waters

Celsius Network’s pursuit to recover from its financial turmoil involves demanding returns from large pre-bankruptcy withdrawals. The company’s strategic shifts, legal challenges, and settlement demands reflect the evolving landscape of the digital asset industry, where regulatory compliance intertwines with financial stability.

In the unfolding drama of Celsius’s financial repositioning, its actions remain a dynamic interplay of regulatory dynamics, creditor demands, and strategic considerations.

This intricate journey underscores the challenges faced by digital-asset lending platforms, emphasizing the critical need for regulatory adherence and financial resilience in an industry prone to volatility and legal scrutiny.